As one of the major Bitcoin crypto investment companies in the Asia region, QCP Capital reported significant changes in the US employment market. Following the data release, expectations for the US Federal Reserve (Fed) to cut interest rates by more than 25 basis points have strengthened, and the crypto market moved upward.

Expectations for Interest Rate Cuts Above 25 Basis Points Strengthen

The US Job Openings and Labor Turnover Survey (JOLTS) released yesterday fell to its lowest level since January 2021, while layoffs reached their highest level since March 2023. These latest data from the US employment market have increased the likelihood of the Fed cutting interest rates by 50 basis points in September to 50%, strengthening market expectations for an interest rate cut above 25 basis points.

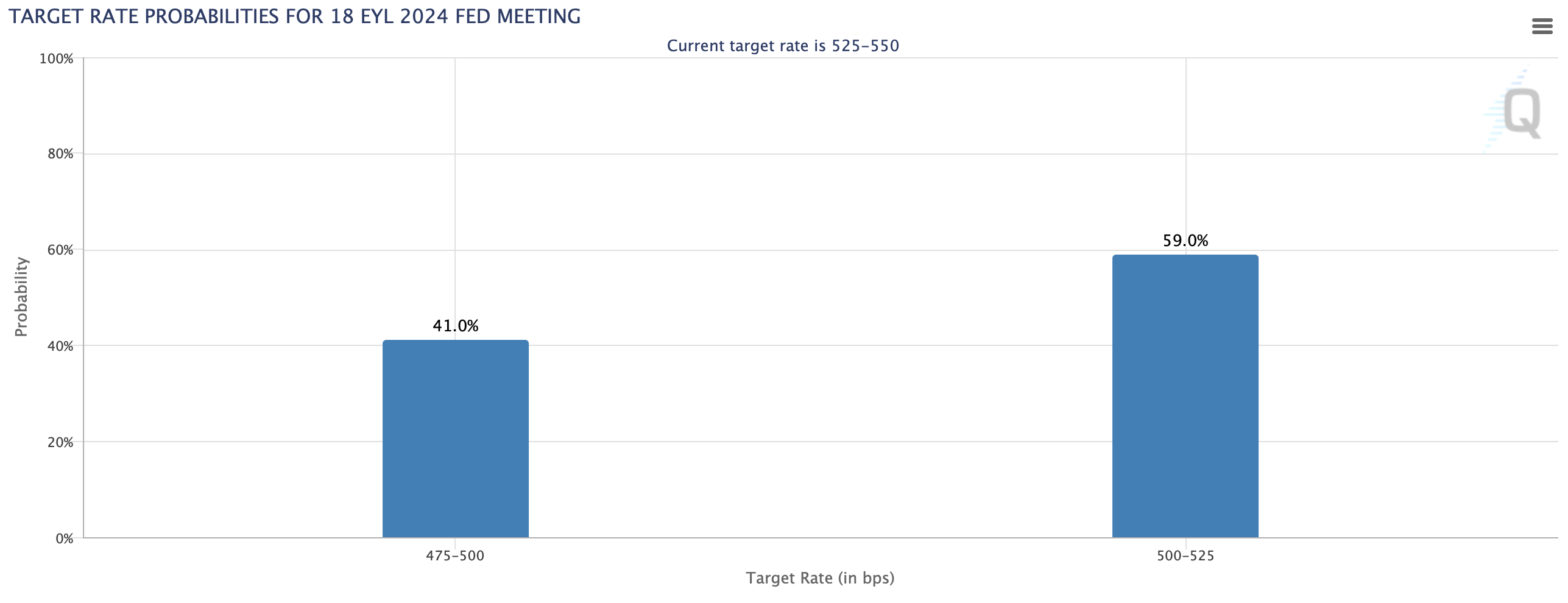

According to the CME FedWatch tool, the expectation for the Fed to cut interest rates by 25 basis points on September 18 is currently at 59%, while the expectation for a 50 basis point cut is evaluated at 41% probability.

Following these developments, Bitcoin (BTC) rose above $58,500 during the US trading session, while Ethereum (ETH) approached $2,500. However, both cryptocurrencies experienced a decline during Asian trading hours and are currently trading at $57,164 for Bitcoin and $2,412 for Ethereum. Despite this price fluctuation, QCP Capital noted that the overnight outflows from spot Bitcoin ETFs were the lowest in the last six trading days, totaling $37.5 million.

High Volatility Expected Across the Market

Meanwhile, this week, Bitcoin’s volatility index showed a 6% increase from the week’s lowest level, indicating that front-end volatility remains high.

QCP Capital, considering the latest Volatility Market Indicator (VMI) signals, stated that market sentiment continues to be influenced by data flows from the US economy and the Fed’s monetary policy decisions, predicting that overall market volatility will remain at high levels.

Türkçe

Türkçe Español

Español