Leading crypto analytics firm Santiment has noted that Ethereum (ETH), the top-ranking altcoin, is demonstrating several bullish indicators on-chain. In its reports, the company shared a wealth of data pointing to a positive ETH outlook and discussed another rallying crypto, Bitcoin Cash.

Santiment Reports!

Data analytics platform Santiment highlighted that the total supply of Ethereum on crypto exchanges, as a percentage of the overall supply, has reached an all-time low. This development suggests that the selling pressure on the leading altcoin could be limited as market participants continue to move their ETH holdings away from the open market.

The analytics firm also mentioned that ETH’s average transaction fees have become attractive again, receding to levels seen before Ethereum’s 2023 peak. The company stated in its reports: “Even though Ethereum currently fails to hold the $1,900 level, the supply continues to move away from exchanges. Furthermore, average fees have returned to the levels seen right before ETH’s price spiked to $2,100 in March.”

At the time of writing, ETH trades at $1,880, about 15% up from its lowest point in June at $1,637.

BCH Rise!

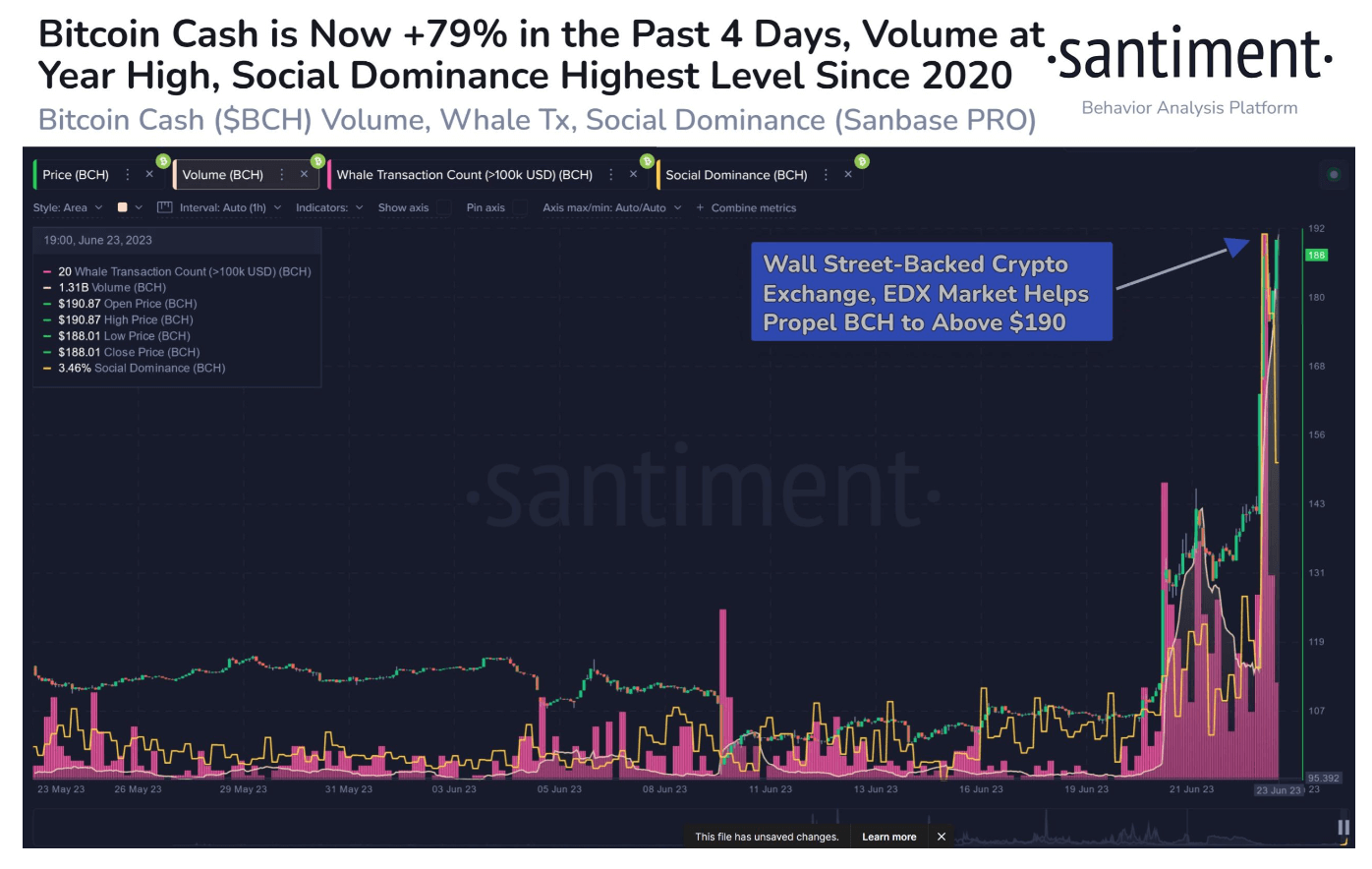

Taking a look at Bitcoin (BTC) hard fork Bitcoin Cash (BCH), Santiment underscored that BCH, the 20th largest altcoin by market cap, trended on social media following support from the digital asset market EDX Markets.

Investors closely monitor EDX Markets after it received funding from big financial names like Charles Schwab, Citadel Securities, Fidelity Digital Assets, Paradigm, Sequoia Capital, and Virtu Financial. Santiment commented on the matter: “With the launch of EDX Markets on June 20, Bitcoin Cash was the biggest beneficiary, seeing a massive price increase of 79% in just four days. Particularly, BCH experienced its highest social volume rates in three years, easily overshadowing its 2023 peaks.”

At the time this article was written, BCH stands at a value of $213.47, approximately a 120% increase from its lowest point in June at $97.87.

Türkçe

Türkçe Español

Español