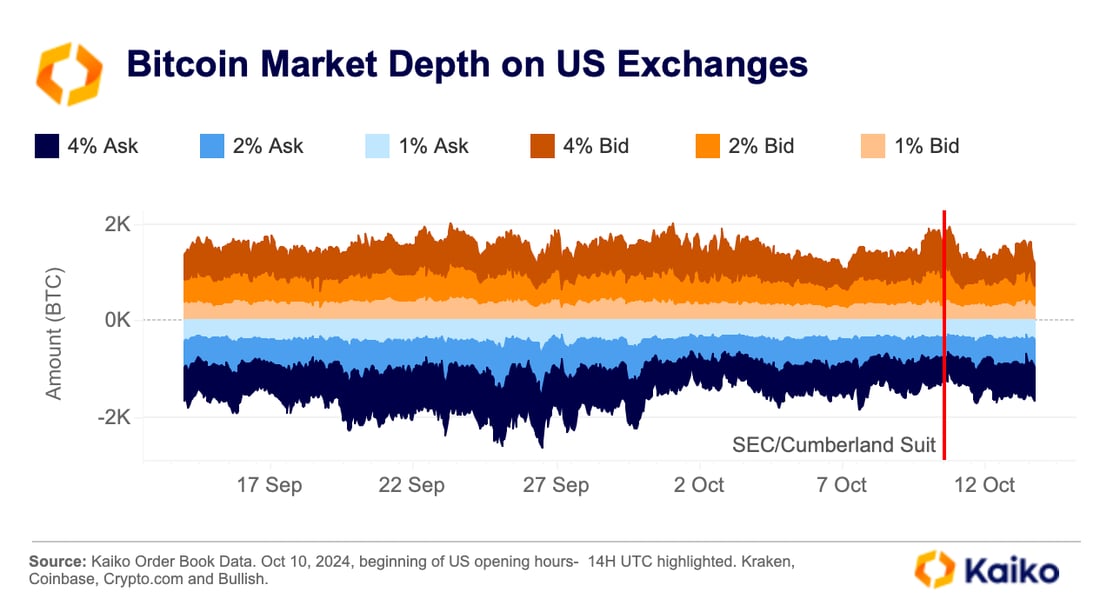

Coinbase announced that there has been no significant change in Bitcoin (BTC)  $91,671 liquidity following a lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against Cumberland. The company aimed to mitigate concerns raised by a report from the Paris-based firm Kaiko, which noted a decline in liquidity. In an email to CoinDesk, Coinbase stated, “We did not see a 2% change or decline in BTC-USD depth throughout October,” asserting that liquidity remained stable. Kaiko’s report indicated a sharp drop in liquidity on October 10th following SEC’s allegations against Cumberland.

$91,671 liquidity following a lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against Cumberland. The company aimed to mitigate concerns raised by a report from the Paris-based firm Kaiko, which noted a decline in liquidity. In an email to CoinDesk, Coinbase stated, “We did not see a 2% change or decline in BTC-USD depth throughout October,” asserting that liquidity remained stable. Kaiko’s report indicated a sharp drop in liquidity on October 10th following SEC’s allegations against Cumberland.

Kaiko: Liquidity Decline and Market Depth

Kaiko reported a 46% decline in Bitcoin liquidity on Coinbase at 11:00 AM on October 10th. This liquidity, measured by a 2% market depth, is calculated based on buying and selling orders concentrated around the average price. This decline implies that even smaller order sizes could move the price by 2%.

Kaiko noted a decrease in liquidity on the selling side, while an increase was observed on the buying side. This situation suggests that market makers might be adjusting their positions in anticipation of a price drop. The firm also mentioned that liquidity has decreased on other exchanges, indicating that overall liquidity on U.S.-based exchanges has not yet returned to pre-lawsuit levels.

Cumberland: No Change in Operations

Cumberland disagreed with Kaiko’s analysis in a statement to CoinDesk, emphasizing that there are no changes in their operations following the SEC lawsuit. The company stated, “We are making no changes to our operations or the liquidity assets we provide.” Kaiko reiterated in a recent statement to CoinDesk that liquidity has since recovered, suggesting that the initial drop may have been related to changes in market expectations.

Monitoring how market depth changes and how liquidity fluctuations impact market expectations will remain an important focus for traders.