The second-largest cryptocurrency by total market value, Ethereum (ETH), has been unable to climb higher since reaching levels of $2,140 in April this year. It continues to face challenges and remains in a downtrend since April. The increasing pressure and inability to sustain a sideways movement have pushed the price to a predictable lower point.

ETH Price Analysis

ETH price experienced a concerning drop to $1,800. Ethereum lost almost the same amount of value as BTC, with a decline of 1.3% to reach $1,815. This level is a critical support, and according to some, it could lead to $1,500 and even $1,000 being on the agenda. Renowned cryptocurrency analyst Ali Charts also shed light on the market.

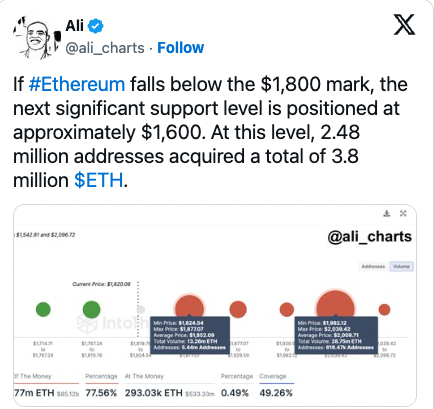

Ali stated that if ETH loses the $1,800 support, the next significant support level is at $1,600. The analyst mentioned that at this level, 3.8 million ETH wallets have purchased 1.8 million ETH, indicating a $6 billion selling pressure. It is possible for ETH investors to sell at a loss if the price drops below $1,600, which is considered a natural selling pressure.

Looking at the graph shared by Ali, selling pressure is evident at these levels, while buying pressure is relatively low. The analyst previously pointed to $1,600, and the price is gradually moving towards that level.

ETH Investors at a Loss

Currently, 77% of Ethereum wallets are in a loss. According to the available data, 46.77 million ETH in investors’ hands were purchased at higher prices. IntoTheBlock reported that only 13.24 million ETH is currently in a profitable position. This indicates that the number of losses and investors in a loss continues to increase.

Despite this, Ethereum continues to experience technical developments and receives new updates with each new period. This situation can contribute to long-term sustainability.

Türkçe

Türkçe Español

Español