Solana (SOL) failed to experience significant upward movement after being labeled “securities” by the US SEC last Monday (5 June). The response from the Solana Foundation provided no hope for the bulls as Bitcoin (BTC) reached $25,000 over the weekend (10/11 June).

At the time of writing this article, BTC was struggling to surpass $26,000 ahead of the Consumer Price Index (CPI) data for May to be announced on June 13 and the FOMC meeting on June 13/14. A bullish trend beyond $27,000 for BTC could help SOL overcome a major general barricade.

Why is Solana Coin Falling?

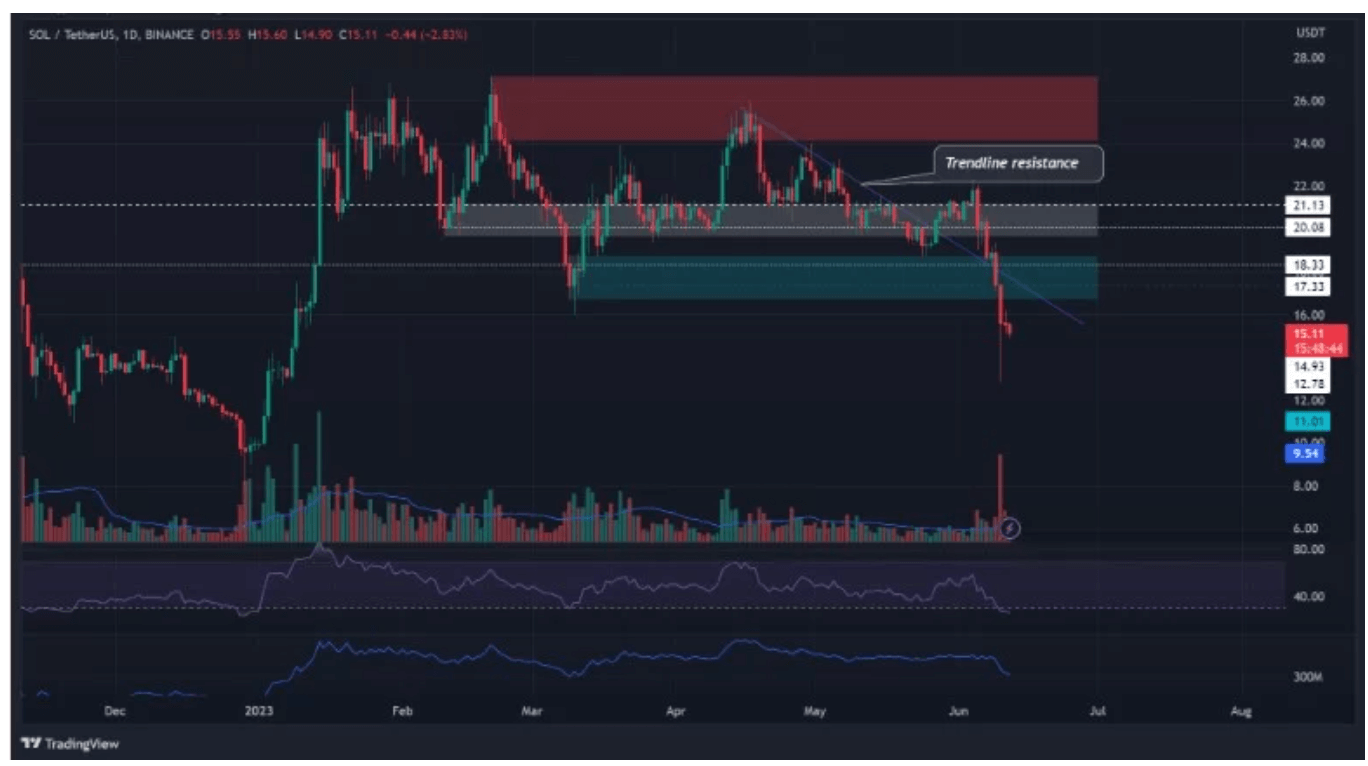

The weekend decline caused SOL to depart from the support area between $16.7 and $18.8 (aqua). The support area was also a bullish order block (OB) formed on the daily chart on March 9. The weekend decline turned SOL into a bearish trend after BTC retested $25,000, and SOL dropped below the trendline resistance and the lowest level in March at $16.

Unless BTC breaks beyond $26,600 and moves above $27,000, bulls might struggle to clear the merging area of the bullish OB around $17 and the trendline resistance. A price rejection at this merging area could drag SOL to the support levels of $14.9 or $12.8.

