Cryptocurrency trading volumes and rising prices have led to increasing volatility. Within minutes, altcoins experienced declines of up to 20%. The surge in trading volumes and liquidity blocks in futures has paved the way for such sudden shifts.

Market Reaction to Upcoming Inflation Data

Ahead of the upcoming U.S. inflation data on Wednesday, unexpected market movements were anticipated. Today, after BTC surpassed 100,000 dollars, warnings were issued regarding the potential for larger fluctuations. As expected, intense demand in futures triggered an exciting drop.

Significant Declines in Altcoins

The drop in altcoins exceeded 2%. At the time of writing, SHIB fell by 20%, DOGE by 13%, and XRP by 15%. While ETH briefly dipped into the 3,400 dollar range, BTC declined to 94,150 dollars. Investors, concerned about short-term volatility risks against bulls before Wednesday’s data, engaged in panic selling, further supporting the speculative drop.

The total market value of cryptocurrencies decreased by 5.7%, while Bitcoin  $94,744‘s dominance surpassed 55% again.

$94,744‘s dominance surpassed 55% again.

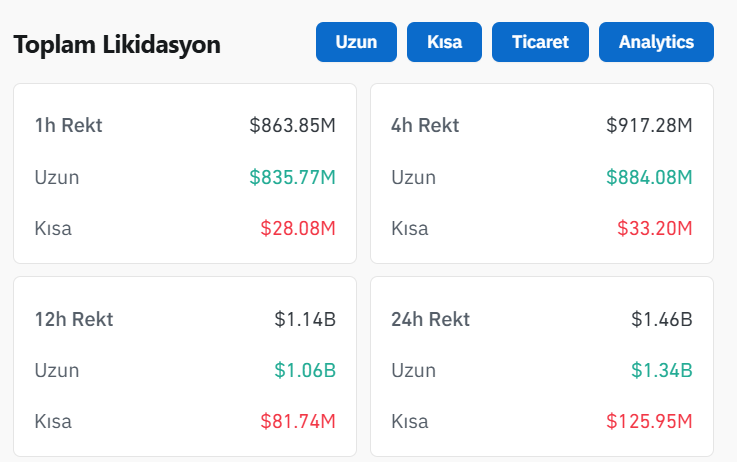

In just the last hour, nearly 850 million dollars in long positions were liquidated.