BTC price continues to hover around the levels it was in a 1.5-month period when this article was prepared. Although it may be frustrating, this is part of the nature of the cryptocurrency markets. Just as rapid price increases and strong volatility periods are normal for crypto, these types of sideways, boring days are also normal. So, what does the current situation tell us?

Bitcoin (BTC) On-Chain Analysis

Bitcoin‘s on-chain data provides us with a clear picture of investor sentiment. Imagine being able to see all the movements, buying and selling activities, and transfers in all bank accounts. If everyone could easily see where the trend is heading, they could easily take positions. Blockchain transparency provides us with this information, making Bitcoin’s on-chain analysis extremely important.

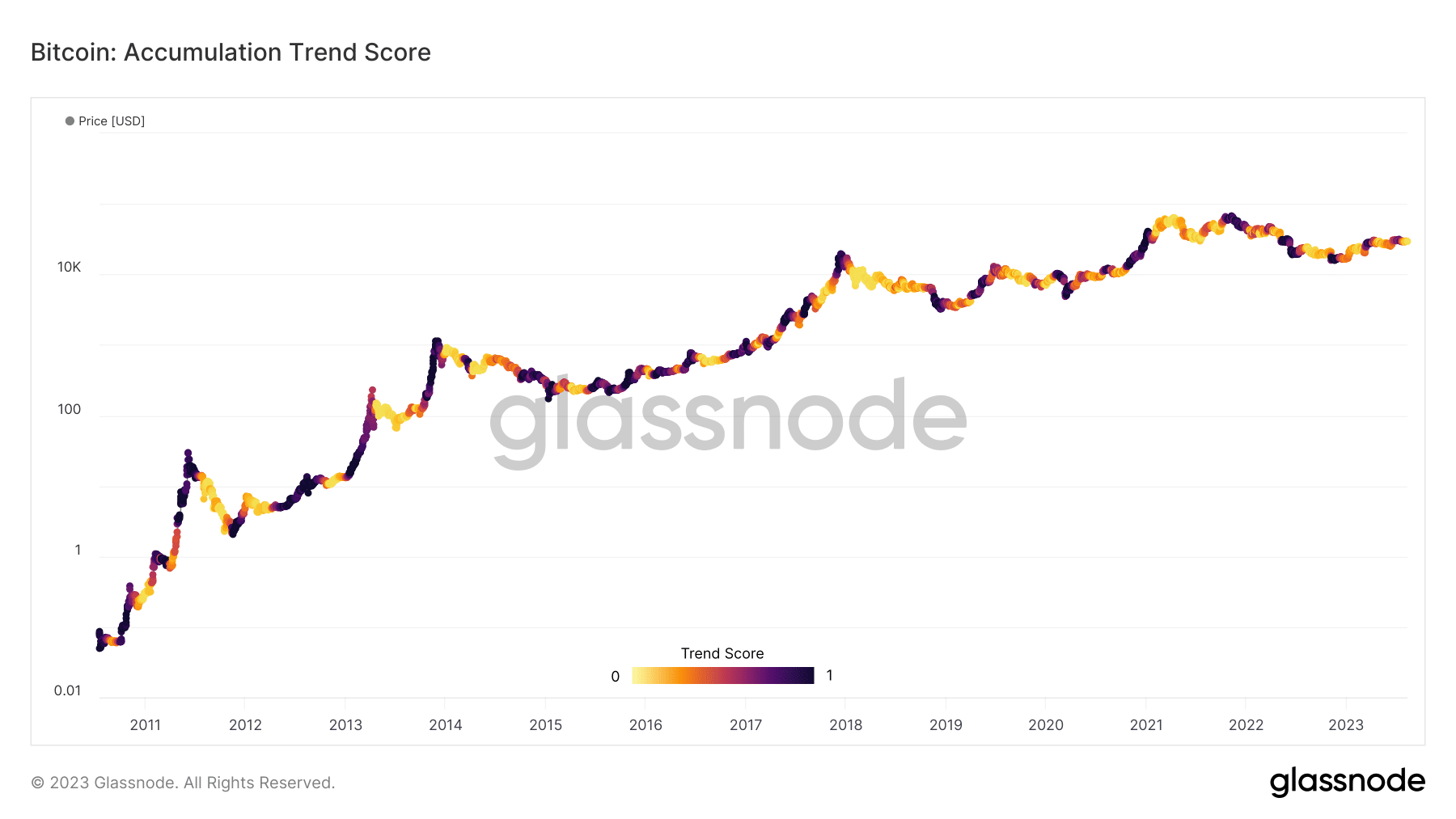

The current data suggests that there has been a noticeable shift in on-chain activity away from previous accumulation tendencies. In terms of BTC price movements, the balance between accumulation and distribution is critical to understanding market sensitivity. One metric that explains this is the accumulation trend score.

The analysis of this metric shows a transition towards a more widespread distribution of Bitcoin. The accumulation trend score, as an indicator of market behavior, reflects the number of new coins accumulated or sold during a specific period.

