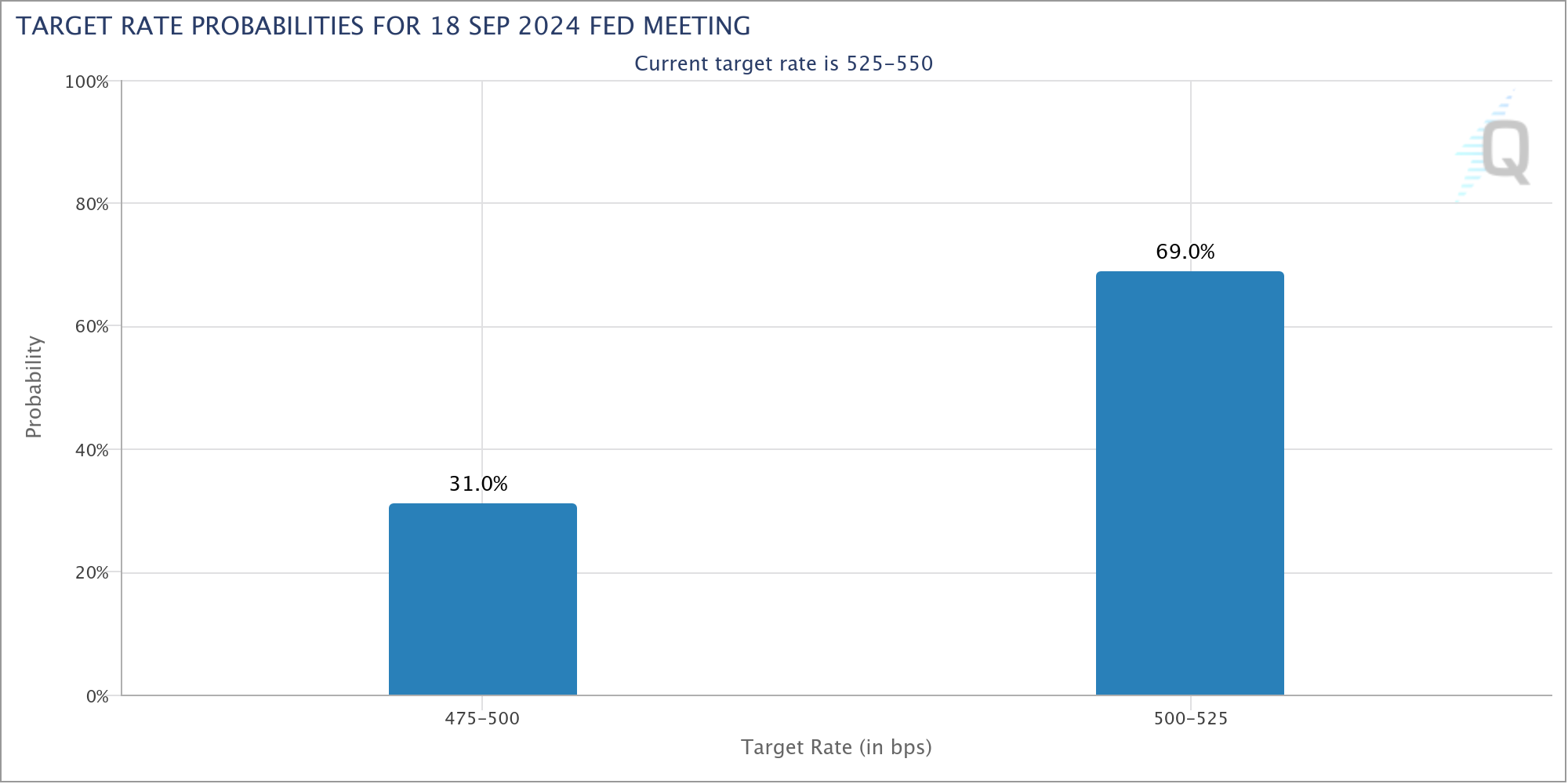

US markets are closed on September 2nd for Labor Day, so investors will wait for the rest of the week for any economic volatility. Ahead of the Federal Reserve’s interest rate meeting on September 18th, macro data is crucial as markets fail to meet expectations. Recent data from CME Group’s FedWatch Tool shows a minimum 0.25% rate cut as the most likely outcome of the meeting.

Microeconomic Data and the Crypto Market

This process diverged from expectations of a 0.5% cut amid turmoil originating from Japan a month ago. Meanwhile, this week will focus on US unemployment figures, which are central to what should be a generally calm start to the month.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Trade source The Kobeissi Letter announced to its X followers that they expect high volatility and great trading conditions by focusing on August job data. Kobeissi revealed the extent of the stock market’s rebound since the lows at the beginning of August, with the S&P 500 adding an average of $250 billion every trading day since then.

