The price drop experienced on the night of August 18th in the Bitcoin and Ethereum fronts caused the two leading cryptocurrencies to reach their lowest price levels in two months and triggered a series of liquidations for thousands of leveraged traders. It is noteworthy that this loss, which occurred after the biggest loss in the last eight months since the bankruptcy of FTX, coincided with the lowest daily volatility in years.

Millions of Dollars Vanished with a Single News

The rapid decline in the cryptocurrency sector triggered by the news of SpaceX led to the liquidation of leveraged trading positions worth billions of dollars and caused many investors to lose millions of dollars in a single transaction. Especially leveraged traders suffered significant losses during the night, while spot investors were able to partially recover their losses.

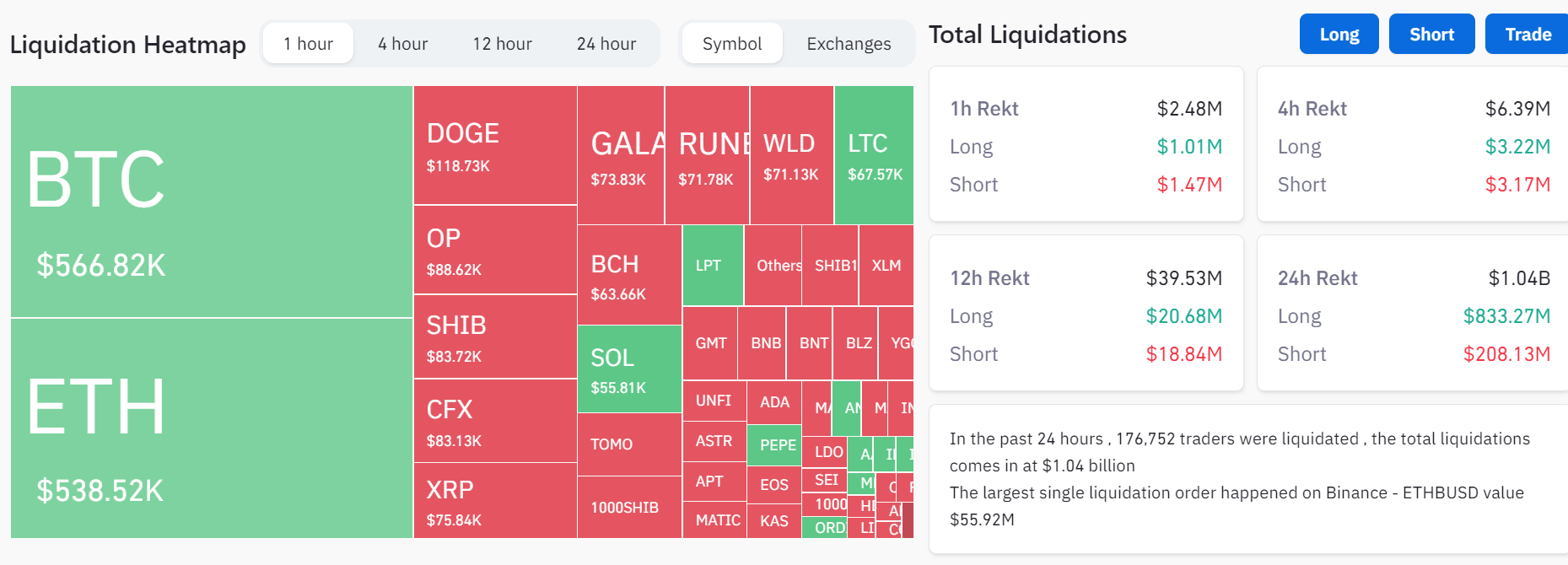

According to the data from cryptocurrency data analysis company Coinglass, a total of 176,752 investors’ leveraged trades were liquidated in the past 24 hours. 90% of these liquidations occurred in the last 12 hours, and events unfolded with a rapid increase in price volatility shortly after BTC and ETH recorded the lowest daily volatility in years.

The Biggest Loss in Eight Months

Two specific liquidations among the investors who lost a significant portion of their leveraged trading positions caught the attention of the crypto community. During the price drop, an investor in Binance‘s ETHBUSD contract was liquidated as the Ethereum price reached $1,434, resulting in a loss of $55.9 million, making it the largest liquidation of the day. Another Binance investor in the BTCUSDT contract lost approximately $10 million in liquidations. The billion-dollar liquidation became the biggest liquidation event in crypto in the past 8 months after the incident during the FTX collapse.

The price function in the crypto market has been attributed to various factors, including a report claiming that SpaceX sold Bitcoin and the fact that BTC and ETH have been trading within a range for the past few months, including macroeconomics. While BTC held the $28,000 support for a few months, ETH held the $1,500 support before succumbing to selling pressure yesterday. Liquidity in the crypto market is currently at a low level, and leading crypto exchanges like Coinbase continue to experience a significant decrease in trading volumes.

Türkçe

Türkçe Español

Español