On the contrary, if SOL can close above the intersection area at $18.75, the bulls could gain an advantage. However, the area between $19.7 and $21.2 (white) stood out as another bullish OB-return resistance area formed on the daily chart on February 10.

The RSI indicated a slide into the oversold area at the time of writing, and the OBV fell to 300 million, signaling a decline in buying pressure and demand.

Calm Before the Storm?

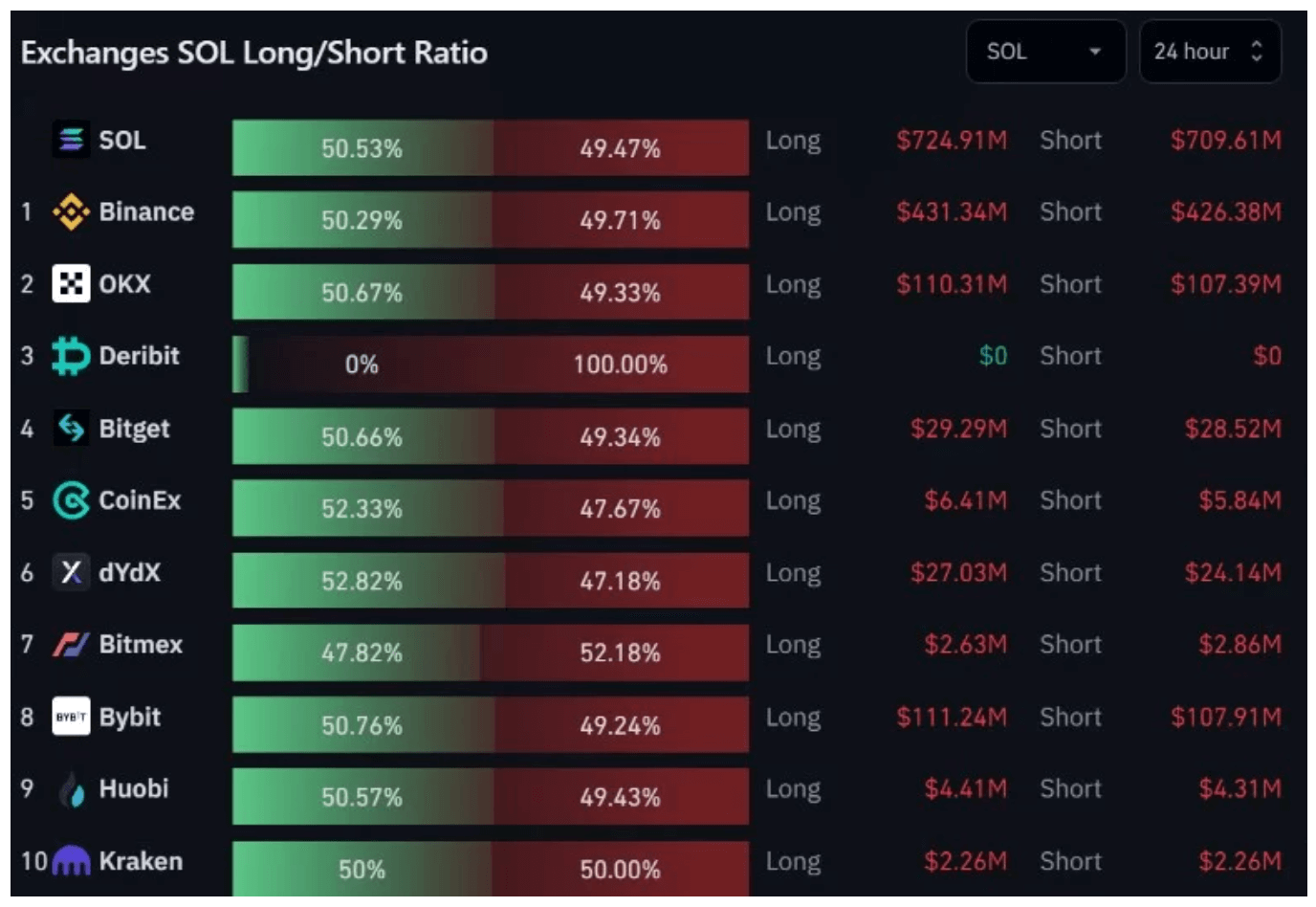

The 24-hour timeframe for SOL‘s exchange long/short ratio indicated a neutral sentiment in the futures market. Similarly, the overall crypto sentiment was green and neutral according to the fear index at the time of writing.

However, this could be the calm before the storm as price fluctuations can be anticipated from June 13. Investors should follow the US economic calendar for this week (June 11-17) for more optimized trading setups.