Fluctuations in the price of Bitcoin have also affected a significant portion of altcoins. Often, downturns bring along significant increases. Investors who have been involved with cryptocurrencies for a long time predicted that the extreme selling last week would provide short-term profit opportunities for many altcoins. And indeed, it did.

Stellar (XLM) Review

While the crypto market remained calm over the weekend, some altcoins initiated upward movements. The XLM price fell below a decreasing resistance line since July 13th. On August 15th, XLM broke away from the horizontal support area of $0.130. This is a crucial price range as it initially provided resistance in July 2022 and later turned into support in July 2023.

Following the breakout, XLM investors confirmed the horizontal support area of $0.110. Since then, the price has increased by 18% and returned to the critical area of $0.130. If the price can break above the decreasing resistance line, it may test $0.17. On the other hand, in a bearish scenario (as Bitcoin appeared to be heading downwards at the time of writing this article), we may see a retreat towards the support area of $0.11.

Ripple (XRP) Chart Analysis

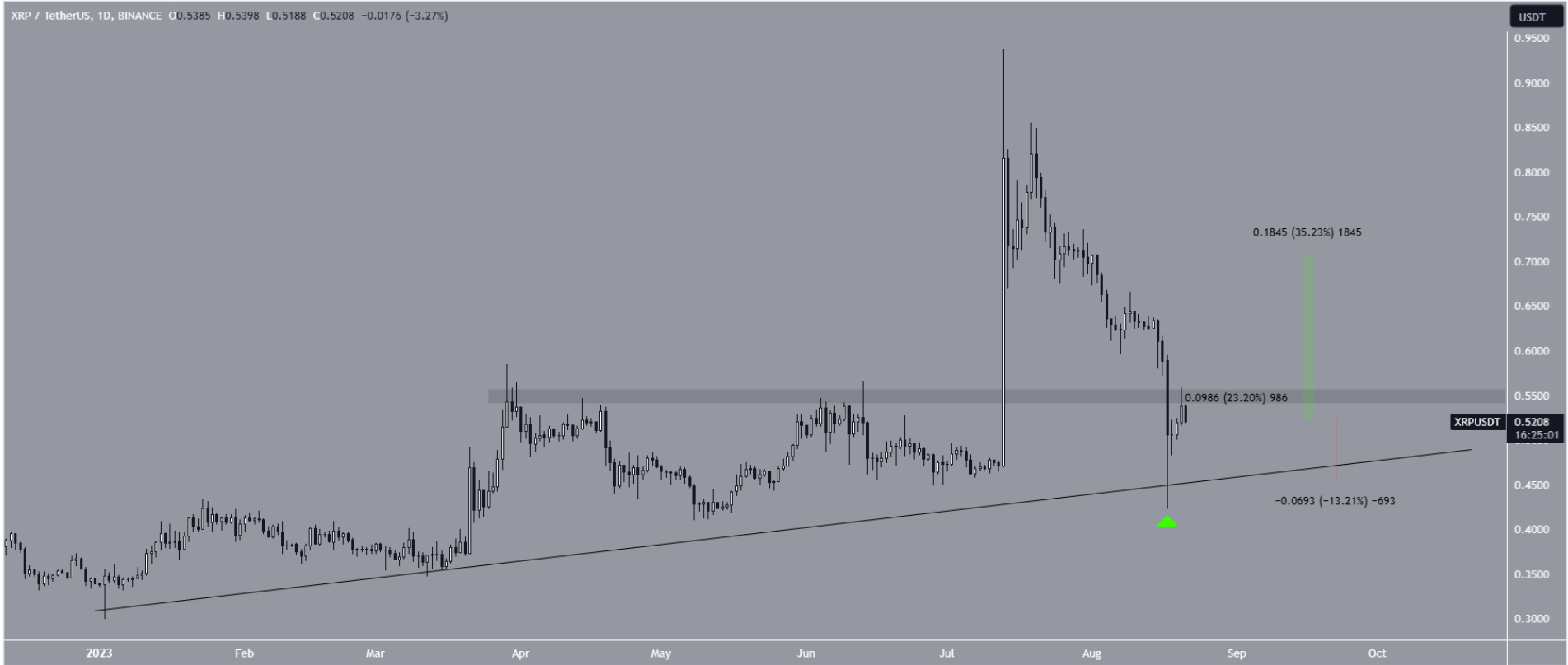

The price of XRP has significantly increased since the beginning of the year, following an upward support line. This increase triggered the peak of $0.938 on July 13th. However, the rally triggered by the summary judgment in the lawsuit reversed due to subsequent statements. On August 17th, Ripple confirmed the rising support line, forming a long lower wick. A long lower wick is considered a sign of buying pressure. In addition to confirming the support line, it also catalyzed a 22% price increase.

Despite the jump, XRP could not reclaim the horizontal area of $0.55. The SEC’s appeal process will become clearer around September 1st. The acceptance or rejection of this request will likely determine the future direction of the trend. A successful recovery could potentially lead to an increase to $0.70, a 35% increase.

Monero (XMR) Price Prediction

XMR price broke away from a descending resistance line on June 23rd. Prior to the breakout, the line had remained intact since the beginning of February. After the breakout, the XMR price reached a peak of $172 before dropping. The rejection and subsequent decline paved the way for a dip to $136 last week.

Subsequently, the XMR price rebounded and showed an 8.70% increase. If the upward movement continues, there could be a $15 increase towards the resistance area of $168. On the other hand, if the rally loses momentum, we may see a drop to $133.

Türkçe

Türkçe Español

Español