The cryptocurrency market has seen Bitcoin prices fall back to around $98,400, coinciding with the release of an anticipated investment report. This report tracks the activities of institutional investors in the cryptocurrency market, revealing which altcoins are attracting investments through ETFs and ETPs. Every Monday, we share this vital report with our readers.

Institutional Investor Report

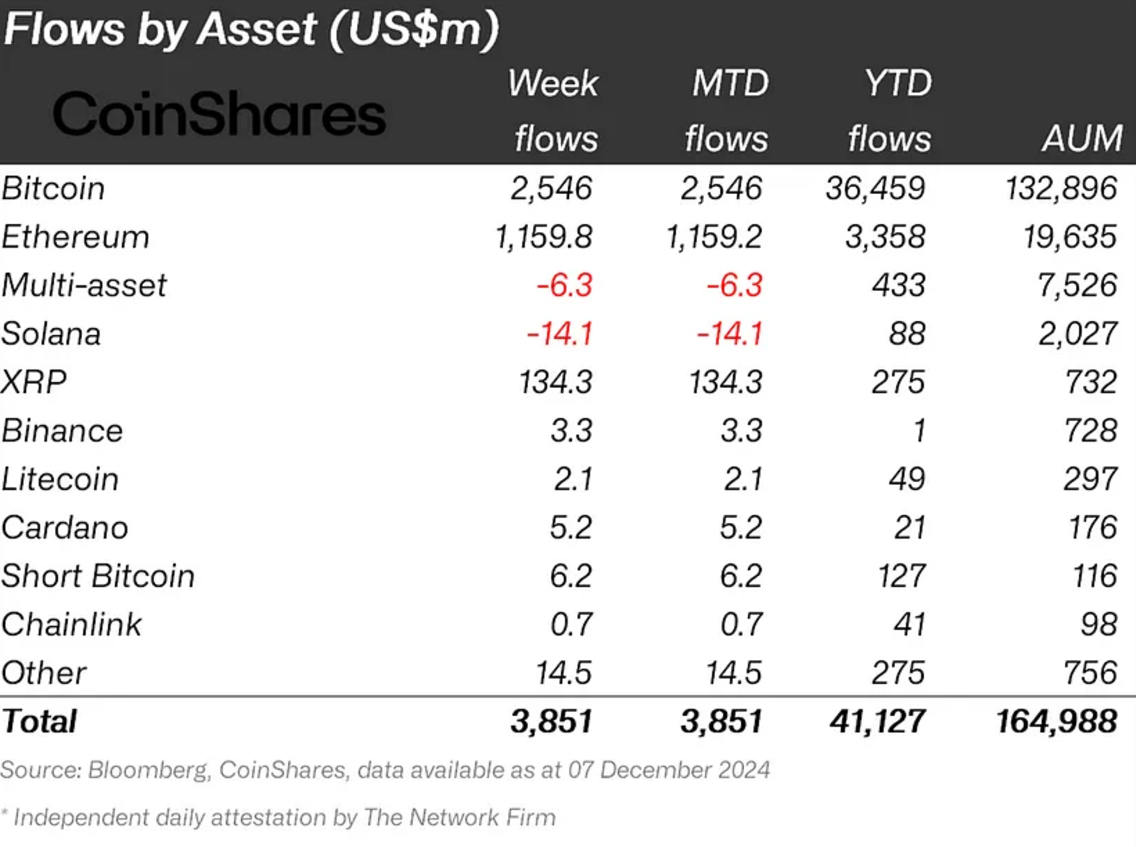

Recent weeks have witnessed record inflows, peaking at $3.85 billion for the largest weekly entry. These inflows reflect a growing interest in cryptocurrencies, indicating that institutional demand may not yet be satiated. Since the beginning of 2024, total inflows have reached enormous levels.

Yearly inflows have surpassed $41 billion, with the total assets of cryptocurrency investment products climbing to a new record of $165 billion. In contrast, the previous cycle’s peak in 2021 recorded annual inflows of $10.6 billion and total reserves of $83 billion. While total assets have doubled, inflows this cycle are nearly four times higher.

Given that we have not yet reached the peak of this cycle and the year is not yet closed, this situation is indeed exciting.

Bitcoin and Altcoin Inflows

Which cryptocurrencies have attracted the most interest alongside total inflows? Bitcoin (BTC)  $84,833 leads the pack, with details shown in the table below. U.S. investors accounted for nearly all inflows, contributing $3.6 billion, while Switzerland, Germany, Canada, and Australia had inflows of $160 million, $116 million, $14 million, and $10 million, respectively.

$84,833 leads the pack, with details shown in the table below. U.S. investors accounted for nearly all inflows, contributing $3.6 billion, while Switzerland, Germany, Canada, and Australia had inflows of $160 million, $116 million, $14 million, and $10 million, respectively.

Ethereum  $1,598 experienced its best week since the ETF launch in July, attracting $1.2 billion in weekly inflows, with the altcoin reaching $4,000 last week. Solana

$1,598 experienced its best week since the ETF launch in July, attracting $1.2 billion in weekly inflows, with the altcoin reaching $4,000 last week. Solana  $139 (SOL) faced its second consecutive exit week with $14 million in sales, as spot prices dropped to $227.

$139 (SOL) faced its second consecutive exit week with $14 million in sales, as spot prices dropped to $227.

Although blockchain equities saw their largest inflow of $124 million since January, BTC short-sale products experienced $6.2 million in inflows. XRP Coin recorded an inflow of $134 million, followed by Cardano  $0.632203 (ADA). LTC and BNB Coin attracted $2.1 million and $3.3 million in inflows, respectively.

$0.632203 (ADA). LTC and BNB Coin attracted $2.1 million and $3.3 million in inflows, respectively.

Türkçe

Türkçe Español

Español