In January and the following months, we saw the Bitcoin price making new highs. As long as the price was rising, investors were happy. However, especially from mid-April onwards, investors became more demoralized. The Bitcoin price could not determine a clear direction and its uncertainty was causing altcoins to bleed.

Why is Bitcoin Falling?

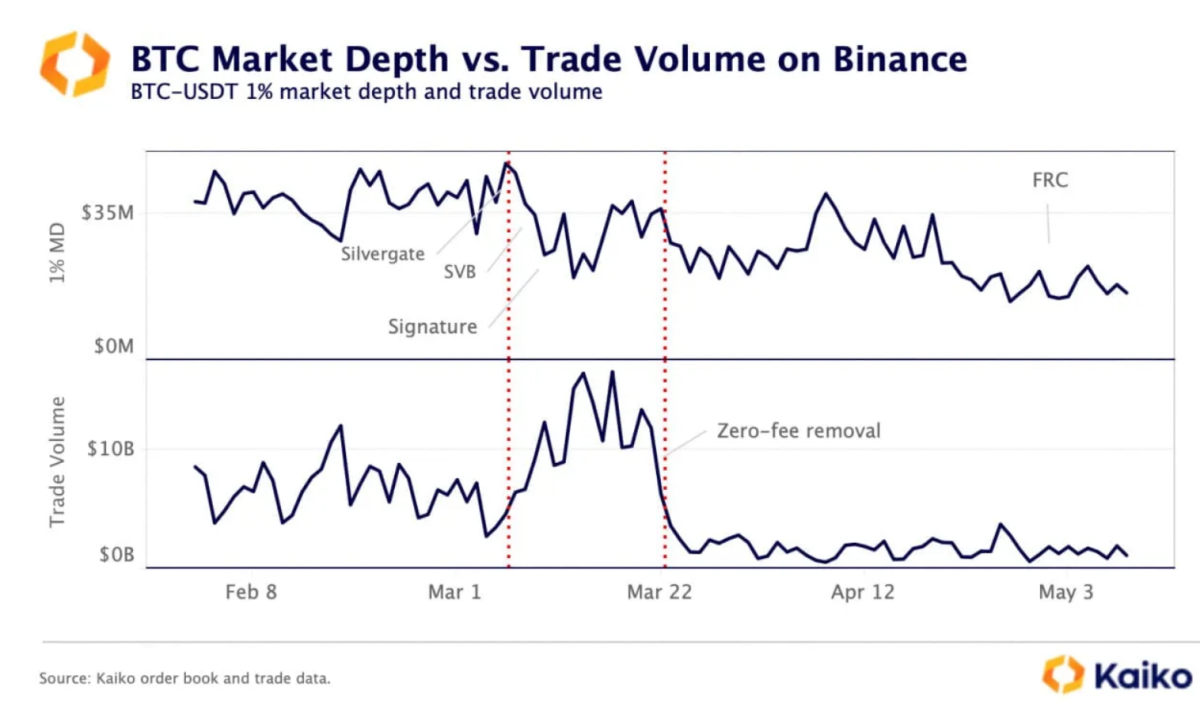

Binance trading volumes and liquidity have steadily declined in the first quarter of 2023 following the banking failures in the US and the end of the zero-fee promotion. This is worrisome because the shallowing of liquidity causes medium-sized sell-offs to trigger larger losses.

Kaiko analyst Dessislava Aubert cites this as a reason for the Bitcoin decline.

“Overall, Bitcoin liquidity on the Binance exchange more than halved from early February, falling from around $45 million to $16 million in early May.”

One of the main reasons for this was the crypto giant’s abandonment of its zero-fee policy across 13 different pairs. Also, key market makers have pulled out of the game, and this is a serious problem.

What About Cryptocurrencies?

The Kaiko analyst said that monthly trading volume, especially for BTC-USDT, the exchange’s most traded pair, dropped from $16 billion in March to $2 billion in April. Aubert argued that drying liquidity has increased as banking failures have intensified. The collapse of pro-crypto banks like Silvergate and Silicon Valley Bank has hurt Ripple, Circle, Yuga Labs and many other crypto companies.

Kaiko‘s intraday volatility metric for the 10-minute interval was quite high as liquidity continued to dwindle on the Binance exchange. Low liquidity conditions mean that order books on exchanges are thin, which provides room for wild price swings from large orders. That’s what we’re seeing on the bearish side these days, but it’s also possible that a group of whales will quickly drive the price up in the coming days. So the Bitcoin price is now much more susceptible to manipulative moves.

Despite favorable conditions, such as a positive CPI report and market expectations that the US Federal Reserve will cut interest rates in the future, the price of Bitcoin fell this week. A low interest rate environment allows for cheaper borrowing in the economy, which in turn fuels the rise of speculative assets like Bitcoin. However, speculative moves by short-term investors are causing the market to move in the opposite direction to expectations.