Bitcoin  $94,952 has finally surpassed the long-awaited resistance level of $67,400, reaching $68,000 after two and a half months. Many market observers anticipated that breaking this threshold would pave the way for the price to reach new heights. Consequently, confidence in the cryptocurrency market has surged. However, a report by Santiment indicates that this upward momentum may soon slow down. What are the reasons behind this expected potential stagnation?

$94,952 has finally surpassed the long-awaited resistance level of $67,400, reaching $68,000 after two and a half months. Many market observers anticipated that breaking this threshold would pave the way for the price to reach new heights. Consequently, confidence in the cryptocurrency market has surged. However, a report by Santiment indicates that this upward momentum may soon slow down. What are the reasons behind this expected potential stagnation?

Market Experiences Bullish Sentiment

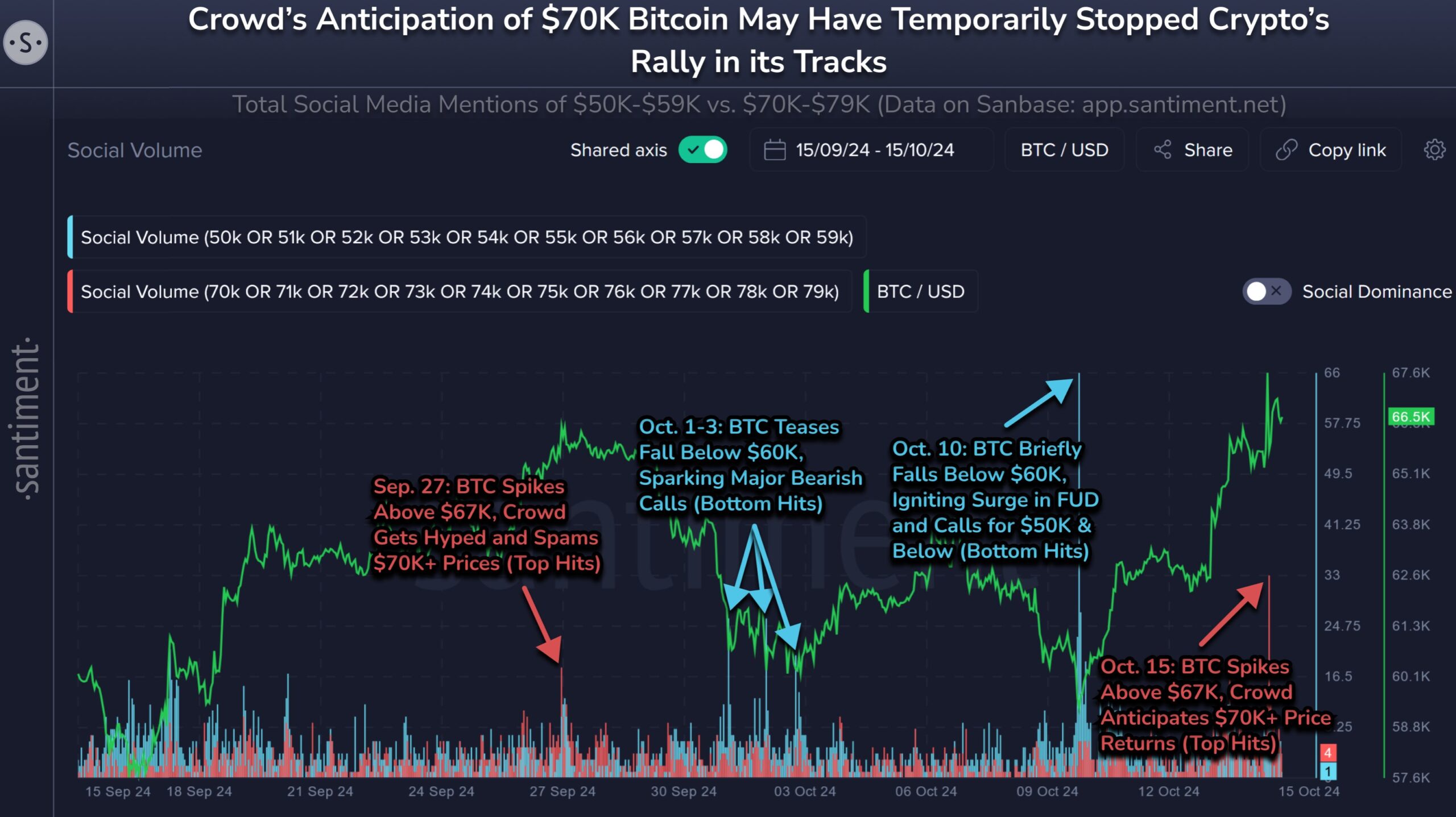

Santiment‘s report reveals that the market embraced a significant bullish sentiment during the first two days of the week. The report suggests that this newfound excitement may inadvertently slow the current upward momentum of the market.

Data from Santiment shows that such fluctuations align closely with social media interactions. Notably, as the price dipped between $50,000 and $59,000, negative social media posts increased; conversely, as the price reached between $70,000 and $79,000, positive posts peaked. This trend indicates that the price may fluctuate based on public sentiment.

Market Moves Against Crowd Expectations

Santiment also notes that the cryptocurrency market tends to move contrary to crowd expectations. This suggests that when the majority believes prices will rise, a decline may occur, and vice versa. This emphasizes the importance of independent thinking for market participants.

The Santiment report highlights the need for investors to avoid the crowd’s traps. In this context, understanding the recent stagnation in the Bitcoin market requires investors to steer clear of misleading cues created by social media and public sentiment.

The insights gained from Santiment’s data provide clues about potential future market movements. Social media interactions play a significant role in determining when prices might hit their lows or highs. Therefore, monitoring such data may prove beneficial for investors.