As investors persist in their inquisitive anticipation within the cryptocurrency market and global markets, macro economist Henrik Zeberg prognosticated that both Bitcoin (BTC) and US stock markets verge on the precipice of a substantial ascent.

“Uptrend” Forecast for Bitcoin

Henrik Zeberg asserted on his personal Twitter account that he envisions Bitcoin surpassing $30,000. It is imperative to note that the preeminent cryptocurrency was valued below $28,000 at the time the macro economist proffered this prediction, and the analyst initially posited that the $28,000 threshold would be transcended. Indeed, subsequent to the critical Federal Reserve interest rate determination, the foremost cryptocurrency exceeded $28,000 and successfully ascended above $29,000.

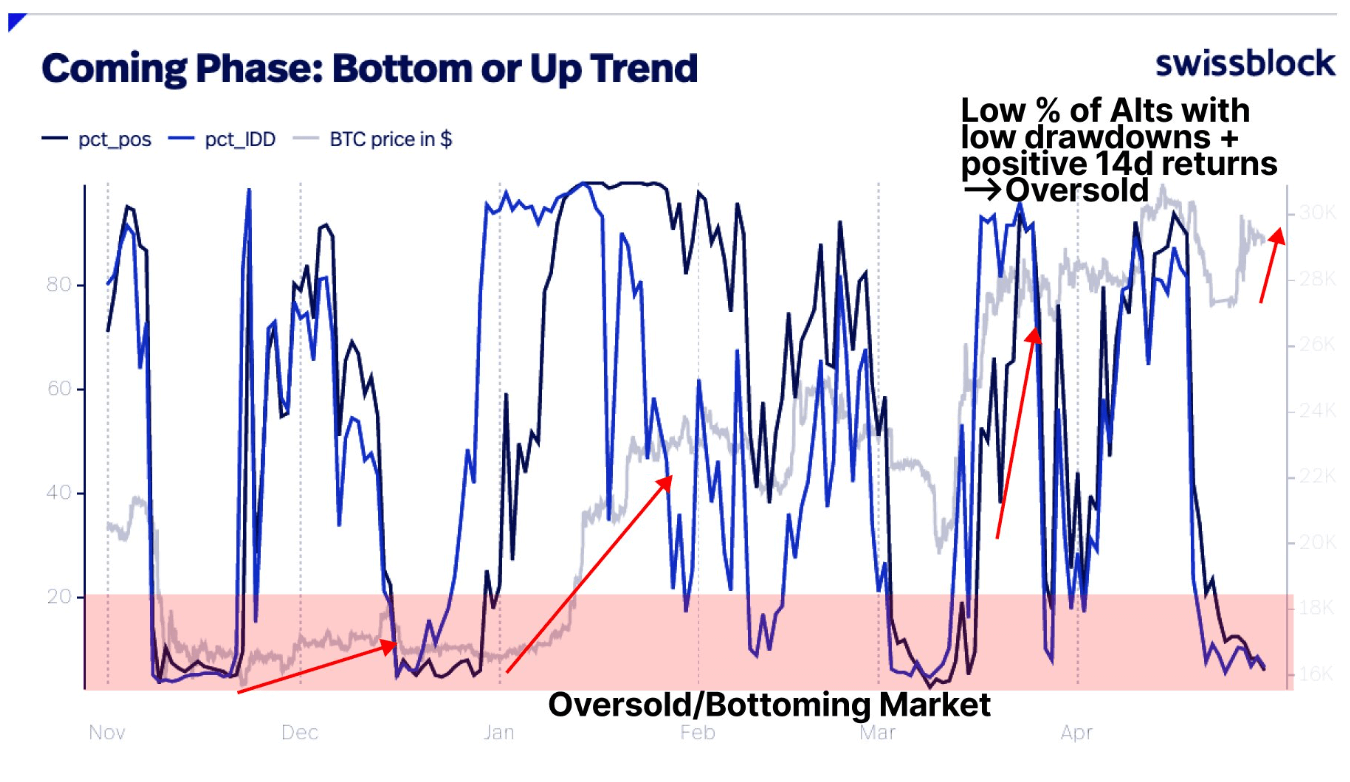

To buttress his prediction, Zeberg disseminated a chart from the cryptocurrency-centric hedge fund Swissblock, demonstrating that BTC was oversold and transacted beneath its intrinsic value, remarking, “Swissblock’s indicators inform us that the uptrend is imminent.”

