The cryptocurrency market saw volatility accelerate as Bitcoin’s rapid climb was swiftly reversed by an even sharper daily drop, pulling altcoins down in its wake. Dogecoin, which had posted double-digit gains earlier in the week, continued its decline with a 6% loss today following Bitcoin’s correction. Attention now turns to key developments that could influence digital asset trends and market sentiment in the coming days.

Geopolitical Tensions and Market Holiday Shape Crypto Movements

Cryptocurrency markets are navigating choppy waters as geopolitical developments loom large and traditional financial markets in the US and China observe holidays. Eyes are fixed on scheduled indirect talks between the United States and Iran set for tomorrow in Oman. While former US President Donald Trump has signaled openness to a deal, he has also repeatedly emphasized the readiness to respond with force if required. Trading volumes in crypto are likely to remain isolated as US and Chinese markets are closed, and no major US economic releases are slated for today.

Central Bank Comments and Capital Outflows Keep Market Cautious

Later today, Federal Reserve Vice Chair for Supervision, Bowman, will take the stage at an American Bankers Association conference in Orlando, while ECB’s Villeroy will address geopolitical fragmentation at an event in Paris. These speeches are unlikely to reset market narratives, leaving a calm news cycle—at least on the surface. Any late-breaking statements from ongoing negotiations with Iran could introduce fresh volatility. Market participants will closely monitor tomorrow’s announcements for new signals.

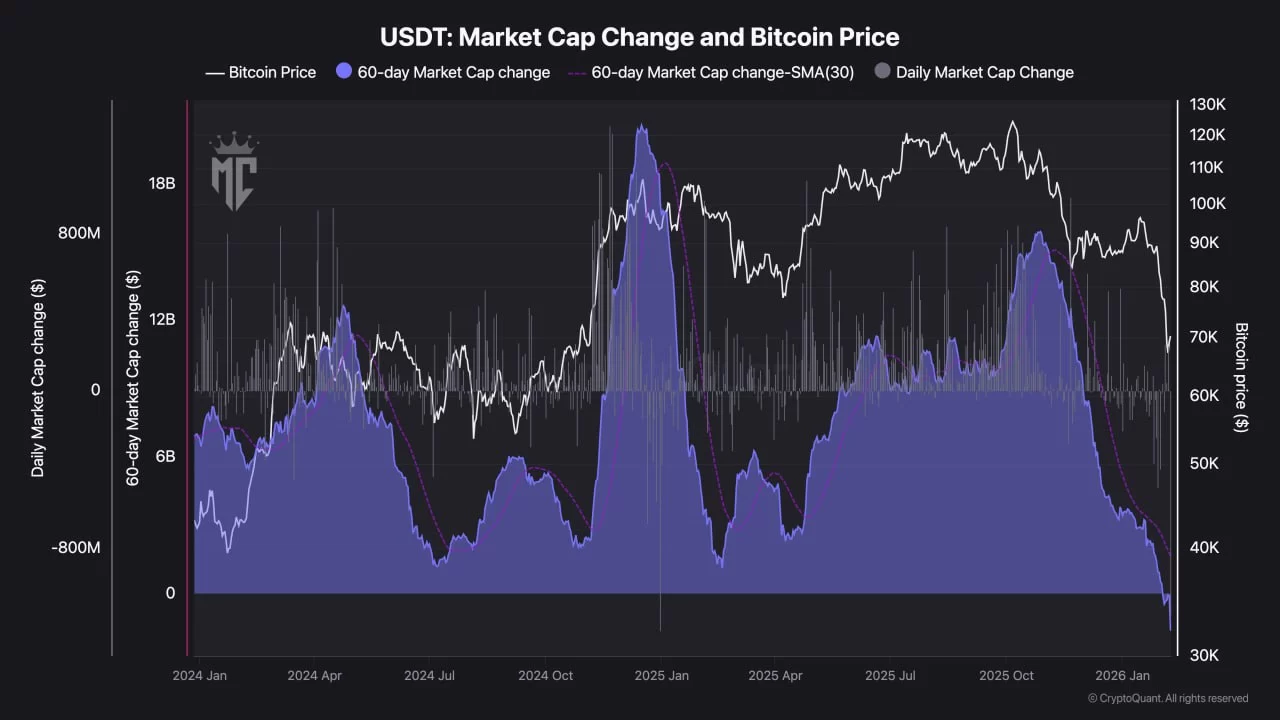

At the time of writing, Bitcoin has stabilized around $68,400. However, data from USDT shows persistent capital outflows from the broader crypto space—an indication that market players remain cautious or are exiting positions for the time being.

“USDT’s market cap is moving in the negative direction. Funds are exiting crypto… This is a very bearish signal.” – @misterrcrypto

Dogecoin Euphoria Fades Amid Rumor-Driven Surge

Dogecoin’s price action this week was propelled by unfounded rumors that X (formerly Twitter) would soon support crypto transactions—a spike that quickly reversed. While the overall market backdrop continues to suggest selling pressure, some prominent analysts remain optimistic regarding DOGE’s potential. Trader Tardigrade points to technical patterns that may offer hope for bullish traders.

“Looking at Dogecoin’s daily chart, the trendline was tested in retrospect. Dogecoin broke above the falling trendline, then pulled back to retest support and held perfectly.

This is the classic bullish setup described in textbooks — when old resistance turns into new support, confirming the breakout. If DOGE maintains this level, we could see a strong rally.”

Still, the technical optimism faces a tough test. Should Bitcoin struggle to hold above $68,000, Dogecoin stands a real risk of falling below the psychologically important $0.10 mark. The interplay between leading crypto assets continues to dictate sector-wide trends as traders assess both chart signals and macro headlines.