Ki Young Ju, a well-known figure in the crypto community, especially among on-chain enthusiasts, has shared a market update. The CEO of CryptoQuant discusses the current outlook on Bitcoin, focusing on an important issue. So, what is the next expected move in the crypto markets? What does the current outlook tell us?

Bitcoin Expert Opinions

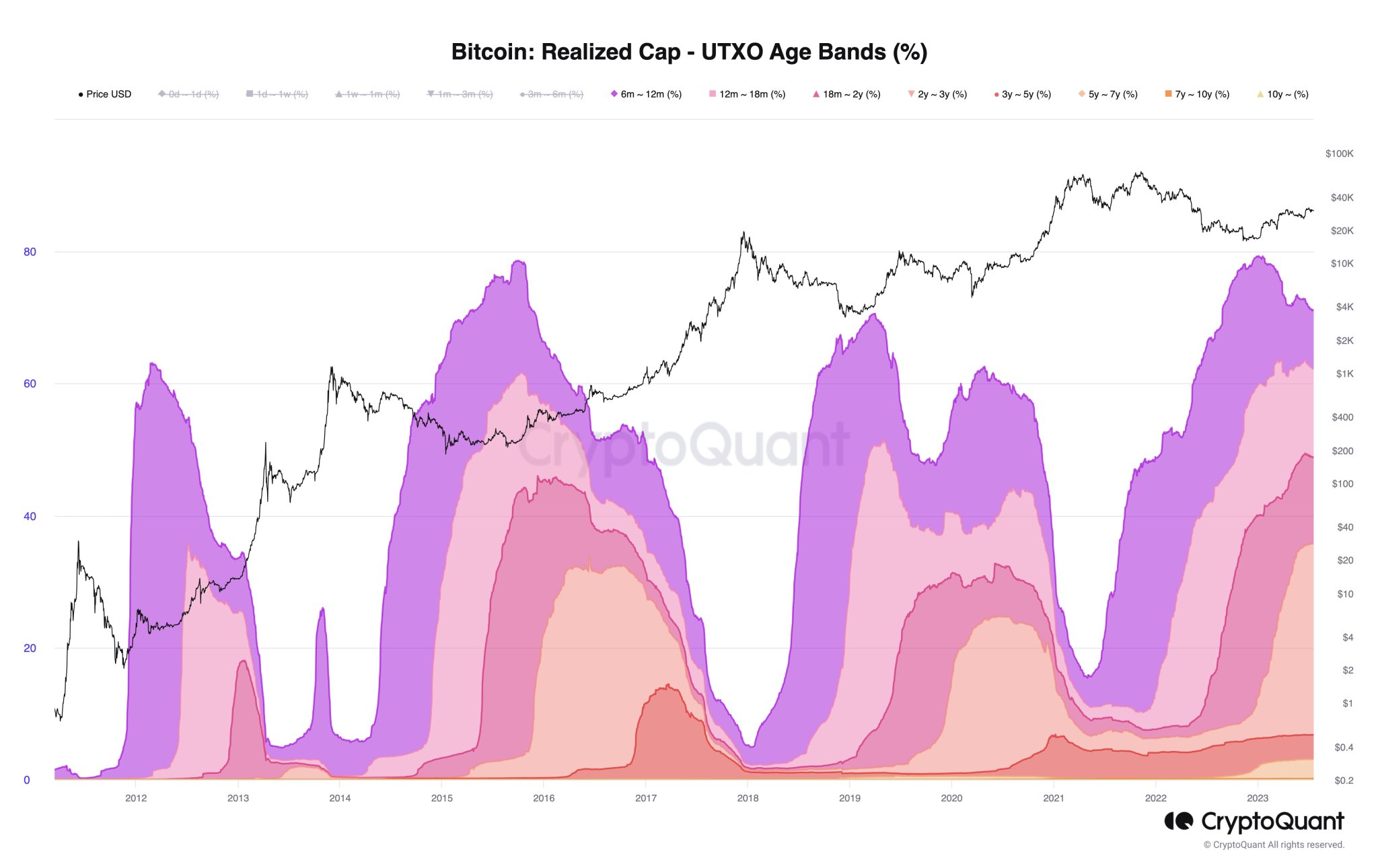

Ki Young Ju, the founder and CEO of the analysis platform CryptoQuant, discussed the current situation while Bitcoin is approximately 10% below its yearly peak. According to Ki Young Ju, Bitcoin is still in a bull cycle due to the low selling pressure witnessed as a result of most BTCs (held for over six months) remaining inactive, either purchased or mined by miners.

“Bitcoin is still in a bull cycle. About 71% of realized capital consists of inactive BTCs (held for over six months), indicating low selling pressure from long-term holders.”

Bitcoin and Crypto Commentary

So, why is Bitcoin not rising as expected if it is in a bull market? Bitcoin is currently trading at $29,178, approximately 10% below its highest level in 2023. However, Ki Young Ju states that we are technically in a bull market. In fact, the CEO of CryptoQuant emphasizes that the current situation does not necessarily indicate a definite price increase for BTC.

“Lower selling pressure does not guarantee a price increase, but it makes it less likely for BTC to be at least at the peak of the cycle. Stablecoins are good for BTC. People are buying BTC using stablecoins.”

According to the crypto CEO, the reason behind the current stagnation is the stablecoin supply remaining stable. As long as there is no increase in stablecoin demand from investors or surpassing the issuance of new stablecoins, boring price movements will continue.

“The market will remain boring until more stablecoins are injected for buyer-side liquidity.”

Additionally, Ki Young Ju highlights the increasing dominance of Tether (USDT) in the overall stablecoin market. This is partly due to the decline in demand for alternatives such as USDC and BUSD, resulting in their loss of strength. Currently, the market cap of USDT is $83.8 billion, while its closest competitor, USD Coin (USDC), has a market cap of $26.6 billion.

Türkçe

Türkçe Español

Español