On October 11, 2025, the global cryptocurrency market experienced an unprecedented collapse, marking a significant event in financial history. This dramatic downturn was sparked by U.S. President Donald Trump’s announcement of a 100% tariff on Chinese products, a move perceived as retaliation against China’s restriction on rare earth elements exports. This decision resulted in a sharp decline in investor confidence, leading to simultaneous plummets in both cryptocurrency and traditional markets.

Massive Liquidations and Investor Losses

Following Trump’s announcement, the S&P 500 index fell by 2.7% and the digital asset market saw an unprecedented wave of liquidations. Data from Coinglass indicated that $19.1 billion worth of positions were closed within 24 hours, affecting 1.6 million investors. This event marked the largest single-day altcoin liquidation in crypto history.

Bitcoin  $91,081 fell below $105,000, while Ethereum

$91,081 fell below $105,000, while Ethereum  $3,094 dropped beneath $3,800. Significant altcoins like Solana

$3,094 dropped beneath $3,800. Significant altcoins like Solana  $139, Cardano

$139, Cardano  $0.385644, Avalanche (AVAX), and XRP saw losses exceeding 30%. AVAX and XRP depreciated by 61% and 62%, respectively, prompting panic selling throughout the market. Consequently, the global crypto market capitalization fell by 9.1% within a day, reaching $3.86 trillion.

$0.385644, Avalanche (AVAX), and XRP saw losses exceeding 30%. AVAX and XRP depreciated by 61% and 62%, respectively, prompting panic selling throughout the market. Consequently, the global crypto market capitalization fell by 9.1% within a day, reaching $3.86 trillion.

The hardest hit were investors using high leverage. On the Hyperliquid exchange, $10 billion worth of positions were liquidated, with long positions encountering $9.3 billion in losses. Nevertheless, a brief recovery was observed in smaller altcoins like TRX, SUN, and JST.

Crypto Stocks Plummet as Panic Selling Accelerates

The crash severely impacted crypto-focused publicly traded companies. Coinbase shares dropped 7.75% to $357, while crypto finance company Bullish fell 9.4% to $60. Bitcoin mining giant MARA Holdings ended the day with a 7.6% loss, and Strategy’s shares, known for holding Bitcoin reserves, declined by 4.8% to $304. Geoffrey Kendrick, Head of Digital Asset Research at Standard Chartered, noted that the net asset value ratio of companies like Strategy, holding Bitcoin reserves, fell below 1.18, the lowest in two years, potentially increasing balance sheet pressure in the sector.

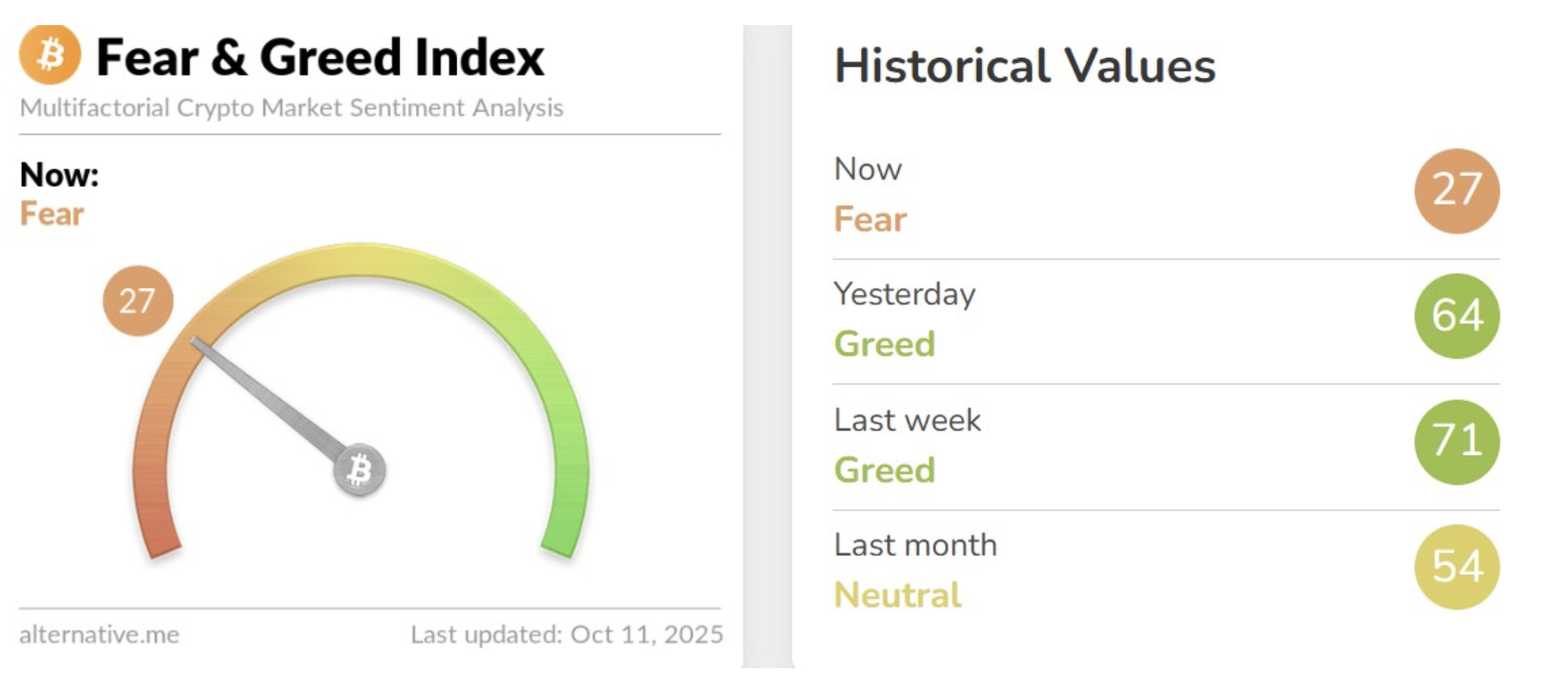

Amid these developments, Google, Coinbase, and Mastercard introduced the Agent Payments Protocol (AP2) project, aiming to integrate AI-powered payments with crypto. However, this positive development failed to dispel the prevailing market fear. The “Fear and Greed Index” fell sharply from 64 to 27 within a day, highlighting the rapid spread of panic.

The Russian Central Bank’s permission for banks to engage in limited crypto activities and the announcement of a G7-indexed global stablecoin initiative indicate a strengthening trend toward long-term regulation despite the market downturn.