Following the consumer inflation data released yesterday, today we also have producer inflation data. The data does not seem favorable for cryptocurrencies. On the other hand, we have seen that prices do not react positively during periods of inflation decline. The reason for this is the unchanged Fed policy that is not expected to change in the short term. So what are the experts’ views on the price?

Bitcoin (BTC) Analysis

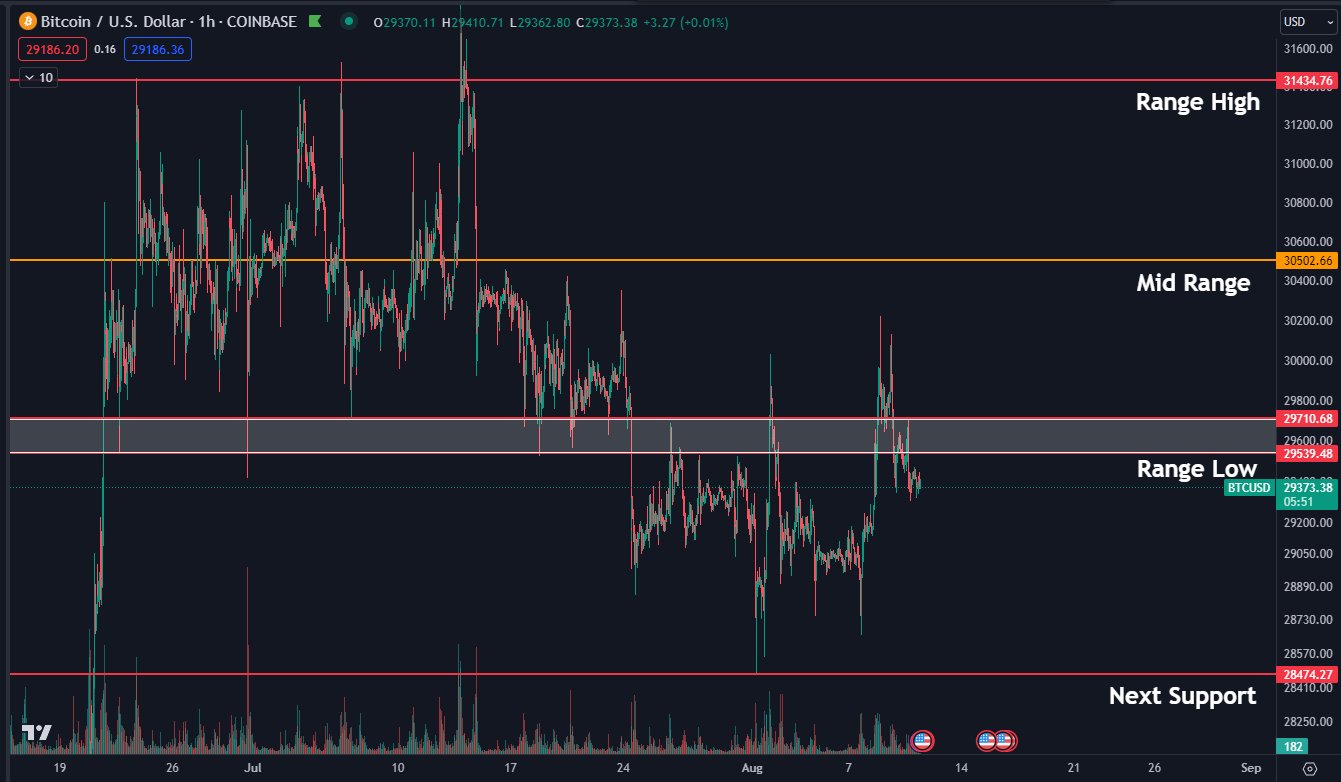

Daan Crypto Trades highlighted a critical level in a tweet on August 11, stating that reclaiming this area is necessary for a real upward movement. Daan Crypto Trades says that both the Bitcoin bulls and bears are “strongly controversial” and stuck in a range with constant failed price breakouts.

Since mid-June, the BTC price has been ranging between $28,500 and $31,800. Therefore, it is important for the bulls to take control of the area around $29,700 in order to completely change the landscape.

“We see that the $29,500 to $29,700 range has turned into a battleground for bulls and bears. An important area to keep an eye on.”

Therefore, the analysis is related to other perspectives in recent weeks, which also focus on a downside target of $28,500 or slightly lower.

When Will Bitcoin Rise?

The second analyst, Skew, described the spot price movement on the four-hour timeframe as “weak.” The price being stuck in a shallow range is seen as frustrating for many experts. If the levels indicated by Daan Crypto for Bitcoin are not surpassed, we may not see a significant upward movement. Failed attempts have significantly discouraged both bulls and bears. On the other hand, with the speculation that the Fed will not loosen its tight monetary policy until the end of the year, combined with recession concerns, it is not difficult to understand the lack of appetite.

So why did cryptocurrencies diverge negatively despite the demand in the stock markets? Cryptocurrencies have their own unique problems at this point. Regulatory uncertainty, issues faced by major companies, lawsuits filed by the SEC, and speculation that new upcoming laws will negatively impact the industry. The list can be extended further, but the current outlook suggests that we will not see a true bull market until the SEC approves a spot Bitcoin ETF.

Türkçe

Türkçe Español

Español