Interest in Bitcoin ETFs is rapidly growing among the largest hedge funds in the US. At the beginning of the year, the US Securities and Exchange Commission’s (SEC) approval of Bitcoin ETFs was considered a critical moment for institutional investors to gain direct access to the cryptocurrency market. Following the approval, traditional investors’ interest in cryptocurrencies significantly increased.

Hedge Funds Turn to Bitcoin ETFs

Sam Baker from the cryptocurrency-focused firm River stated that 60% of the largest hedge funds in the US now own Bitcoin ETFs. None of these funds sold their Bitcoin positions during the second quarter; instead, most chose to increase their holdings. Giant companies like Citadel Investments, Millennium Management, Mariner Investment, and Fortress Investment made more share purchases in the second quarter.

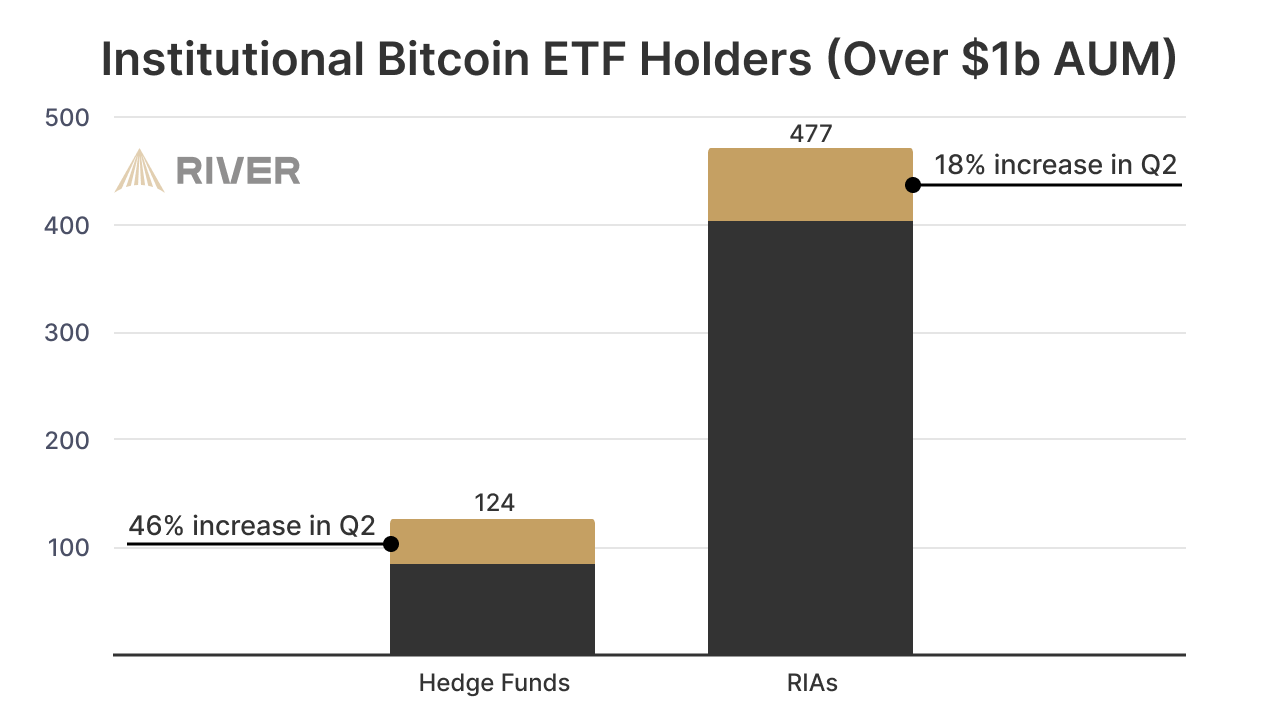

Investment advisors also followed this trend. Thirteen out of the 25 largest registered investment advisors in the US have invested in Bitcoin through ETFs. Advisory firms like Cambridge Associates, Hightower Advisors, Moneta Group, and Cresset Asset Management are gradually increasing their allocations in this area.

Hedge Funds’ Interest in Bitcoin Grows, But Criticisms Persist

Large institutions with assets over $1 billion continue to increase their interest in Bitcoin. The number of registered investment advisors with Bitcoin allocations increased by 18% in the second quarter alone. Interest in Bitcoin ETFs among hedge funds rose by 46%. This rise indicates growing confidence in Bitcoin among major financial players.

Although ETFs are thought to legitimize cryptocurrencies, there are criticisms as well. Among the criticisms is the notion that these financial instruments overshadow Satoshi Nakamoto’s vision. As institutions gain power, Bitcoin and other cryptocurrencies start to trade like traditional stocks. Trading like traditional stocks could weaken the decentralized nature of cryptocurrencies and dilute Bitcoin’s fundamental principles.

I believe that institutional investors’ interest in Bitcoin has led to significant changes in the market. As hedge funds and other large institutions increase their interest in Bitcoin ETFs, this will shape Bitcoin’s future. However, this interest could also threaten Bitcoin’s original decentralized nature. We will see over time how this balance will be established.

Türkçe

Türkçe Español

Español