Tether (USDT), which acted as the primary source of FUD throughout the past week due to the depegging incident, faced significant negative comments. According to Messari, the popular stablecoin started the week with a bad note as it experienced the biggest drop below the ideal value of $1 since the collapse of the FTX exchange in November. However, the storm has gradually subsided and USDT has returned to its dollar value by the end of the week. At the time of writing, USDT was available for 0.9 cents according to CoinMarketCap.

Will USDT Suffer?

Due to the depeg, USDT has witnessed a significant increase in redemptions. Like deposits in a bank or savings account, most stablecoins are instantly exchangeable at a 1:1 ratio with their off-chain counterparts such as USD. This allows them to move independently of their market prices.

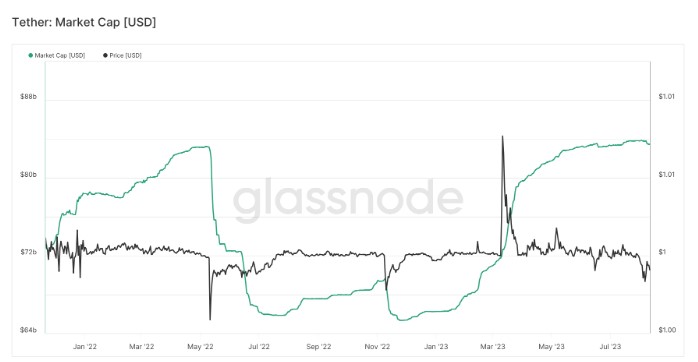

Redemptions significantly affect the market value of stablecoins as they involve the removal of tokens from circulation. Unlike previous depegs, it was noteworthy that there was no significant decrease in the market value of USDT.

On a 7-day basis, USDT’s market value showed a negligible decrease of 0.004, dropping from $83.8 billion to $83.4 billion. When compared to the events related to the FTX fiasco, we see that the market value of USDT has decreased by approximately 5.7%. Therefore, the most important result that can be drawn from all of these events is that the world’s largest stablecoin has become much more resilient against market disruptions.

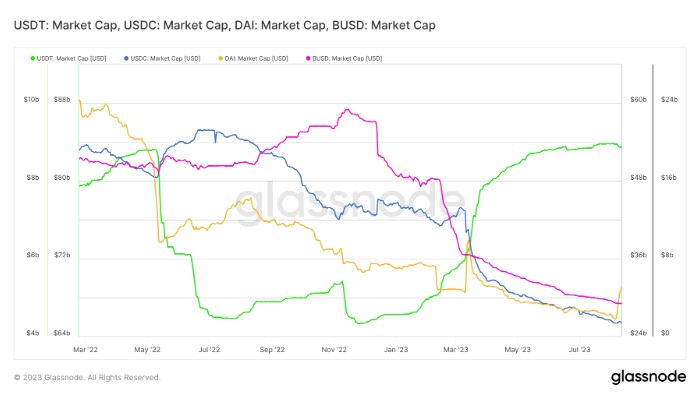

USDT Ahead of Its Competitors

When looking at the stablecoin landscape, the strong fundamentals of USDT have further strengthened. USDT has significantly increased its distance from other assets in the ecosystem by surging in 2023. Its market value has grown by 26% year-to-date, reaching a 66% market dominance at the time of writing. On the contrary, other players such as USD Coin (USDC), DAI, and Binance USD (BUSD) have lost billions of market value since the beginning of 2023, succumbing to the factors in the game.

The incident of losing value also led to a decrease in trust in USDT’s reserves. Investors have long been skeptical about the assets supporting USDT and whether redemptions would be fulfilled in the event of a major market shock.

However, the creative company Tether’s ability to process requests without much trouble has helped alleviate negative sentiments. According to Tether, assets worth $86.7 billion were backing USDT, which was more than its market value.

DAI’s Market Factor

The 3Pool of Curve continues to remain imbalanced with USDT reserves accounting for approximately 60% of the total supply. The 3Pool of Curve serves as a stablecoin liquidity pool consisting of USD Coin (USDC), DAI, and USDT, and it is expected to hold roughly equal balances of all three at any given time (33.33% each). This pool is considered as an indicator of investor sensitivity towards stablecoins. One of the factors fueling this asymmetry could be the increased demand for DAI stablecoin.

In fact, the supply of DAI in Curve’s 3Pool had dropped below 20%. DAI issuer MakerDAO (MKR) recently increased the DAI savings rate (DSR) to 8%. The allure of earning higher rewards from DAI assets caused investors to refrain from using their USDTs in favor of DAI.

DSR serves as one of the most powerful monetary policy levers used by MakerDao to control the supply and demand of DAI. As previously highlighted, DAI suffered a major blow in its supply since the value loss fiasco of USDC in March. Since then, Maker has continuously increased the savings rate to attract investors back to DAI.

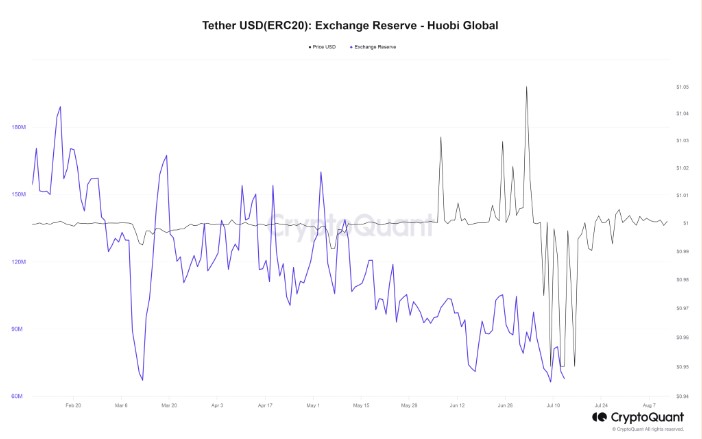

Huobi’s Mysterious Move

A more controversial event that caused fluctuations around USDT sales was associated with the cryptocurrency exchange Huobi (HUOBI). According to CryptoQuant, the USDT reserves on the Seychelles-based platform have decreased by approximately 65% since the beginning of August, leading to bankruptcy concerns.

Analyst and founder of Tron, Justin Sun, strongly criticized by Adam Cochran, accused Sun of exploiting USDT funds deposited by users to Huobi to support his DeFi positions. Overall, last week was turbulent for USDT. However, the resiliency demonstrated by the largest stablecoin in the market has provided relief to many participants.

At the time of writing, Tether maintains its dominant position as the largest tradable cryptocurrency. According to CoinMarketCap, transactions worth more than $15 billion were conducted in the past 24 hours.