Anticipates US Stock Markets to Surge Prior to Plummeting

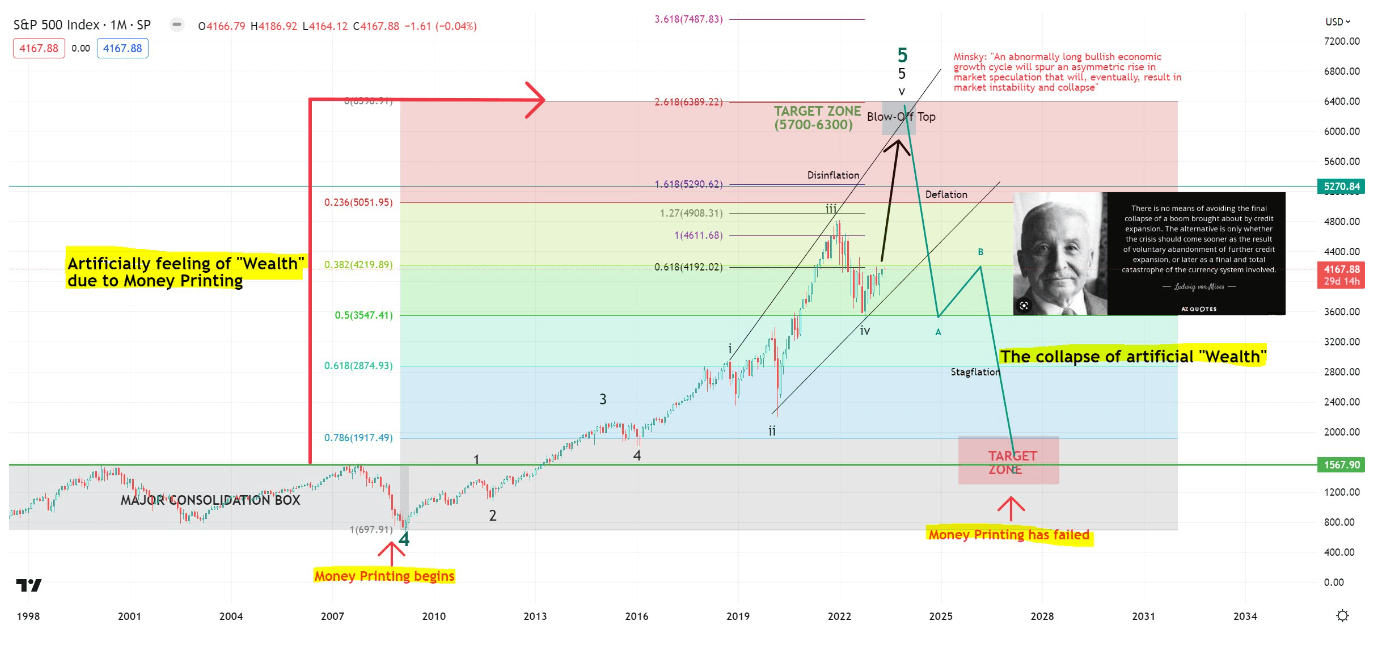

Zeberg also expressed his belief that US stock markets are poised for an explosion and anticipated that the Federal Reserve (Fed) will commence additional monetary printing by infusing liquidity into the markets. Employing the Fibonacci Ratio within the Elliott Wave structure, the macro economist predicted that the S&P 500 would soar above 5,700 points before plummeting to 1,567 points:

Lesson of the Day: Affluence is not a printed commodity, and the ‘wealth’ ensuing from the initiation of monetary printing ultimately collapses. This phenomenon is termed a deflationary bust! An apex of a boom must materialize first.

