Economist Alex Krüger suggests Bitcoin will rebound, fueled by the prospect of ETF approval and ongoing demand from professional investors.

Blackrock’s ETF May Be Approved!

According to the news of BlackRock, the world’s largest asset manager, cryptocurrency analyst and investor Scott Melker gave the following statements in an interview published on July 3:

Applying for a spot Bitcoin ETF is a big deal and it wasn’t properly priced yet. We have very strong news that the BlackRock Bitcoin ETF is likely to be approved. Whether it gets approved or not is debatable… But the matter is, we have only moved 20% in this news. And the likelihood is definitely over 50%, around 75%. So the first point is that the market is not properly positioned for this.

According to the expert, the second point is that the leading cryptocurrency has resistance between $31,000 and $37,000 and $37,000 has been the “moon level” since mid-May. We were nearly having a heart attack and some of us were going out and dancing with joy.

Bitcoin Price Movement!

However, the economist emphasized that Bitcoin’s recent correlation with other risky assets is only temporary and is probably due to ongoing regulatory attacks that have seen many cases opened against large participants in the crypto market. The expert analyst made the following statements:

On the correlation side, regulators in the US have been very aggressive since the beginning of April this year. Many major market makers started stepping out of the market. These correlations caused a drop to the 2020 levels fundamentally before Bitcoin became a macro asset. However, this situation is temporary.

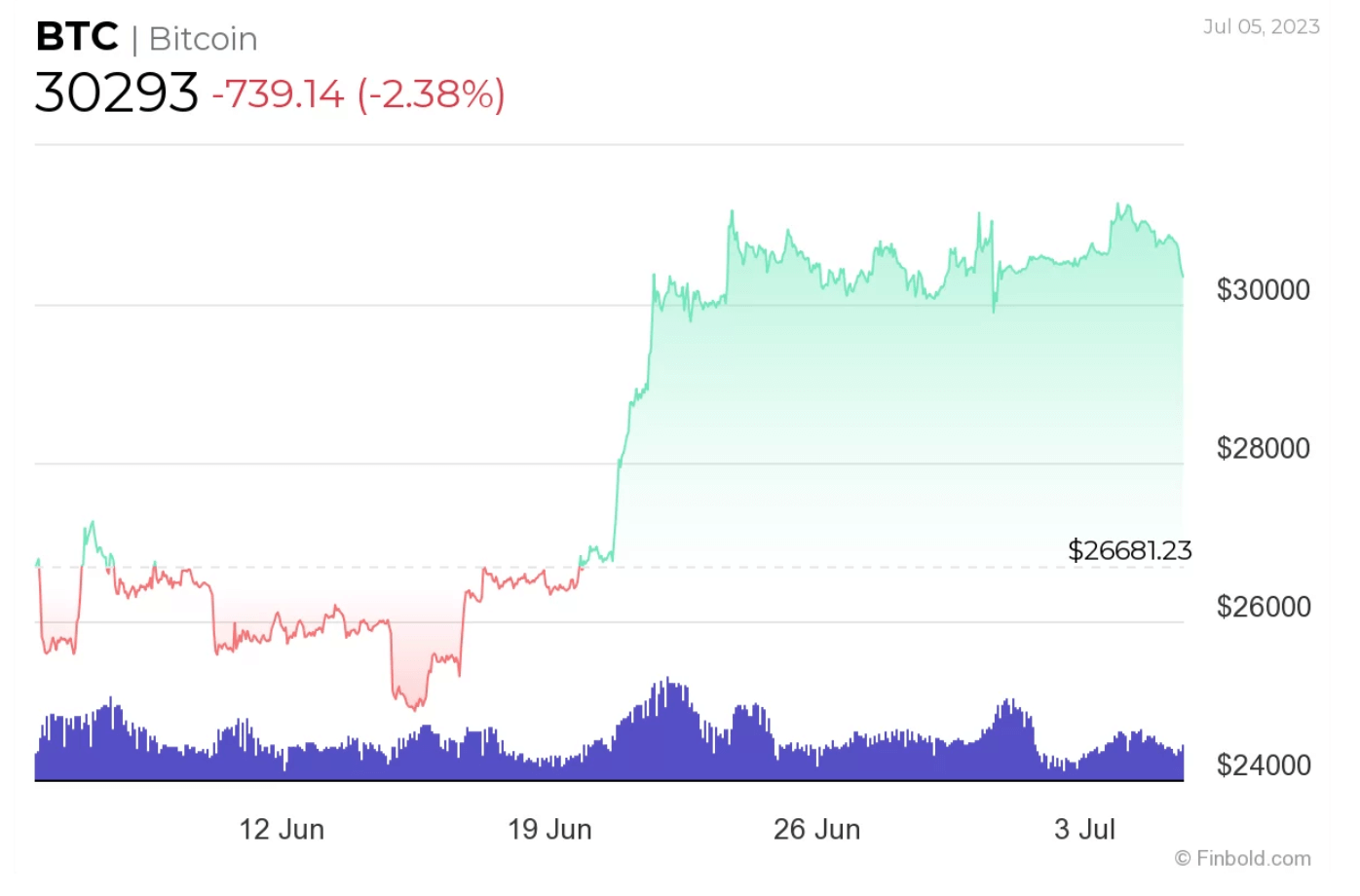

The leading cryptocurrency is trading at a price of $30,293, which represents a 2.38% decrease for the day, but an increase of 0.65% over the previous week and 13.54% on a monthly basis. This is according to the latest data taken on July 5. Meanwhile, cryptocurrency market expert Willy Woo believes that Bitcoin is in another price squeeze following the ongoing demand increase from institutional and professional investors in Bitcoin futures.