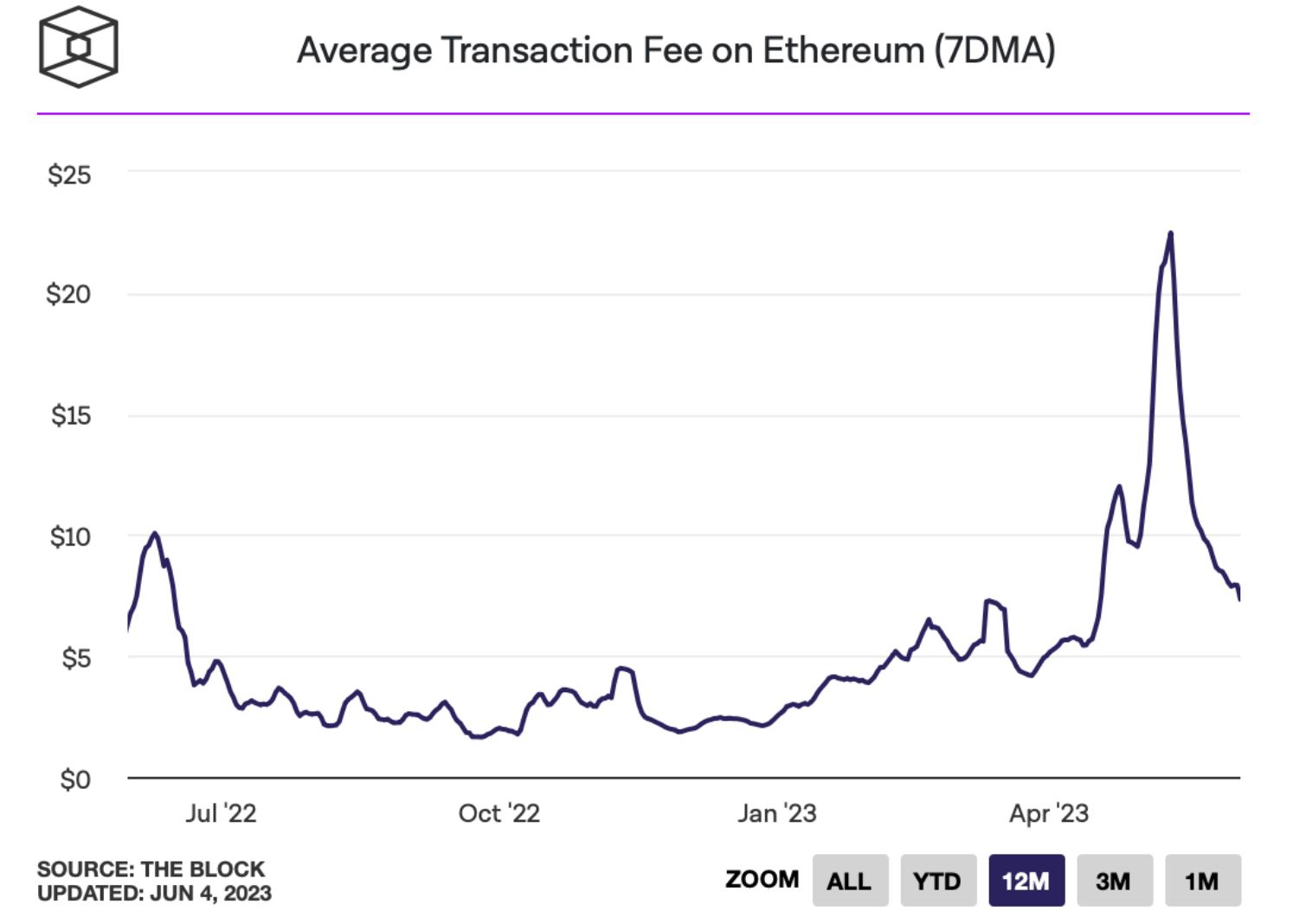

In May, the hype surrounding decentralized cryptocurrency exchanges (DEX) and memecoins caused a spike in Ethereum’s (ETH) network gas fees. The deflation of the memecoin bubble resulted in a significant decrease in the average gas fee on the network.

Ethereum’s Gas Fee Rapidly Declining

The daily average gas fee, a flexible charge for executing transactions or running smart contracts on the Ethereum Blockchain, is moving towards the lowest level in two months following the peak in the midst of last month’s memecoin hype.

According to on-chain data from The Block, the average gas fee of the Ethereum network, calculated using a seven-day moving average, has fallen to $7.34 since climbing over $20 last month. The gas fee was last this low on April 17, 2023, at $6.57.

There’s a similar decline when the gas fee, equivalent to one billionth of an ETH and measured in Gwei, is considered. Data from Dune Analytics shows that the daily average gas fee has dropped to 24 Gwei after exceeding 140 Gwei last month. The gas fee in Gwei was last at these levels on April 12, 2023.

Ethereum’s Block Size Increases

The memecoin hype in May that caused Ethereum network’s gas fee to rise also led to dramatic changes in the ratio of trading volume between DEXs and centralized cryptocurrency exchanges (CEX). With the hype, the DEX/CEX ratio went over 20%, hitting an all-time high. The ratio fell below 15% once the hype deflated.

The DEX/CEX ratio reflects the reluctance of CEXs to hastily list memecoins. High demand for memecoin trading in DEXs caused an increase in Ethereum’s block size, one of the primary reasons for the sharp increase in Ethereum’s gas fee.

According to the Ethereum Blockchain’s working principle, each block’s target size is 15 million gas, but the block size can increase or decrease up to the block limit of 30 million gas (twice the target block size) depending on the demand on the network.

Türkçe

Türkçe Español

Español