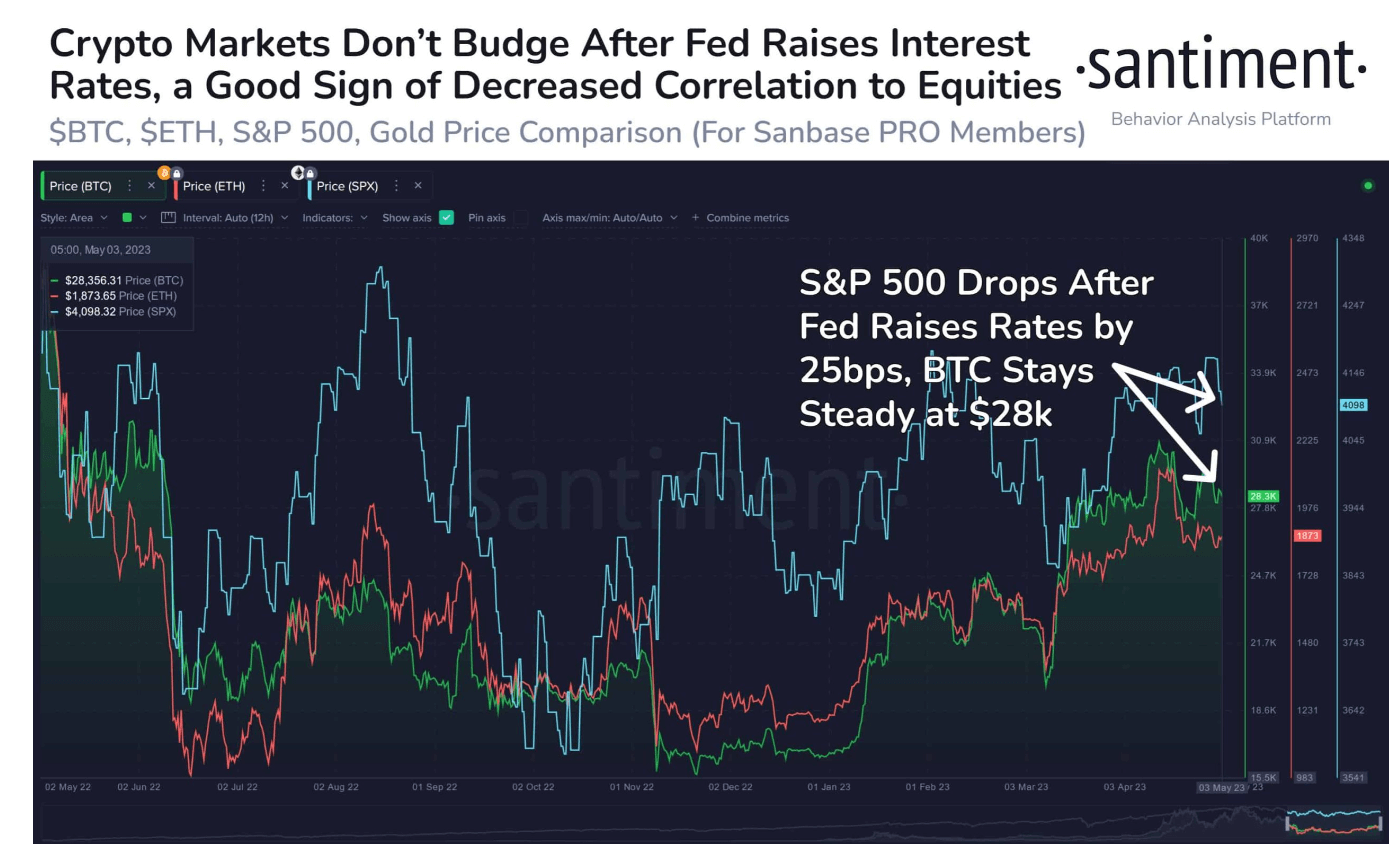

Despite the Federal Reserve’s implementation of a 25 basis point increment in interest rates on Wednesday, May 3, the cryptocurrency market has witnessed a 1.36 percent enhancement in value over the past 24 hours. The ascent observed in the cryptocurrency domain, notwithstanding the Fed’s rate augmentation, indicates that investors are disregarding the escalation.

Cryptocurrency Sphere Maintains Divergence from American Exchanges

While the United States stock markets concluded May 3 on a declining note, the cryptocurrency sector closed the day with positive gains, spearheaded by Bitcoin (BTC). This development has been construed as significant in offering further evidence of the cryptocurrency market’s detachment from the US stock exchanges.

Market connoisseurs and specialists anticipate the favorable trajectory to persist as the cryptocurrency market deviates from the US stock exchanges. The occurrence of interest rates in the US surpassing 5 percent within a 14-month period, however, is not regarded as an ideal scenario for the markets.

Subsequent to the Fed’s proclamation of the interest rate elevation, Bitcoin’s valuation rose over 2 percent, once more surpassing $29,000. BTC has recuperated the majority of its losses during its downward trajectory, which has been incapable of breaching the resistance threshold at $30,000 since the week’s commencement.

Active Wallet Address Undertakings Leap to Fortnightly Apex

Bitcoin’s recent upswing coincided with wallet address operations on the network soaring to a biweekly zenith. “The rally appeared to be significantly more correlated to the rate hike ultimately being ratified, and a marked upsurge in active wallet addresses ensued immediately following the rate verdict’s disclosure,” stated on-chain data purveyor Santiment in its appraisal of the network’s transformation.

Santiment further underscored the current positive outlook for Bitcoin and the altcoin market, adding that no inordinate short selling has been detected among some of the most substantial altcoins by market capitalization. Conversely, this trend is anticipated to endure in Bitcoin and the remainder of the cryptocurrency sphere, which has demonstrated heightened resilience to the banking crisis in the US.

Türkçe

Türkçe Español

Español