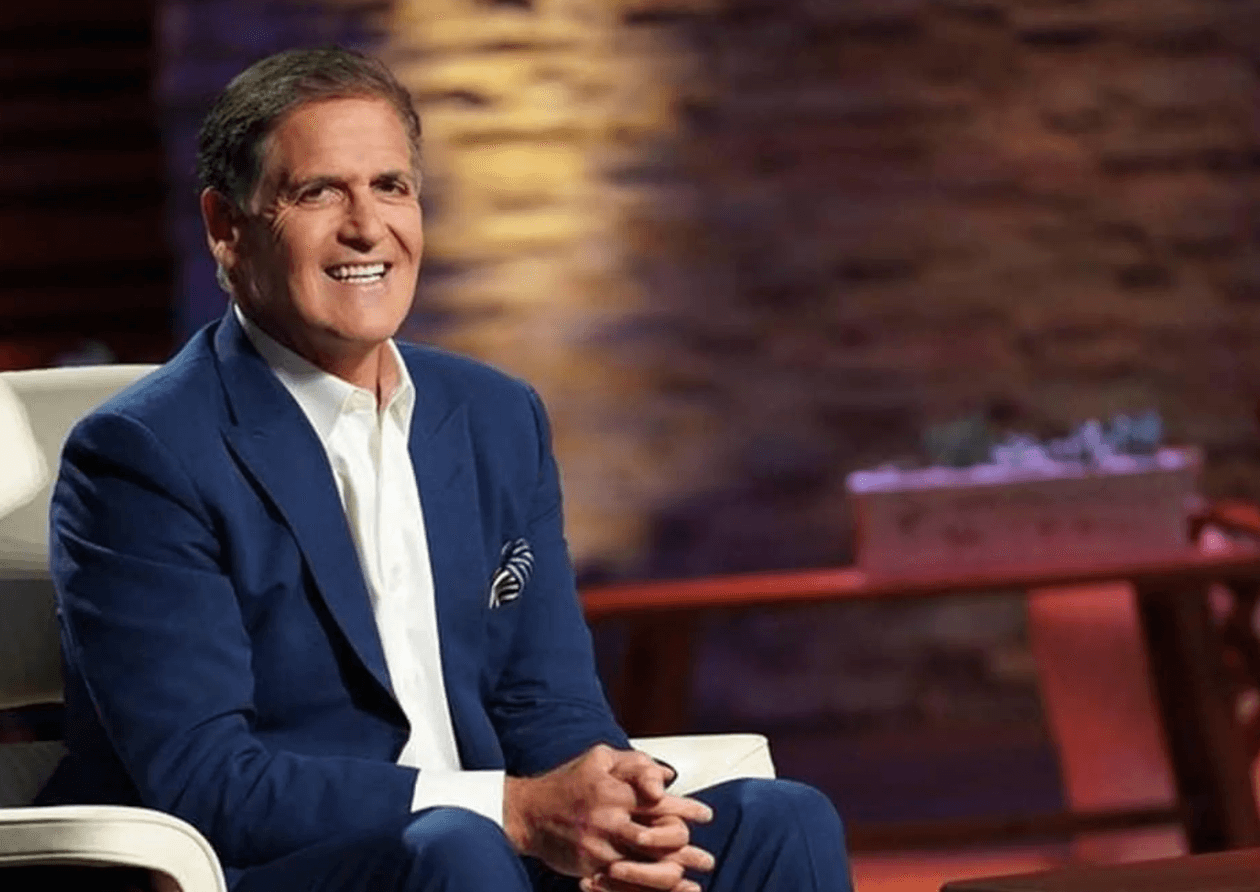

Prominent billionaire investor Mark Cuban has underscored the “fundamental issue” with the regulatory approach of the U.S. Securities and Exchange Commission (SEC), following its lawsuit against Coinbase.

Cryptocurrency Compliance!

Owner of the Dallas Mavericks, Cuban has asserted that the SEC could “easily” approach Coinbase to outline a plan that would help the top American crypto exchange comply with securities laws. The expert stated in his remarks:

If Coinbase or anyone else does not comply, they sue due to the legal disputes they have. Instead, they’re doing what we tell one of our companies: ‘Read these lawsuits and hire a lawyer to solve it for you.’ This is the basic problem with SEC. They don’t want to help companies achieve compliance, they want to force them into compliance. They’re filled with lawyers. Lawyers want to litigate. If they were more like your businessmen [small businesses], there would be more compliance, fewer lawsuits, and better investor education and protections. However, if this happens, 2,000 SEC lawyers would be unemployed.

However, Mark Cuban is also challenging that there are “thousands of financial frauds on Twitter every minute” where the SEC does nothing. The star of Shark Tank also questioned whether the regulator is putting in sufficient effort to protect investors from certain over-the-counter (OTC) traded stocks.

Market Impact!

After news emerged on Monday about the SEC’s lawsuit against the world’s largest crypto exchange, Binance, and its CEO Changpeng Zhao, cryptocurrency prices broadly fell. The regulator alleges the exchange violated investor protection and securities laws.

The SEC followed the Binance lawsuit on Tuesday with a lawsuit against Coinbase, claiming the exchange operates as an unregistered securities exchange, broker, and clearing agency.

Mark Cuban further stressed in his closing statement that the SEC could better protect investors from malevolent actors if it established stronger connections with compliance-seeking companies. He said, “In its current state, no one wants to talk to the SEC because no one trusts them for fear of finding themselves in the same situation as Coinbase. You get what you measure.”

Türkçe

Türkçe Español

Español