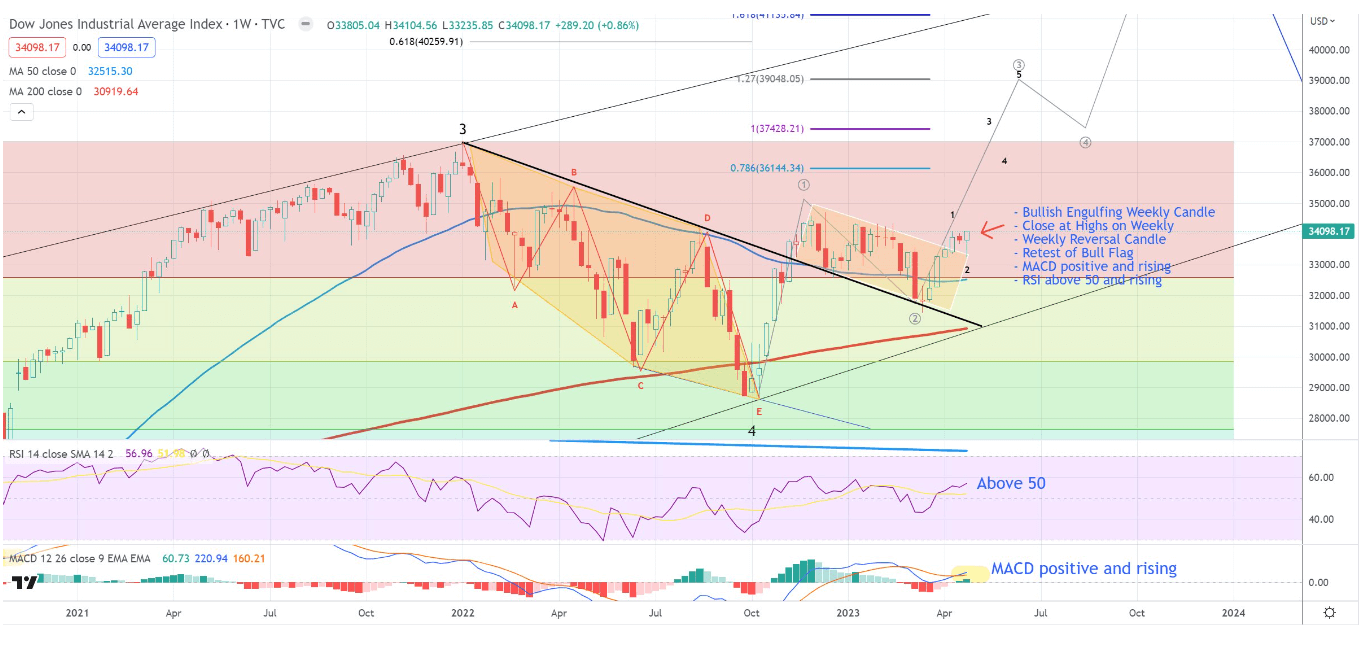

Zeberg further observed that multiple indicators for the Dow Jones Industrial Average (DJIA) index, encompassing the Relative Strength Index (RSI), a technical indicator utilized in trading to quantify an asset’s momentum, and the Moving Average Convergence Divergence (MACD), a trend-following indicator, are exhibiting bullish signals, declaring that “there is NOTHING DESCENDING on the DJIA chart. This chart is technically bullish. Moreover, the economy is not in recession and inflation is subsiding. Regardless of vehement protestations, a goldilocks phase and a blow-off top are imminent.”

Türkçe

Türkçe Español

Español