While the altcoin market continues to decline this week, Dogecoin bulls have fiercely defended the $0.065 support level. On-chain data after weeks of profit-taking indicates that Dogecoin miners are now chasing another price rally.

DOGE On-Chain Data Analysis

Dogecoin miners currently control about 3.1% of the total circulating DOGE, with 4.37 billion tokens in their reserves. On-chain data analysis examines how recent accumulation patterns could affect DOGE prices in the coming weeks.

Dogecoin reached $0.082 around July 25, its highest point in three months. On-chain data reveals that many Dogecoin miners took advantage of these high prices to make profits. However, as meme coin prices fell below the critical $0.07 support level, miners began to accumulate again this week.

The following IntoTheBlock chart shows that miners started reducing their recent selling frenzy when DOGE prices dropped below $0.075 around August 8. Miners also accumulated an additional 80 million tokens worth approximately $5.3 million between August 8 and August 17.

Miner Reserves data tracks real-time changes in the wallet balances of prominent miners and mining pools. When the reserves increase, miners are likely accumulating more block rewards in preparation for another price rally.

Currently, miners control over 3% of the total circulating supply of DOGE. Therefore, it is not surprising that their recent sales are closely related to the ongoing DOGE price correction. The decrease in block rewards being sent to exchanges due to the market supply decrease could propel DOGE towards another rally.

Transaction Volume Increases as Price Declines

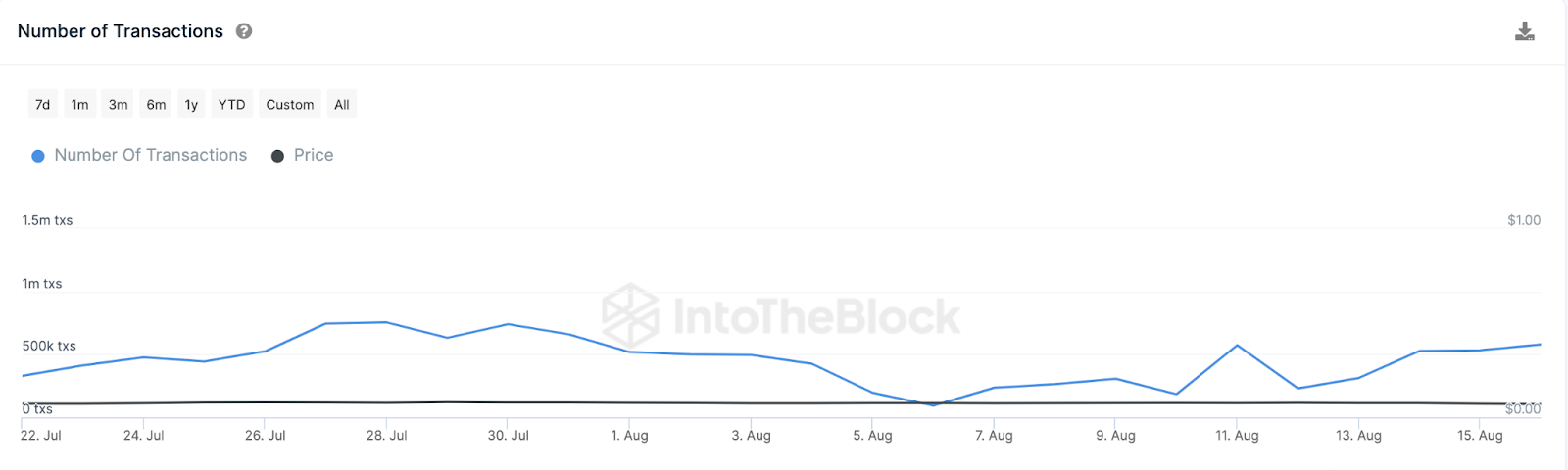

Since August 8, the global altcoin market has contracted by an astonishing 5%. It appears that the industry-wide headwinds have negatively impacted DOGE prices in recent weeks. The graph below shows that while the DOGE price fell by over 10% between August 6 and August 17, Dogecoin Transaction Activity increased from a daily average of 92,960 transactions to 578,860. This represents a six-fold increase in transaction activity.

