The Chicago Mercantile Exchange (CME), a pivotal hub for cryptocurrency options markets, experienced an unexpected shutdown, leaving many financial markets in suspense. Imagine a scenario where the world’s largest options exchange goes offline during trading hours—this is precisely what transpired. Trading activities for assets like Bitcoin  $91,081, silver, and other commodities came to a halt, sparking speculation around whether the disruption in silver trading was more than a mere technical failure.

$91,081, silver, and other commodities came to a halt, sparking speculation around whether the disruption in silver trading was more than a mere technical failure.

The Unexpected CME Shutdown

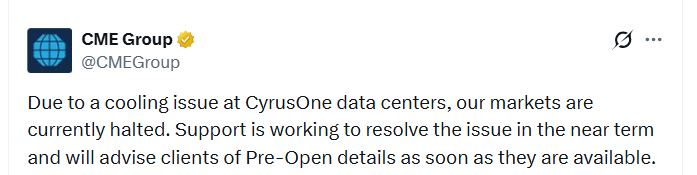

Citing data center issues managed by CyrusOne, the CME was compelled to halt all futures and options trading. As the world’s largest exchange offering options for a plethora of products including stocks, treasury bonds, energy, Bitcoin, Ethereum  $3,094, and agricultural commodities, this pause sent shockwaves across global markets. The initial announcement from CME highlighted a cooling issue at the data centers.

$3,094, and agricultural commodities, this pause sent shockwaves across global markets. The initial announcement from CME highlighted a cooling issue at the data centers.

“Markets are currently paused due to a cooling issue at CyrusOne data centers. Our support team is actively working to resolve the issue swiftly, and clients will be informed with pre-opening details as soon as they are available.”

Hours later, news surfaced that some markets had reopened. However, the CME clarified that BrokerTec AB markets were operational, while the rest of the CME Group’s markets remained suspended due to ongoing cooldown challenges at CyrusOne. Updates were promised as information became available.

Although exchanges powered by CME such as CBOT, NYMEX, COMEX, and Gulf Mercantile Exchange faced interruptions, a clear timeline for reopening from CME is still pending.

Silver Prices and CME’s Moves

Nick Twidale, the chief analyst at AT Global Markets in Sydney, cautioned of potential imbalances in the options and futures markets upon resumption of trading. Despite numerous firms voicing frustration due to the suspension, the situation remains uncertain.

Meanwhile, Tansel Kaya contends that the CME was driven to suspend trading due to record silver prices, suggesting that CME’s actions might be an attempt to cool the markets amid fears of a margin collapse. He speculates that such moves could lead to increased volatility in BTC and ETH futures, as BTC recently rose above $92,000, but now finds buyers at $91,400.

“The Chicago Mercantile Exchange (CME), the world’s largest futures exchange, offers futures for an array of assets. Today, CME fell prey to a cooling system wreck, leading to temporary market halts amid record silver futures at $53.67. Theories suggest that the CME’s pause was a strategic move to allow short position holders a breather from the large short positions they were trapped in over ‘paper silver’, exacerbated by Chinese export restrictions and burgeoning solar panel/chip demand.”