Bitcoin (BTC) price dropped below $56,000, hitting a daily low of $55,817. While BTC’s price negativity continues, altcoins remain in the red. Two different crypto analysts share their predictions on the current situation. We mentioned analysts targeting $53,000 today; is BTC heading to these levels?

Bitcoin (BTC) Analyst Commentary

Earlier today, we shared crypto analyst Roman’s bearish scenario. He was right, and the price decline accelerated. However, the weakening volume along with the price drop still indicates a recovery possibility on the daily chart. BTC lost $56,000, and Roman wrote the following;

“This morning I published a bearish scenario, but the daily chart still shows upward potential. This is because the price is falling along with the volume.

We are also approaching the $55,000 support on the daily chart, so longs make more sense, but I need to see more to trade.”

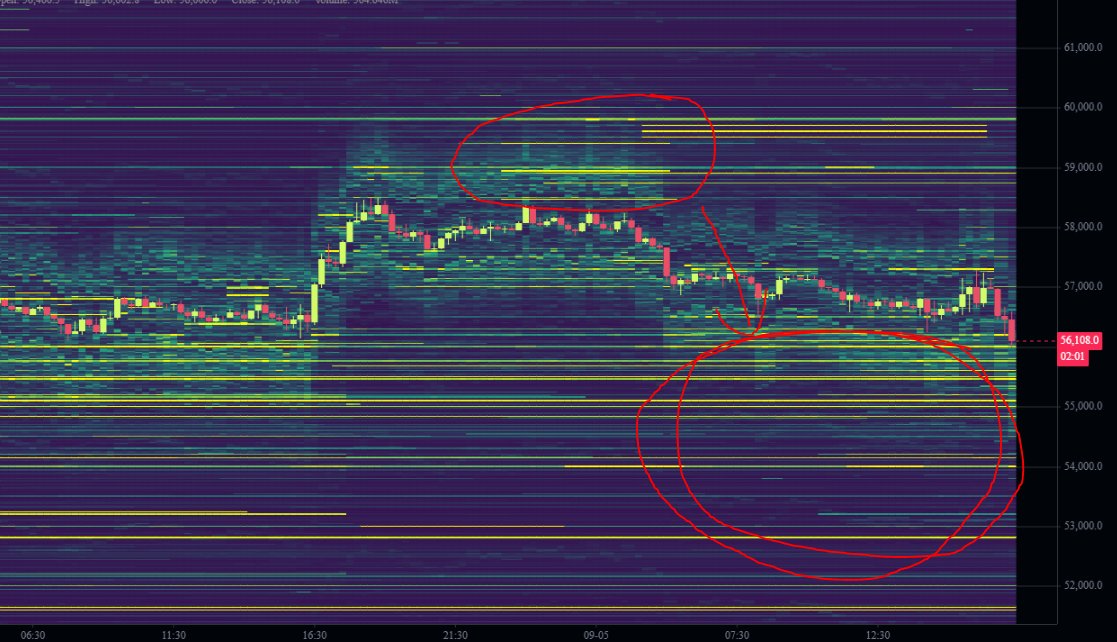

Another popular crypto analyst SETH says whales are trying to keep the price low while buying, and the recent move is related to this.

“Sell orders came in and pushed BTC down, filling buy orders.

There are a lot of bids down here! Bitcoin has been doing this for 6 months, are you surprised? You ask why the price doesn’t rise while whales are buying. This is the reason. They are pulling the price down again to buy more.”

Binance order book image added by the analyst remains hopeful for a rise.

Cryptocurrency Commentary

On Friday, the latest labor data will be released, leaving only inflation figures. If tomorrow’s data or the inflation data comes in at abnormal levels, it will increase the Fed’s likelihood of a 100bp cut for 2024. But that’s not the only issue. Simultaneously, Japan’s negative interest rate story due to inflation increases the likelihood of more hikes.

News from Japan negatively affected the markets last month as well. Due to the potential for a similar wave, we see investors remaining very cautious, especially in cryptocurrencies. Experts expect a rise in the markets with improved liquidity conditions in the last quarter, but in the short term, buyers have valid reasons not to act boldly. This keeps the markets down.

Türkçe

Türkçe Español

Español