Cryptocurrency investors have faced significant losses in altcoins over the past seven months due to stagnant market movements. For this trend to reverse, Bitcoin  $103,821 must surpass its all-time high (ATH) of $73,777 to reach new peaks. As of the writing of this article, BTC has been hovering above $68,000, raising hopes that boring price movements may soon come to an end. What do experts say?

$103,821 must surpass its all-time high (ATH) of $73,777 to reach new peaks. As of the writing of this article, BTC has been hovering above $68,000, raising hopes that boring price movements may soon come to an end. What do experts say?

Bitcoin Supply Shock

ETF demand has regained strength, indicating a rise in institutional interest and confidence about future prices. Although it is yet to complete its first year, the inflows of BTC into ETFs have resulted in massive amounts of supply accumulating in the reserves of institutional players like BlackRock.

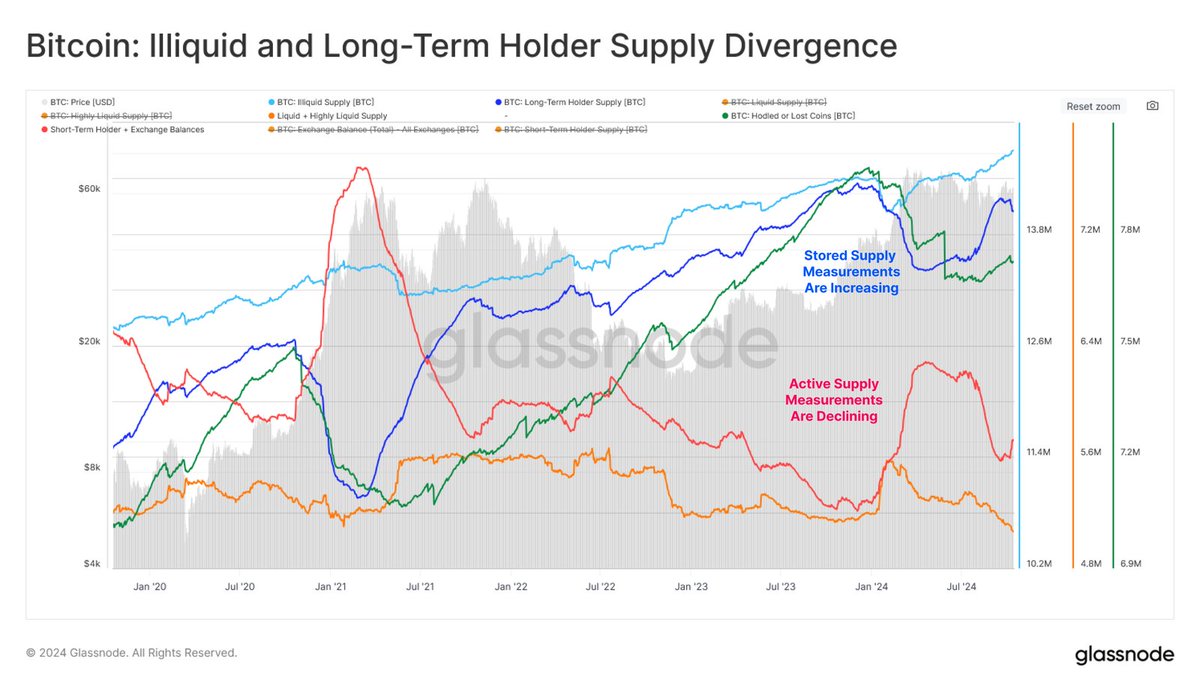

Popular crypto analyst Nic shared insights early today regarding the expected supply shock:

“Bitcoin supply shock is coming!

According to Glassnode data, the supply held by long-term holders is increasing while that of short-term holders is decreasing. Therefore, expect some extreme movements if we experience a surge in demand in the coming weeks.”

For BTC prices to sprint towards six-figure targets, a rise in demand must coincide with a dwindling supply on exchanges.

