Bitcoin‘s plunge below $25,500 has led to severe losses in altcoins in just a few minutes. Fresh lows could be in sight. Today’s Fed announcements largely met expectations, but Powell’s hawkish remarks severely undermined investors’ risk appetite. The ongoing losses in the king cryptocurrency suggest that ETH and XRP Coin prices could drop even further.

Ethereum Price Analysis

ETH price has turned down from the moving averages, indicating sellers are offloading during mini-rallies. ETH is trading below $1,700 at the time of writing, and the minor support in the $1,600 region offers little reassurance. If this area also gives way, investors may witness a free fall to $1,352.

Even more concerning is the potential for Bitcoin’s price to break below the $25,000 support. This repeatedly tested area is currently being defended by thin buyers at the time of writing. After testing below $25,100, the price has clawed its way back to $25,250, but sellers are motivated. The anticipated interest rate hike in July and sticky core inflation have turned the medium-term outlook for crypto markets negative. Furthermore, the possibility of the U.S. Department of Justice joining the SEC amplifies investor fears.

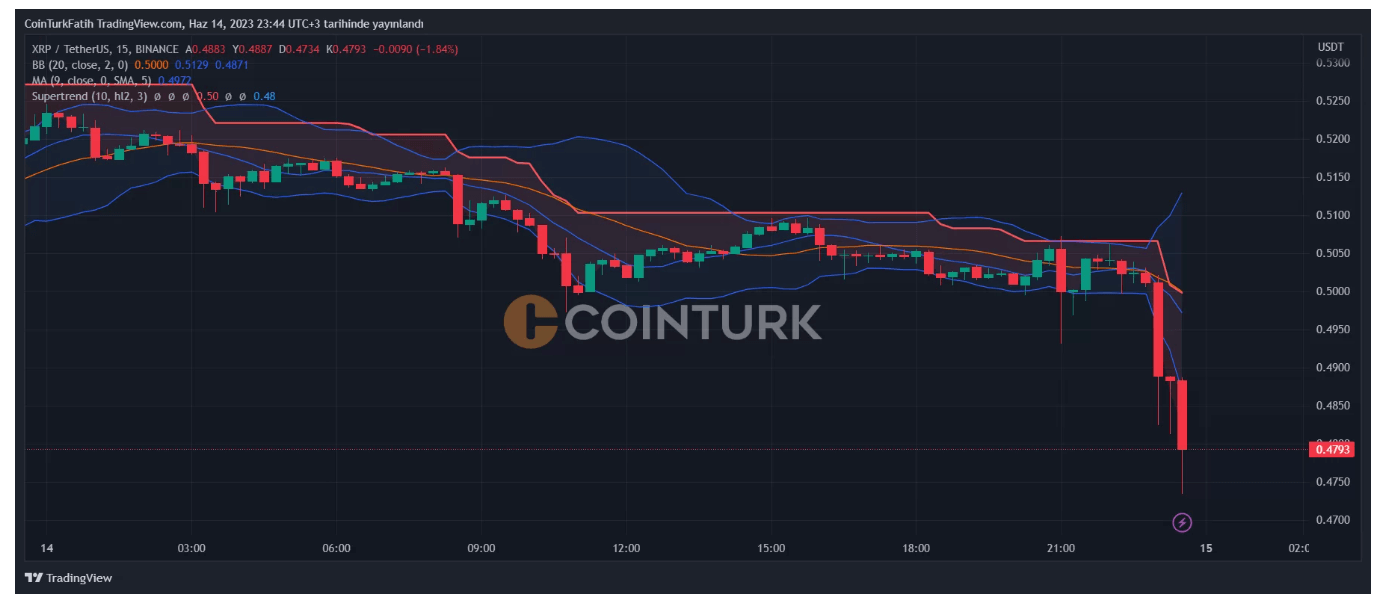

XRP Coin Price Analysis

Buyers pushed XRP above the broad $0.56 resistance on June 13, but couldn’t sustain it. The XRP/USDT pair suffered a sharp decline, forming a long wick on the day’s candlestick. Bears managed to pull the price below the 20-day EMA ($0.50). Below this level, the next critical support to watch is the 50-day SMA at $0.47. At the time of writing, the price hovers around this region.

If sellers persist, we may see XRP price dropping to the $0.41 level. The lack of new developments in the case could also end XRP Coin’s positive divergence process. For now, XRP Coin investors hope for a bounce from $0.47, provided BTC sustains $25,200. With approximately three hours left until the daily close, the tense wait continues.

Türkçe

Türkçe Español

Español