Recently, stocks and gold have significantly outperformed crypto markets, and despite Bitcoin recovering by 40% at one point, it continues to decline.

Bitcoin and the Halving Process

BTC/USD pair ultimately fell by 8.6% in August, setting a gloomy tone for September. According to CoinGlass data, September tends to result in losses, with an average decline of around 4.5%. In contrast, August tends to be a green month, but this year showed historically weak performance.

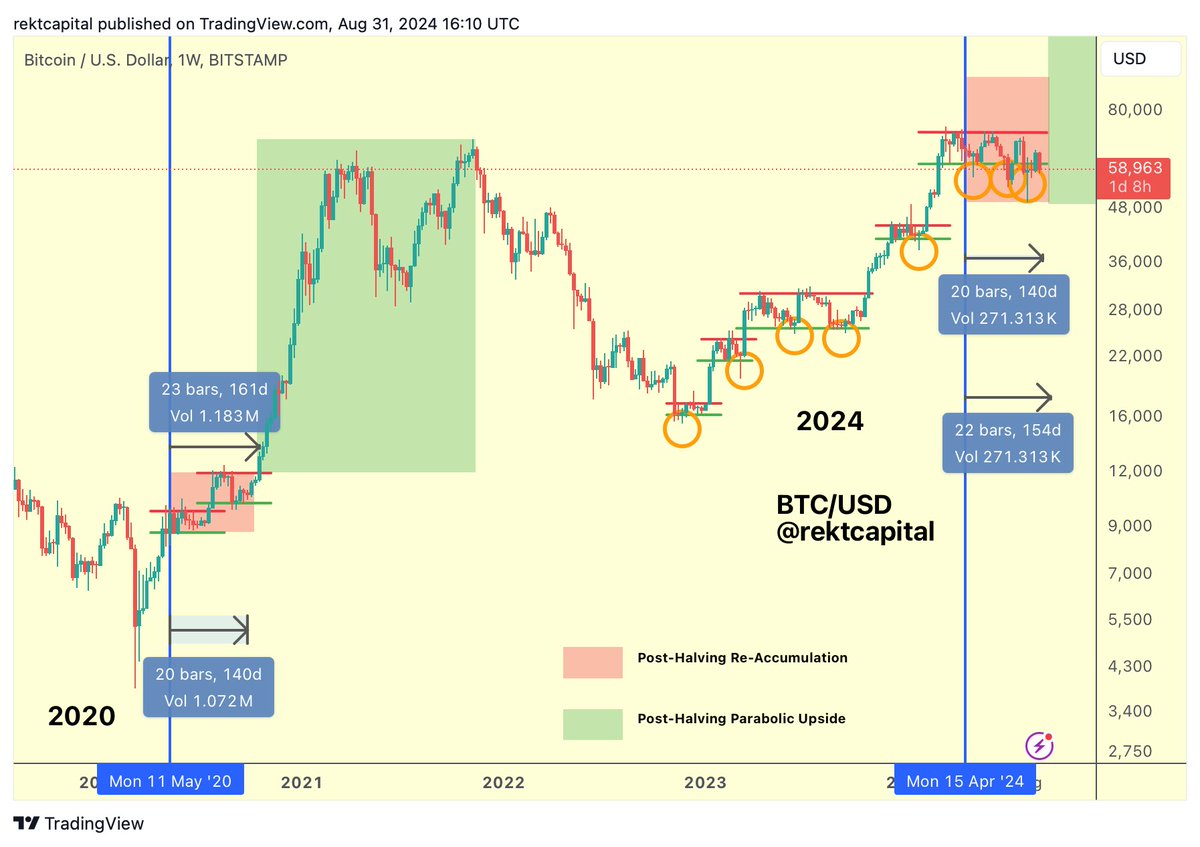

Popular analyst Rekt Capital suggested in some of his recent market comments that the BTC/USD pair still follows its post-halving exit pattern consistent with previous halving years. In an X post on August 31st, he shared the following insights:

“History shows that Bitcoin tends to exit 150-160 days after the halving event. This means Bitcoin will exit the Reaccumulation Range in late September 2024.”

Rekt Capital acknowledged that even Bitcoin’s best September only yielded a 6% gain. However, October could change the game with average monthly returns of around 23%:

“I wouldn’t be surprised if Bitcoin consolidates a bit more and then breaks out in October. After all, October has historically always been a strong month.”

Türkçe

Türkçe Español

Español