The crypto markets have experienced a strong selling wave in the past 24 hours. QCP analysts have shared their latest market predictions. The downward trend gaining momentum today was not surprising for crypto investors. A major breakthrough was already expected as BTC volatility reached a level not seen in the past 7 years. So what are the expectations for the future?

Crypto Experts’ Comments

QCP analysts recently shared their latest predictions about the markets. In their previous market forecast published on Tuesday, they mentioned that “the markets showed signs of waking up from their range-bound sleep” and that “BTC had reached the first termination point of the wedge formation it has been trading in since the 15,000 level.” However, as there was no known catalyst, they did not expect significant movements in the last week of August.

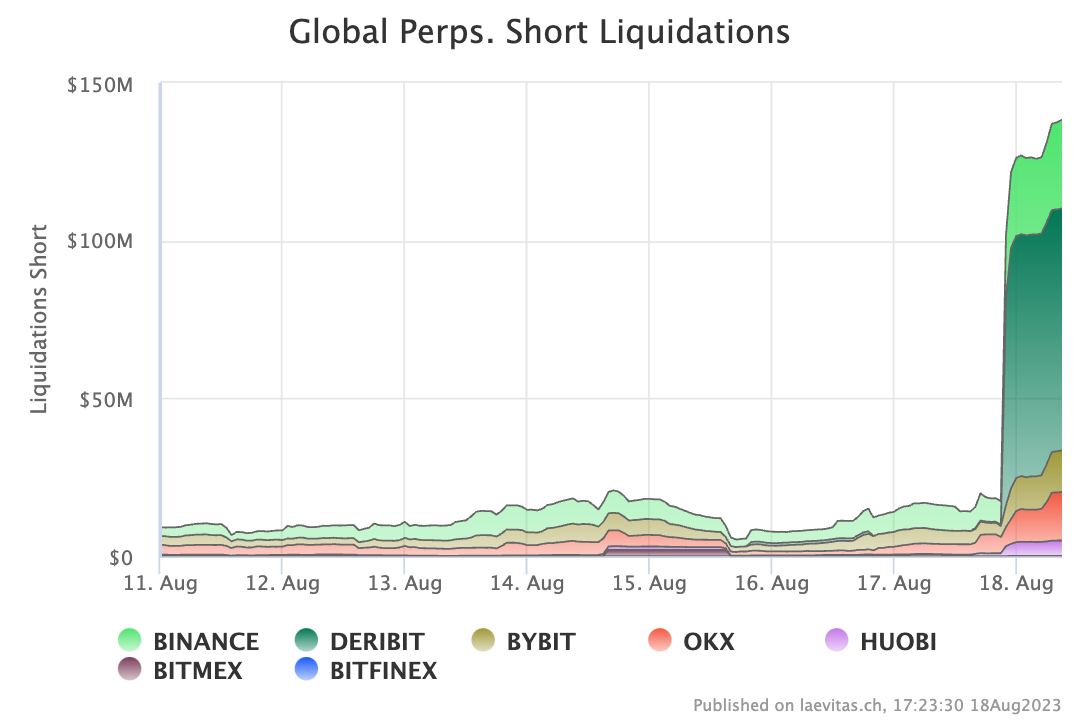

The big move came earlier than expected, and the wedge broke downwards as highlighted by the analysts. This break was driven by the perp liquidations of large BTC and ETH gammas on the Deribit and OKX options exchanges, accounting for about half of the entire liquidation flow.

Crypto Experts’ Predictions

According to analysts, the trigger for the movement was SpaceX selling its Bitcoin at an undisclosed date. We shared this news with you as breaking news and mentioned that it could cause a decline. The SpaceX sale led to a bigger FUD (Fear, Uncertainty, and Doubt) in the market than expected. This situation also led to speculation that Tesla would have the same prediction and that the Dogefather had given up on cryptocurrencies.

“More importantly, it is how this break sent the derivative market into a bear-extension mode. While BTC perp funding reached its most negative level in the past 6 months, BTC risk reversals moved -5 volatilities downward. The carnage in ETH was even more pronounced, with the lowest level traded on Deribit perps being 1466, and end-of-month risk reversals moved -12 vol this week. We believe that many things depend on Powell’s speech at Jackson Hole next week, but after holding the crucial 24-25k region in this move, our wave count requires a corrective A Wave to end here, followed by a bounce in the B Wave to retest the bottom of the wedge.”

Analysts shared the above chart when revealing their targets.

Türkçe

Türkçe Español

Español