When the accumulation trend score approaches one, it means that large institutions are accumulating. However, when the metric approaches zero, it indicates a shift towards selling. At the time of writing, Bitcoin’s accumulation trend score was 0.05, indicating that major investors are selling.

Will Bitcoin Price Increase?

We previously reported that whales were accumulating a large number of Bitcoins, and this action was instrumental in pushing the king cryptocurrency above $30,000 at one point. Therefore, the change in sentiment may have affected the recent consolidation that BTC had to deal with.

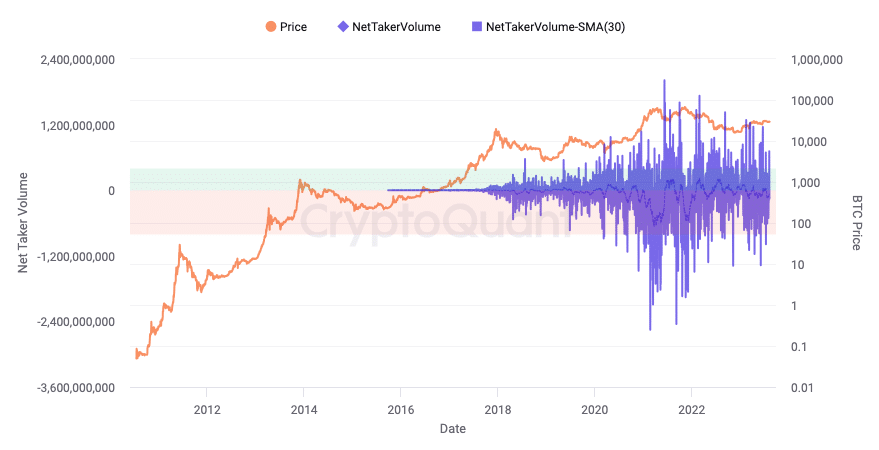

If this metric continues to remain the same, BTC’s consolidation or decline may continue. Additionally, CryptoQuant analyst JA_Maartunn stated on August 12th that BTC’s inability to climb could be related to net buyer volume. Net buyer volume measures the difference between the buying and selling volume of Bitcoin futures contracts. Referring to historical usage of the metric and making reference to 2021, the analyst said;

“In May 2021, when Bitcoin was trading around $60,000, the Buyer Sell Volume was $600 million higher than the Buyer Buy Volume. This indicates that despite the price still being high, intense selling was taking place through market orders.”

Therefore, there doesn’t seem to be an immediate increase for Bitcoin. Despite heavy selling pressure, Santiment revealed that funding on Binance was only 0.01%. A positive funding rate indicates dominance of long position traders. However, recent data highlights the risk of continued selling leading to significant long liquidations in BTC and altcoins.

Türkçe

Türkçe Español

Español