Trading Volume Surpasses $560 Million in a Short Time

As the highly anticipated halving event for Litecoin (LTC), scheduled for August 2nd, approaches rapidly, on-chain data platform Santiment has reported a significant increase in investor interest and trading volume for this popular altcoin.

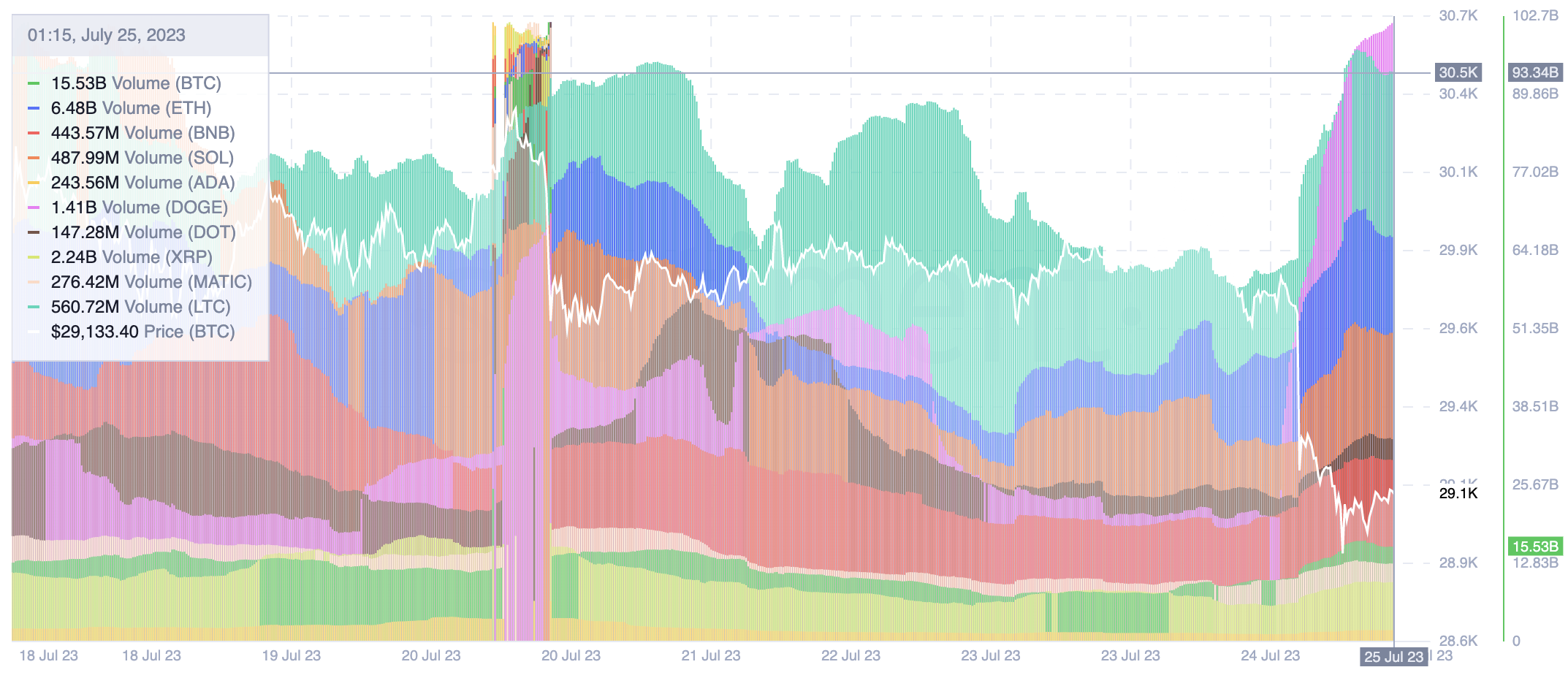

According to the latest data, Santiment reveals that Litecoin’s trading volume has rapidly increased. In less than 24 hours, the trading volume for Litecoin has surged by an astonishing 48.5%, surpassing $560 million. This increase in trading volume is quite remarkable, especially considering that the altcoin’s price has dropped by over 20% since the beginning of June.

Despite the recent price drop, analysts have identified potential signs of a bottoming out pattern on smaller time frame charts, suggesting a change in sentiment surrounding Litecoin. However, leading market analysts and experts have differing opinions about the future direction of LTC’s price.

Cryptocurrency analyst Benjamin Cowen has warned investors, pointing out a historical pattern of Litecoin experiencing a post-halving price decline. Interestingly, Cowen’s observation aligns with the recent drop in LTC’s price.

Another data-driven model, indirectly related to the upcoming halving event, has been identified by analyst Ali Martinez. Martinez discovered that whenever the number of new LTC addresses exceeds 350,000 in a five-year period, a significant decline follows. The number of new LTC addresses has surpassed 690,000 in recent days, indicating a potential event similar to a “sell the news” scenario before or after the upcoming halving event.

Beware of FOMO

The increase in Litecoin’s trading volume indicates growing excitement among investors. However, market experts continue to exercise caution, considering the possibility of a price decline. Historically, Litecoin has experienced significant price movements after each halving event, predominantly in a downward direction. This cautious approach by analysts suggests that caution should be exercised when dealing with LTC.

As emphasized by market experts, as the halving event approaches, investors should not overlook the possibility that it could result in a sharp decline, just as it has in the past. It would be advantageous for investors to position themselves accordingly and not succumb to FOMO.