In a startling development in the cryptocurrency sector, Bitcoin prices have held steady over the past 24 hours, even as trading volumes have dropped significantly. The daily volume has inched close to 20 billion dollars, with the BTCUSDT pair on Binance exchange plummeting to a volume of 650 million dollars. These are unfamiliar occurrences, and we have previously discussed possible reasons for them. However, new intriguing details are now emerging.

Why Crypto Volumes Dropped

One pertinent question arising from these developments is why the crypto volumes are plummeting. As we have previously pointed out, market makers such as Jump Trading are pulling back from the exchanges. The buy and sell orders on the exchanges are typically backed by these market makers, ensuring liquidity is properly distributed and preventing price aberrations from trading activities.

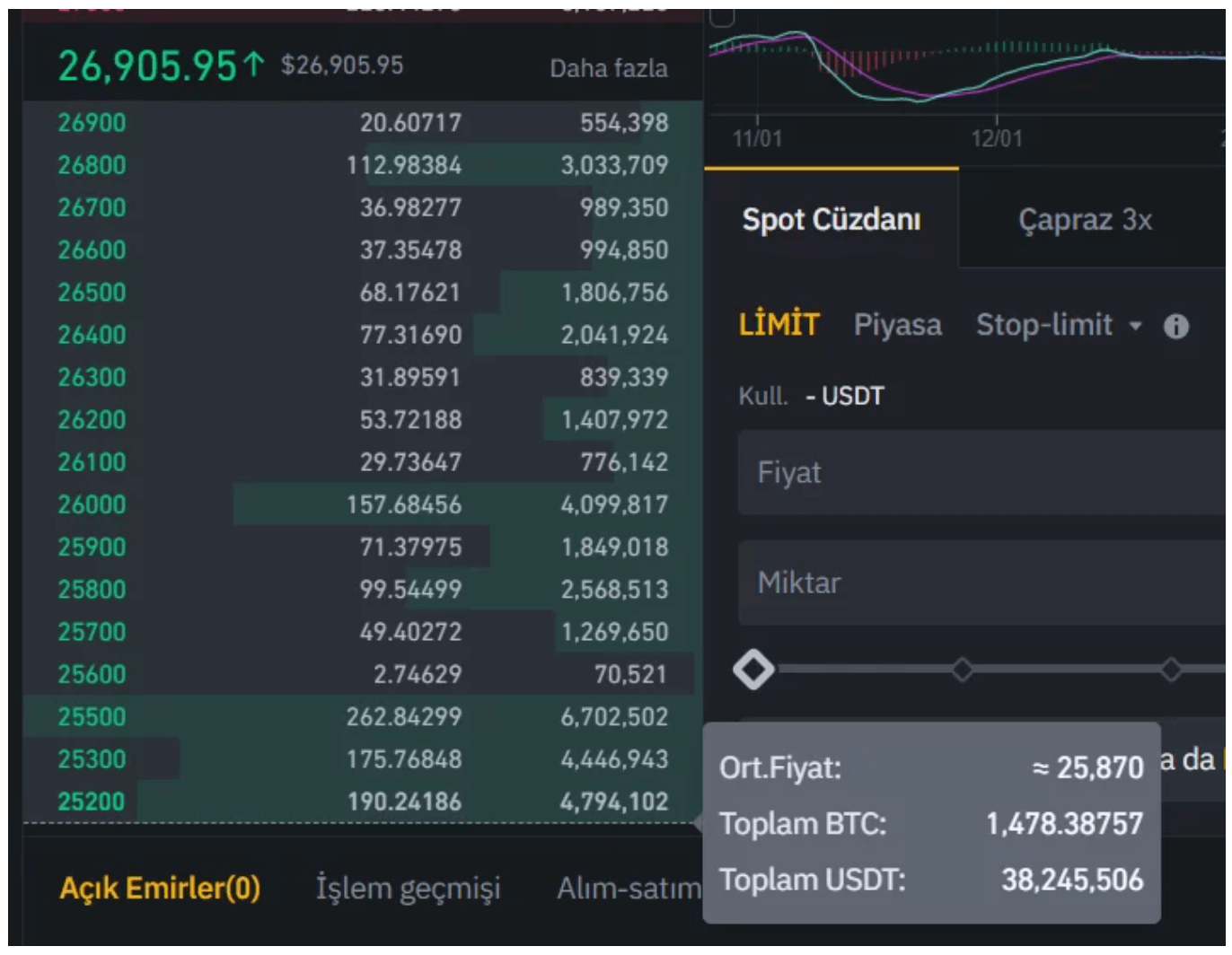

Consider this: the current price of Bitcoin is at 26,900 dollars. But a sale of approximately 38 million dollars’ worth of Bitcoin could cause a sudden drop to around 25,200 dollars. To cause a price swing of 1,700 dollars, all it takes is a sale of 38 million dollars. This occurrence is far less common in other exchanges and often results in the price reaching peculiar levels.

Market makers aim to cushion such large price swings with even larger sales, say, of 100 million dollars. Their role is to balance both the buying and selling sides and to ensure that the global and exchange prices stay aligned.

Jump Trading Escaped

But why have the market makers vanished? The case of Jump Trading offers some insights.

Jump Trading, one of the largest market makers, has been absent from the US market for several months and has significantly scaled back its global operations. The reason behind this withdrawal could be linked to a claim brought up by a user named Kris Kay regarding an incident with LUNA.

Jump Trading allegedly managed to buy LUNA at 0.40 dollars when it was trading at 90 dollars, thanks to a secretive deal that potentially earned them a whopping 1.2 billion dollars.

According to Kay’s assertion, Jump Trading and Do Kwon, founder of Luna, made a backdoor deal. The market maker gave Kwon credit to adjust his peg, and in return, Jump got a 99% discount on LUNA over the next few months. Court documents allege that Jump sold off LUNA while it was trading at over 90 dollars, taking advantage of an unsuspecting retail crowd and making a billion dollars.

The disappearance of Jump Trading and its potential impact on market liquidity offers a fascinating glimpse into the dynamics of the cryptocurrency market. The narrative continues to unfold, and it will be interesting to see how this evolves in the coming weeks and months.

Türkçe

Türkçe Español

Español