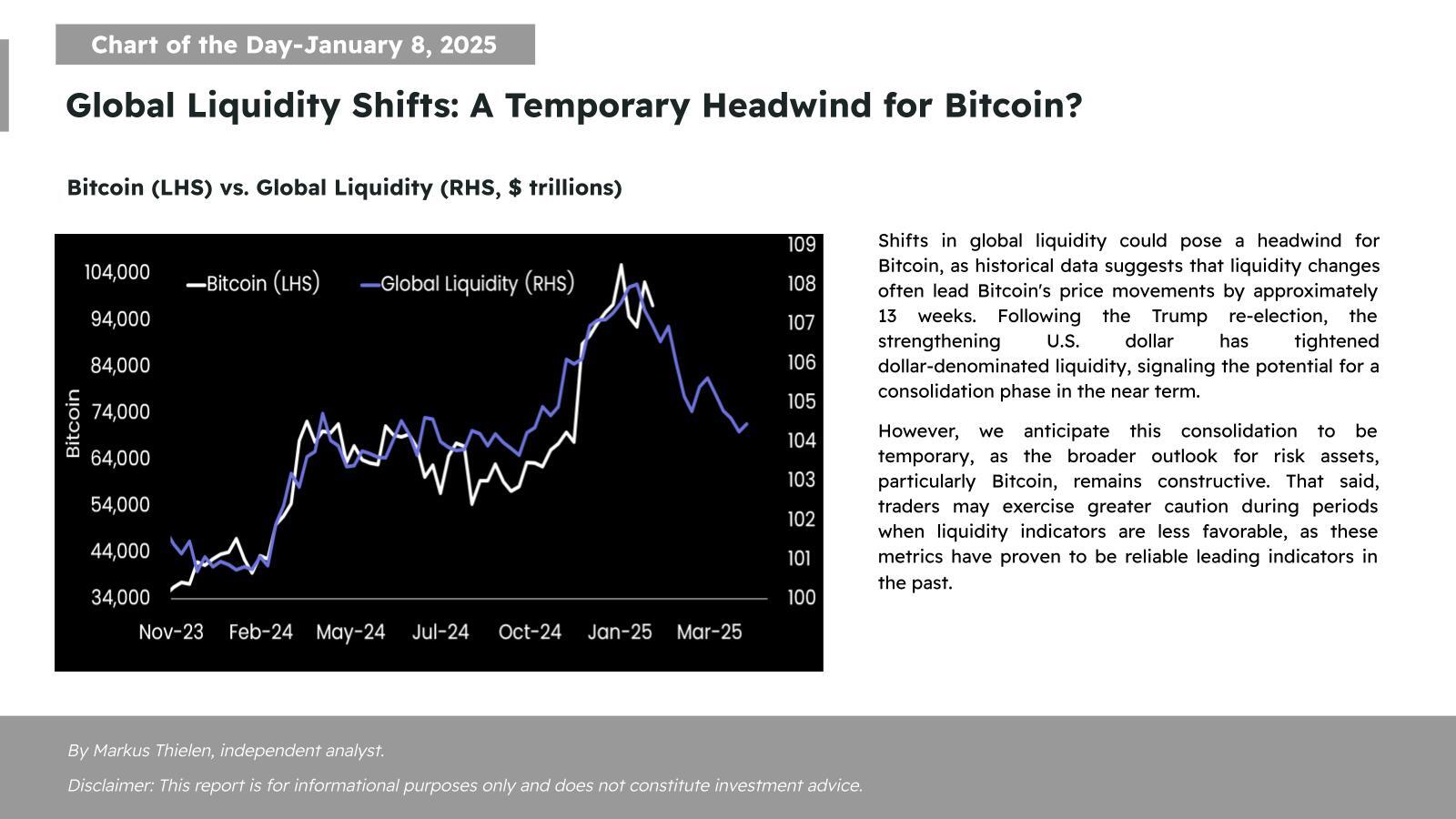

Matrixport’s recent assessment report indicates that fluctuations in global liquidity could place short-term pressure on Bitcoin (BTC)  $95,195. Historical data suggest that changes in liquidity have typically signaled price movements in Bitcoin approximately 13 weeks prior. Recently, with the strengthening of the U.S. dollar and Donald Trump’s reelection, liquidity based on the U.S. dollar has started to contract. This scenario hints that Bitcoin may enter a consolidation phase in the near term.

$95,195. Historical data suggest that changes in liquidity have typically signaled price movements in Bitcoin approximately 13 weeks prior. Recently, with the strengthening of the U.S. dollar and Donald Trump’s reelection, liquidity based on the U.S. dollar has started to contract. This scenario hints that Bitcoin may enter a consolidation phase in the near term.

How Does Global Liquidity Tightening Affect Bitcoin?

The tightening of liquidity in global markets is a critical situation for Bitcoin and altcoin investors. When liquidity decreases, investors tend to reduce their inclination to invest in risky assets.

Although Bitcoin has historically been affected by these processes, experts anticipate that this consolidation will be temporary. Indeed, Matrixport’s report emphasizes that following this transient phase, Bitcoin and other risky assets will retain their long-term positive potential.

Long-Term Outlook Remains Positive

Positive expectations regarding Bitcoin’s long-term performance continue to support the overall market sentiment. However, short-term fluctuations necessitate that investors adopt more cautious strategies. In particular, in low liquidity environments, investors need to take more protective measures to minimize their risks.

Matrixport highlights that exiting the current consolidation phase may take time, but this process could provide a more stable ground for investors. This emphasis serves as an important warning for those looking to understand the dynamic structure of the cryptocurrency market.

The future of Bitcoin and the cryptocurrency market will continue to be shaped by changes in global economic conditions. Liquidity indicators remain an important tool for investors to understand market movements.