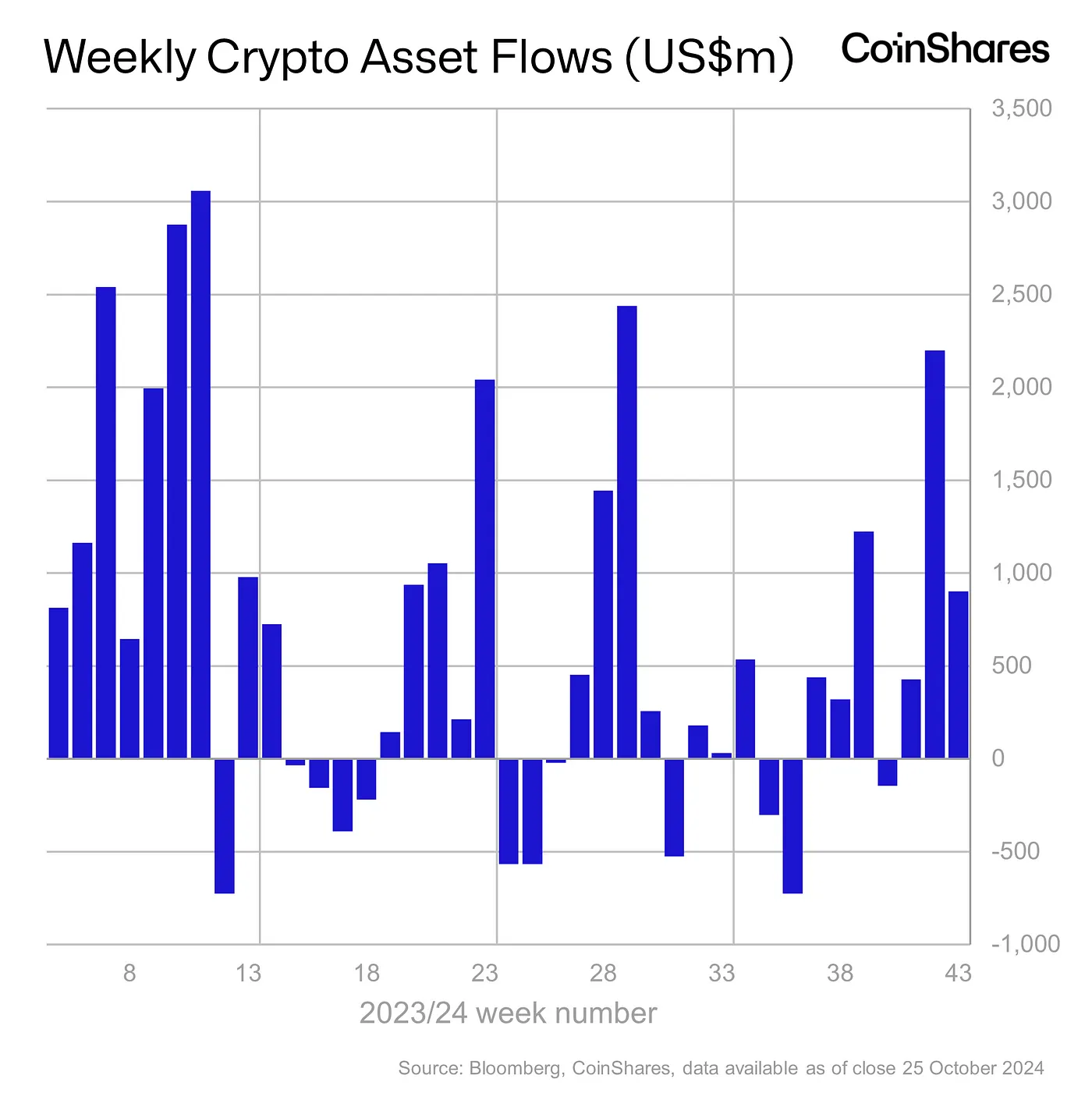

Recent political developments in the United States have significantly heightened interest in cryptocurrency investments. This month, cryptocurrency investment funds witnessed an influx of $901 million, bringing the total for the year to over $27 billion, nearly triple the record set in 2021. The United States led the way with $906 million in investments, while countries like Germany and Switzerland experienced limited growth. In contrast, Canada, Brazil, and Hong Kong saw slight withdrawals.

Impact of U.S. Politics on Bitcoin Investment

A substantial portion of this investment interest is directed towards Bitcoin (BTC)  $104,228. Investments in Bitcoin reached a total of $920 million this month, highlighting its prominence in the market.

$104,228. Investments in Bitcoin reached a total of $920 million this month, highlighting its prominence in the market.

Experts note that Bitcoin’s price and investment flows are influenced by recent developments in U.S. politics. The increasing strength of Republicans in public opinion polls is believed to have spurred this interest. However, during periods when Bitcoin typically rises, there was a $1.3 million outflow from short Bitcoin funds this month, indicating that investors prefer to avoid risk.

Mixed Outlook for Ethereum and Solana

While U.S. political influences support Bitcoin, Ethereum (ETH)  $2,576 has not enjoyed the same level of interest. Ethereum faced the highest outflows among cryptocurrency investment funds, totaling $35 million. Conversely, Solana

$2,576 has not enjoyed the same level of interest. Ethereum faced the highest outflows among cryptocurrency investment funds, totaling $35 million. Conversely, Solana  $173 (SOL) attracted $10.8 million in investments, making it the second most favored cryptocurrency after Bitcoin.

$173 (SOL) attracted $10.8 million in investments, making it the second most favored cryptocurrency after Bitcoin.

Additionally, blockchain stocks have shown signs of recovery, marking three consecutive weeks of positive inflows. Last week, the blockchain sector received $12.2 million in investment.

The increasing interest in the cryptocurrency market, driven by U.S. political developments, has resulted in the fourth highest monthly inflow of the year. These investments represent 12% of total managed assets, illuminating the global activity within the cryptocurrency ecosystem.

Türkçe

Türkçe Español

Español