The negativity in the price of Bitcoin (BTC) and the ongoing lack of volume in the market have reached a level that is frustrating for investors. Despite numerous price catalysts in the midst of a boring market, we have not seen an impressive rise. After reaching an annual high just above $32,000, Bitcoin pulled in sellers, citing macroeconomic developments as an excuse.

Why Isn’t Bitcoin Rising?

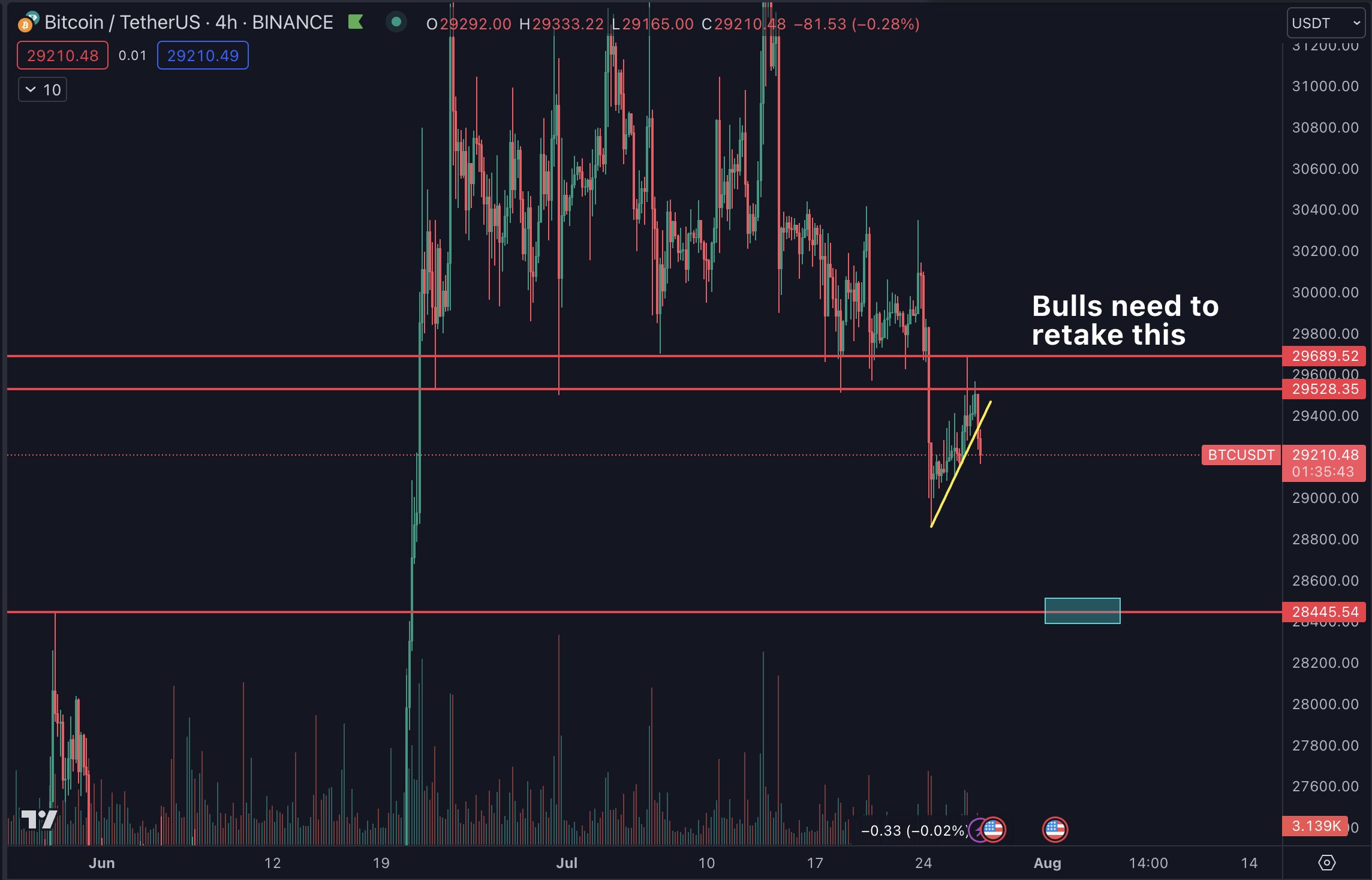

Bitcoin investors are shocked by the silence of BTC price in response to the inflation measure preferred by the Fed. The recently announced core PCE data confirmed the decline in inflation. However, after briefly surpassing $29,500, BTC is now at $29,345. Wells Fargo mentioned in its latest market evaluation that the Fed has made its latest interest rate hike. However, the cryptocurrency markets do not seem convinced by this.

The Kobeissi Letter

The Kobeissi Letter, famous for its involvement in the financial markets, stated that the PCE represents the inflation measure preferred by the Federal Reserve, as previously announced by Chairman Jerome Powell.

“PCE inflation is currently at its lowest level since April 2021. The Fed may have finally brought inflation under control.”

Crypto Tony Bitcoin Commentary

Today, popular crypto commentator Tony said he expects the king crypto to experience further decline. The negative divergence of BTC supports this, as stocks rebounded after positive data. According to the analyst, the price may linger in this range for a while, but eventually form a new low at $28,000.

Daan Crypto Trades

Daan Crypto Trades was another commentator who addressed the current situation. According to him, Bitcoin losing $30,000 indicated the beginning of a bad scenario. The expert also said;

“I think it makes sense to prepare for a move below $28,000 as Bitcoin rejects its previous range. If $29,500 is permanently regained, this can be invalidated, but there is a lot of supply at that level. There is probably a choppy road ahead.”

Türkçe

Türkçe Español

Español

Nice app