The weekend is here, and the unsavory trend in the crypto markets continues. Of course, there are outliers performing positively within this timeframe. In the coming weeks, a popular altcoin could potentially outperform the market due to the imminent halving. What do the current data tell us? How high can the price rise? Here are the current predictions.

Litecoin Halving Forecasts

In just 51 days and 1 hour, the block reward for Litecoin miners will reduce by 50%. This reduction, known as halving, has twice in the past led to an increase in the price of the LTC coin. With mining costs increasing, the base price is pushed higher due to halving, and LTC investors could see further rises.

After a 10% decline due to turbulence in global crypto markets on Monday, the price of Litecoin (LTC) recovered by 3%. On-chain data shows the confidence displayed by Litecoin miners is crucial for early price recovery.

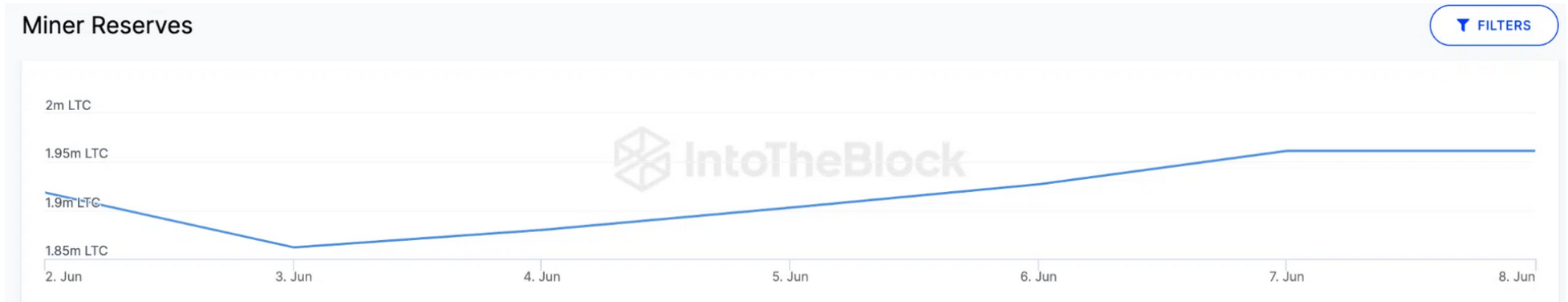

Since the beginning of June, there’s been a positive shift in sentiment among Litecoin miners. Despite the recent contraction across the industry, they’ve continued to increase their holdings. In the most optimistic scenario, we might see the price hit a new peak between $120-200 within 51 days.

LTC Coin Price Prediction

After the pause on Monday, transaction activity on the Litecoin network is trending upward again. The Active Addresses metric, which tracks transactional activity by summing the number of unique wallet addresses interacting on the network over a seven-day period, indicates this. According to the graph below from Santiment, LTC‘s daily active addresses fell to 2.11 million on Monday, June 5. However, by the June 8 closing, it had rebounded by 20%, rising to 2.53 million.

An increase in Active Addresses indicates more users transacting on the network, which ultimately shows that demand for the associated cryptocurrency remains strong.

The bulls, who managed to push LTC above $95, will give the strongest signal for a return. With less than 2 months remaining for halving, miner accumulation and increased network activity are significant indicators. However, if the price unexpectedly falls below the $82 support, Litecoin could enter a downtrend. In this scenario, support between $77.5 and $75 will be watched.

Türkçe

Türkçe Español

Español