Yesterday, the Federal Reserve Chair made some relatively optimistic remarks, even hinting that there might not be a rate hike in June. While all these seemed promising, banks claimed safety, and the US Treasury Secretary’s message of potential further bank failures surfaced. The synchronicity of these events was intriguing.

How did it affect Crypto?

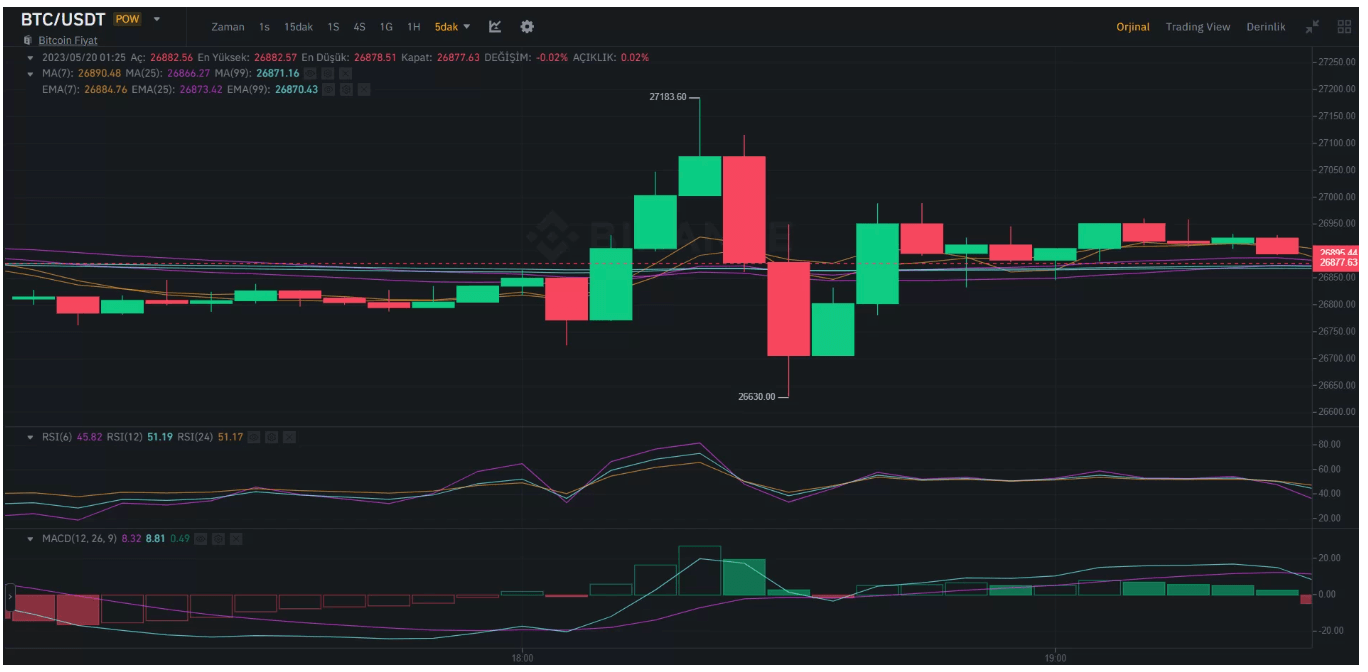

Negatively. The announcement of possible bank failures was quickly followed by news of stalled debt ceiling negotiations. All this happened within 15 minutes. Bitcoin‘s price exceeded $27,100 following Powell’s statements but plummeted again as debt ceiling discussions came to a halt. The US has until June 1 to raise its debt ceiling because money is running out. But why did this happen? We’ll delve into the reasons in the next section.

The possibility of the US defaulting on its debts and June 1 being the deadline is causing investor anxiety. In this scenario, stocks and cryptocurrencies are expected to perform poorly. This will be the hottest topic of the coming week, and if an agreement is not reached, we could see further decline on the Bitcoin front (due to its correlation with stocks).

Stuck in the Mud

For the US, the situation looks exactly like this. Unless there’s a surprise next week, the debt ceiling will be raised for the 79th time. The US government is swiftly heading towards a day it won’t be able to pay its debts unless Congress passes a law to raise the debt ceiling. Earlier this year, the Congressional Budget Office had stated that the estimated date (X-date) when raising the debt ceiling would be necessary would be between July and September.

However, Treasury Secretary Janet Yellen wrote in a letter to House Speaker Kevin McCarthy this month that “after reviewing the latest federal tax revenues, our best estimate is that the government will not be able to continue to fulfill all its obligations beginning in early June and possibly by June 1”.

So why did this estimate go wrong? Because tax revenues fell short of expectations. According to Michael Pugliese, a senior economist at Wells Fargo, capital gains taxes, which are money borrowed from profits made from selling investments, were a significant part of this year’s tax revenue puzzle. Pugliese stated that the capital gains taxes paid to the state last year (2021) were “unusually strong” due to the market boom.

Stock prices have risen considerably, crypto has boomed, all these different things. This led to really strong increases in capital gains tax revenues.

However, values of other assets such as stocks, cryptocurrencies, and the housing market saw declines last year. And that wasn’t the only problem. Tornadoes, winter storms, and landslides made final payment deadlines challenging for millions of taxpayers. Unexpected natural disasters could have been another factor lowering the federal government’s tax revenue this year.

Tax payments were postponed due to natural disasters in many states like Tennessee, Alabama, and Georgia. The US Internal Revenue Service extended the tax payment deadline for California residents to October 16 due to disasters that occurred at the end of last year and the beginning of this year.

Mark Zandi, Chief Economist at Moody’s Analytics, said that the delay of California’s payments could have a substantial impact on the federal government’s tax revenue shortfall.

Zandi says the capital gains gap and deferred tax payments were a “real surprise” for the US government and were likely the main reason for the potential default date being moved up.

While all this is happening, Republicans are suggesting that the government could manage the process for a while longer by spending less. However, the cuts they recommend are particularly severe for Democrats, especially before the 2024 elections. In short, Democrats are currently twisting and turning to convince Republicans to raise the debt ceiling.

Türkçe

Türkçe Español

Español