Bitcoin and Cryptocurrencies

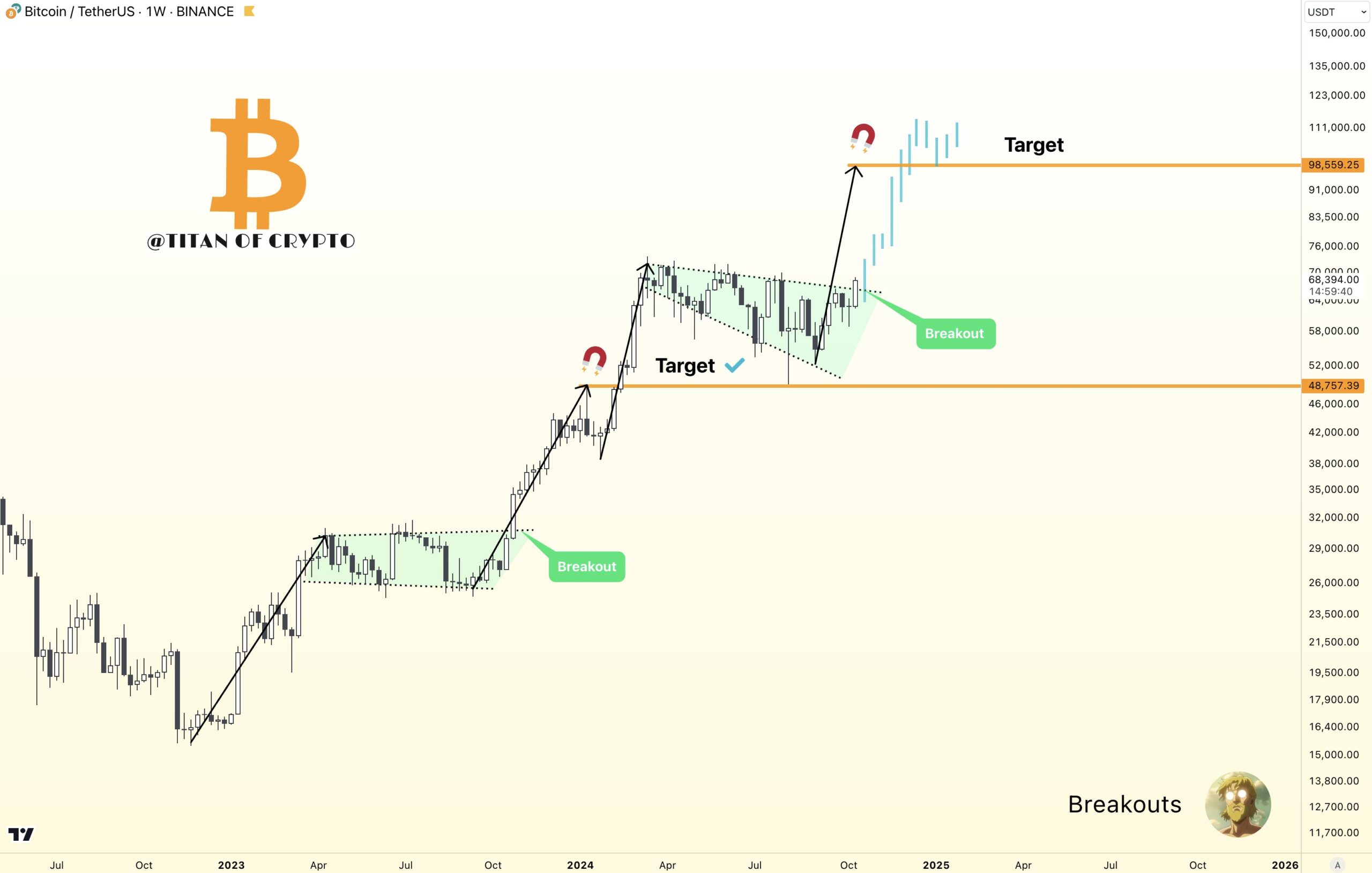

Titan Of Crypto confidently states that BTC’s price can now focus on the $98,000 target due to the momentum created. The analyst, addressing the prolonged dull movements, highlights patterns from previous years in the chart, suggesting that upcoming phases will be much more exciting.

Benjamin Cowen offers another perspective, emphasizing the significance of his findings for altcoin futures. He points out that in nine out of the last ten quarters, the ETH/BTC pair saw negative performance.

Altcoins may only begin to rise if ETH comes under pressure against BTC.

“In nine out of the last ten quarters, it has been down.

When I first mentioned this would happen three years ago, many thought it was absurd due to reasons like the transition to Proof of Stake and deflationary aspects. They completely ignored monetary policy. Now, monetary policy is loosening but slowly. We may see the ETH/BTC ratio hitting a bottom in Q4 of 2024 and rising in 2025. It’s crazy that some who once laughed at my views on ETH/BTC now see the validity after nine out of ten quarters of decline.”

Türkçe

Türkçe Español

Español