Daily Transaction Volume provides information on how much a blockchain network is currently being used for economic activity. An increase in transaction activity during a price decline trend suggests that external factors may be responsible for the pullback. Since Dogecoin has not experienced a significant deterioration in transaction activity, it can immediately enter another price rally when the downward trend in the industry subsides. In summary, miner accumulation and increased transaction activity are vital on-chain data indicators that could boost DOGE prices in the coming weeks.

The Most Important Support Level for DOGE

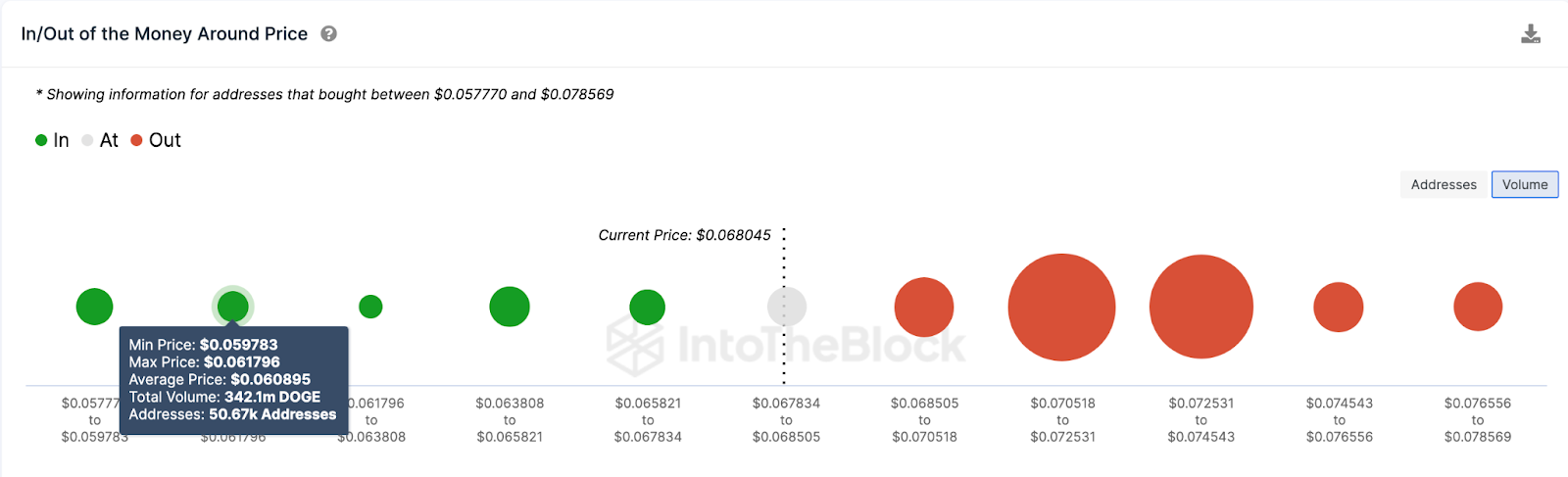

Based on the aforementioned blockchain statistics, it can be inferred that the DOGE price will likely consolidate around $0.06 amidst the broader industry decline. The In and Out of the Money Around Price (IOMAP) data, which shows the distribution of buying prices by current holders, also confirms this proposition.

The chart below shows that 44,000 addresses bought 1.18 billion DOGE tokens at an average price of $0.065. If miners continue to accumulate and transaction activity remains high, DOGE could encounter significant support within this range. However, if this support level fails, bulls may establish another significant buying wall at $0.059.

Conversely, rising miners could lead a new rally towards $0.08. However, in this case, the 206,950 addresses that bought 24.45 billion DOGE at an average price of $0.075 could trigger a retracement. Nevertheless, if positive news flow is provided across the industry, DOGE could break through this resistance and once again head towards $0.080.

Türkçe

Türkçe Español

Español