The first quarter concludes with a challenging three months for cryptocurrency investors. As discussions surrounding tariffs intensify, Bitcoin  $85,023‘s price has fallen below $86,000. S&P Global recently shared its market expectations, including forecasts for 2025, sparking curiosity about what lies ahead.

$85,023‘s price has fallen below $86,000. S&P Global recently shared its market expectations, including forecasts for 2025, sparking curiosity about what lies ahead.

Tariff Expectations

Experts describe the uncertainty stemming from U.S. trade policy as an unpredictable period, anticipating that more details will emerge in April. S&P analysts summarize their predictions for the year as follows:

- The 25% tariffs on steel and aluminum imposed by the U.S. are expected to remain indefinitely.

- Mutual tariffs are anticipated to be announced in April across all countries linked to the U.S., regardless of trade balances. Sector-specific tariffs of 10% on automobiles, pharmaceuticals, and semiconductors are also projected.

- The additional 20% tax on China is expected to remain in effect.

- Experts estimate that the tariffs on Mexico and Canada are around 10% and will stay in place throughout 2025, noting that the initial 25% tax announcement has eased due to tariff exemptions under the USMCA.

- The USMCA is expected to remain in force after its 2026 review process.

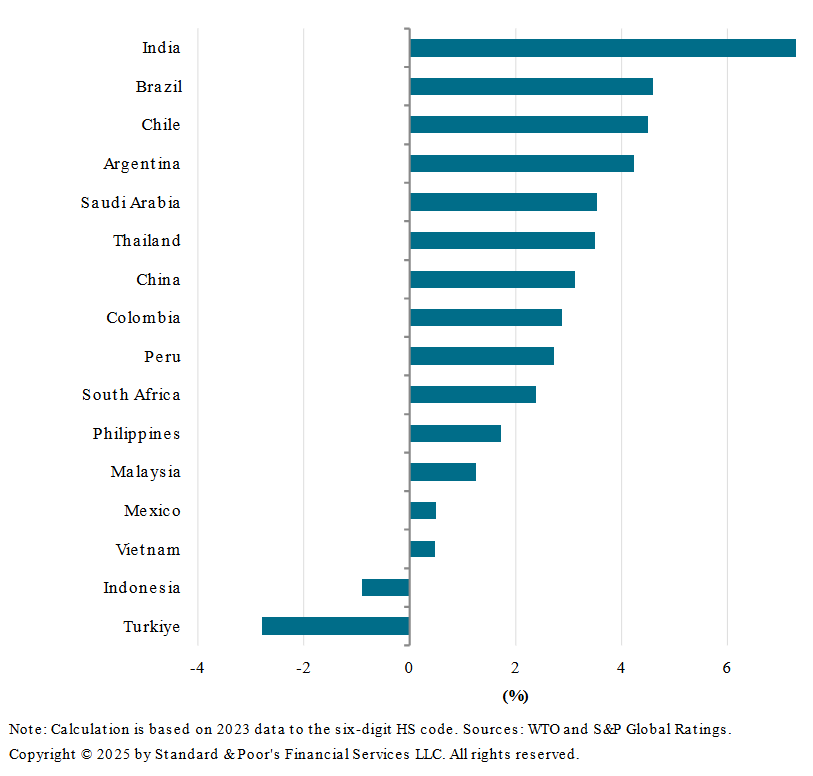

“We calculated tariff differentials between developing markets (EM) and the U.S. based on harmonized system codes for trade classification. According to our forecasts, India has the widest tariff gap with the U.S. at 7.3 percentage points.

Following India, Brazil, Chile, and Argentina impose tariffs approximately 4.5 percentage points higher than those the U.S. applies to them. The remaining EMs have tariff differentials of 3.5 percentage points or lower, with some countries like Indonesia and Turkey experiencing negative tariff differences with the U.S.”

Economic Predictions for 2025

Predictions for a recession in the U.S. have increased to 25%. However, the latest report forecasts a significant slowdown in growth rather than an economic downturn. Experts expect GDP growth to decline from 2.7% in 2024 to 1.9% this year, mirroring Fed forecasts.

The S&P Global report anticipates U.S. inflation to remain around 3% throughout the year. Experts expect only one interest rate cut from the Fed during the year, with a continued downward trend towards a neutral interest rate expected in 2026.

Türkçe

Türkçe Español

Español