Cryptocurrencies may appear to offer easy profits, but the reality is different. Since the peak in 2021, most altcoins are trading significantly above their cost levels from the last bull phase. However, newcomers to the market often mistakenly believe that everything is straightforward when prices start to rise.

Cryptocurrency Market Cycles

These misconceptions will provide ample time for individuals to reflect as the next bull season begins and ends, much like the ongoing nightmare period of the past years. Cryptocurrencies do not grant anyone easy, quick, or consistent profit opportunities. Particularly in the last two quarters, traders who couldn’t manage their emotions faced losses due to panic buying and selling.

What should be done? Is it beneficial to monitor metrics like the fear and greed index? Nagato, in today’s analysis, believes it is not entirely accurate. This is because fear and greed are dominated by a limited number of participants and can be misleading.

Cryptocurrency Market Targets

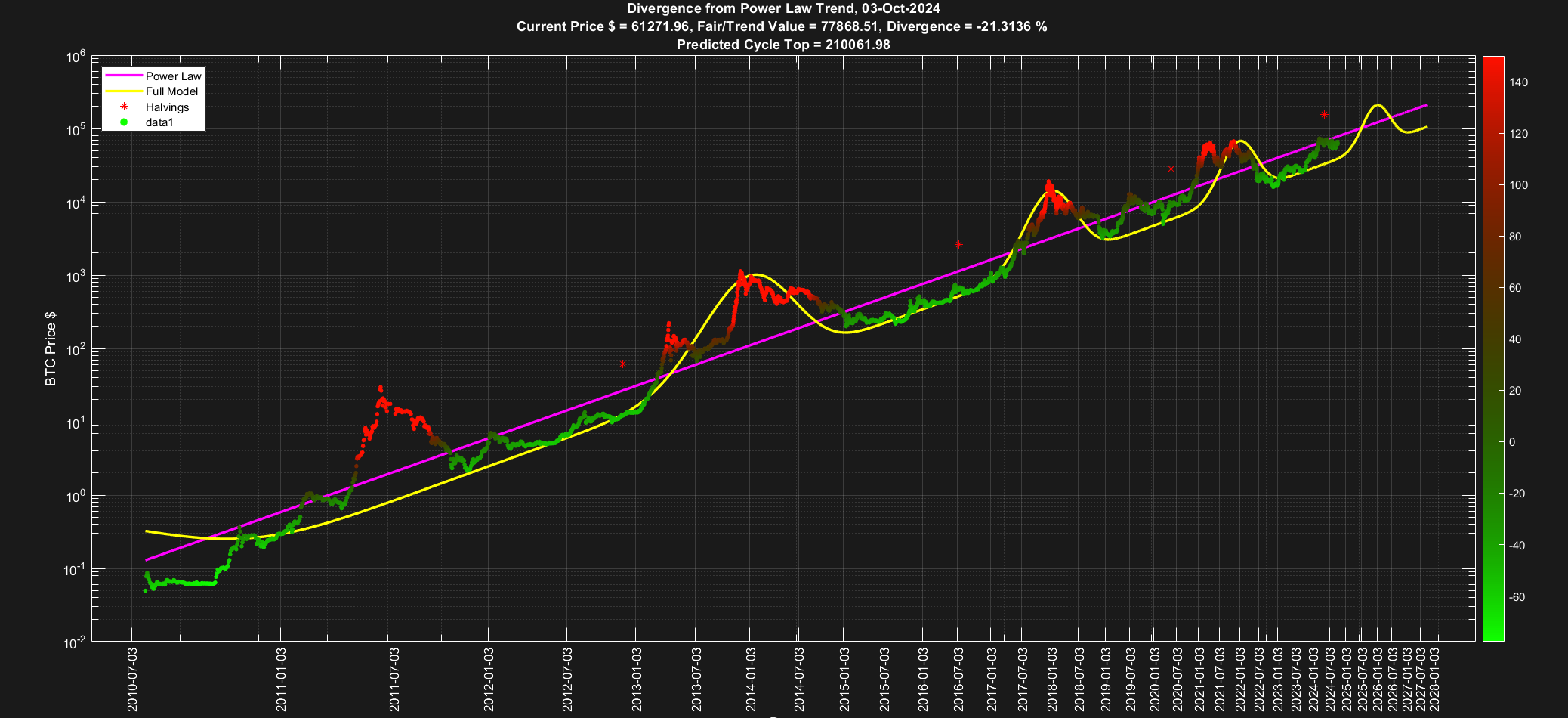

We need to pay attention to PlanB’s forecasts; he has become somewhat of an oracle with his projections. His targets for September, October, and November were met, based on his S2F chart. Despite the backlash when markets turned against him, his scarcity and demand-based price projections work well during bull markets.

During this cycle, it is anticipated that a BTC peak between $250,000 and $1 million will be observed from 2024 to 2028, based on the recent chart he shared.

Moustache shared a total market cap chart for altcoins, indicating that the first green bar (MACD) was seen after 25 weeks of red bars. According to him, following this movement, a one-month price increase could occur since similar patterns have been seen before.

Türkçe

Türkçe Español

Español