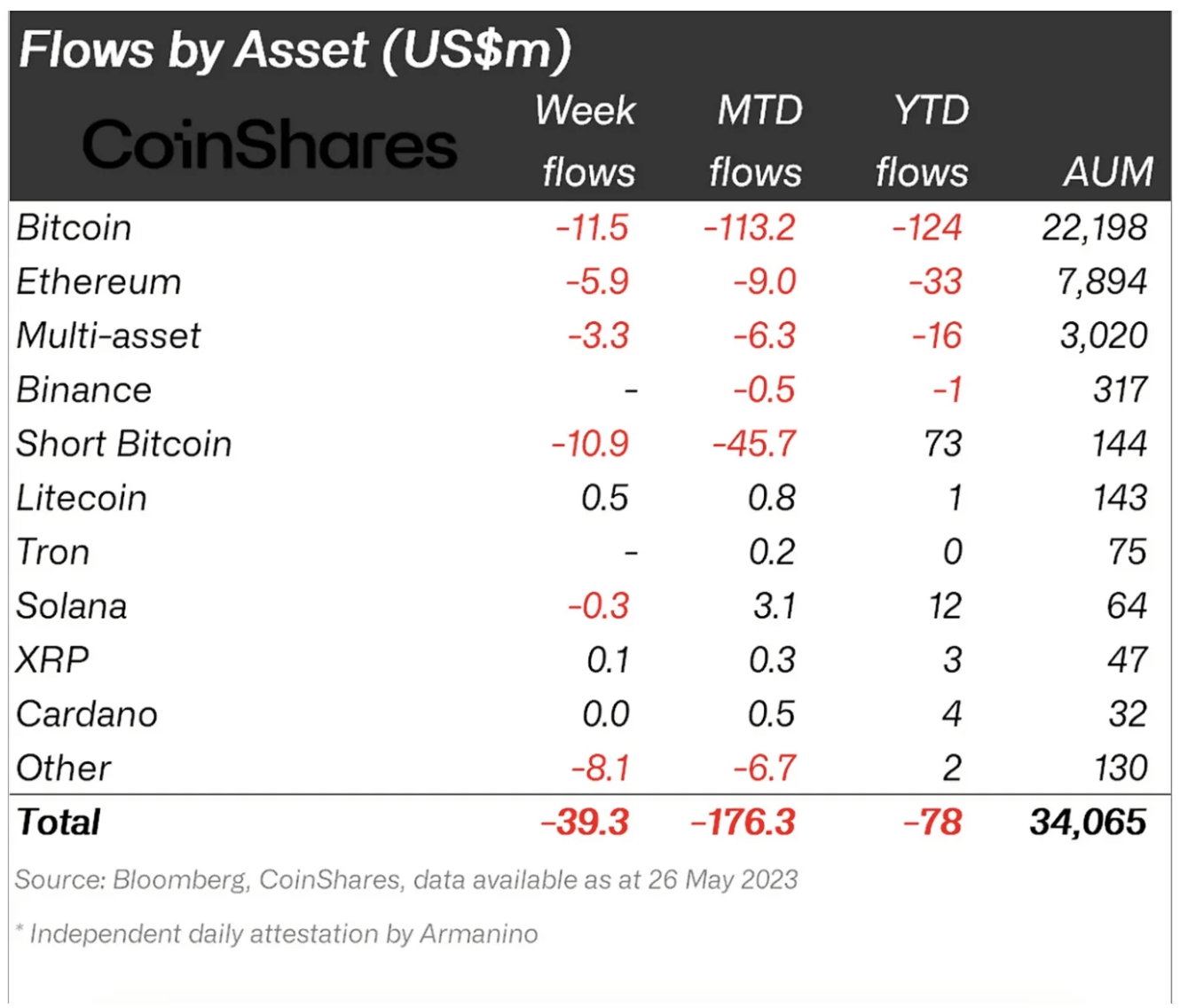

CoinShares, Europe’s largest digital asset investment company, released its 133rd weekly newsletter. According to the figures in the bulletin, outflows from crypto funds continued last week, marking the 6th consecutive negative week. While Bitcoin funds experienced an outflow of 11.5 million dollars, minor inflows were noticed into Litecoin, XRP, and Cardano funds.

Exits from Bitcoin Funds Continue at Full Throttle

In CoinShares’ 133rd newsletter covering the past week, figures indicate a continued trend from two weeks ago where Short Bitcoin funds had a net outflow of 23 million dollars. This past week saw an additional 10.9 million dollars exiting. From the beginning of the year, investments made into Short Bitcoin funds currently stand at a net 73 million dollars. On the other hand, Bitcoin funds experienced a net outflow of 37.5 million dollars. From the first day of the year, investments made into Bitcoin funds have reached a net negative of 78 million dollars. This shows that investors have primarily been positioning themselves in Short Bitcoin funds, anticipating a drop in Bitcoin since the beginning of the year.

Last week saw net outflows from Ethereum funds of 5.9 million dollars and Solana funds of 300 thousand dollars. Minor inflows were recorded in Litecoin, XRP, and Cardano funds.

The United States stands out as the country where outflows from crypto funds were the most prominent. Last week, the U.S. saw a total net outflow of 10.8 million dollars, followed by Germany with a net outflow of 9.5 million dollars, and Switzerland with 8 million dollars.

Most Exits in the US, Germany and Switzerland

The total value of digital investment products is recorded at 34 billion 65 million dollars, of which 22 billion 738 million dollars is constituted by Grayscale. The figure closest to Grayscale was Coinshares’ Bitcoin fund (XBT) with 1.75 billion dollars.