Historical models often form the basis of successful predictions for cryptocurrencies. There are many examples of this. For example, we clearly saw this before the drop last week. So how did this happen? What signals do current data give us about the short and medium-term future of the market? Let’s discuss all these details.

When Do Cryptocurrencies Rise?

Let’s start with the drop that happened last week. The volatility of Bitcoin had reached the lowest levels since 2016 and January 2023 before the recent days. This told us that a major price movement could start soon. Did this happen? Yes, it did, and as expected, the price dropped because the market sentiment was negative. Now, BTC is making upward attempts as it holds the $26,000 support.

So what’s the good news? The total market value of cryptocurrencies is trading within a horizontal support area. While the price movement does not indicate any upward signals, the RSI suggests that there could be an increase of about 50% on the horizon. The cumulative value of cryptocurrencies had dropped since July when it reached $1.24 trillion. At that time, the price seemed to break out of the $1.18 trillion resistance area.

However, instead of breaking the total market value, it formed a long upper wick and has been declining since then. It dropped to $992 billion last week. During the drop, there was a significant increase in expressions like “buy the dip” on various social media platforms like Reddit and Twitter. Therefore, the price could rise in the near future.

Current Analysis of Cryptocurrencies

The cumulative value of cryptocurrencies is still trading above the $1 trillion horizontal support area. As long as it doesn’t close below this region, we could see a return to $1.18 trillion with a 15% jump. However, if there is a close below $1 trillion, there could be a retreat to $890 billion with a 13% drop.

Looking at the daily time frame technical analysis from the RSI, there is an interesting development. The indicator has entered the oversold zone for the third time this year. The previous two occasions resulted in increases of 40% and 50%, respectively. Therefore, if a similar increase occurs, we could see a 50% recovery in the total market value within the next two months.

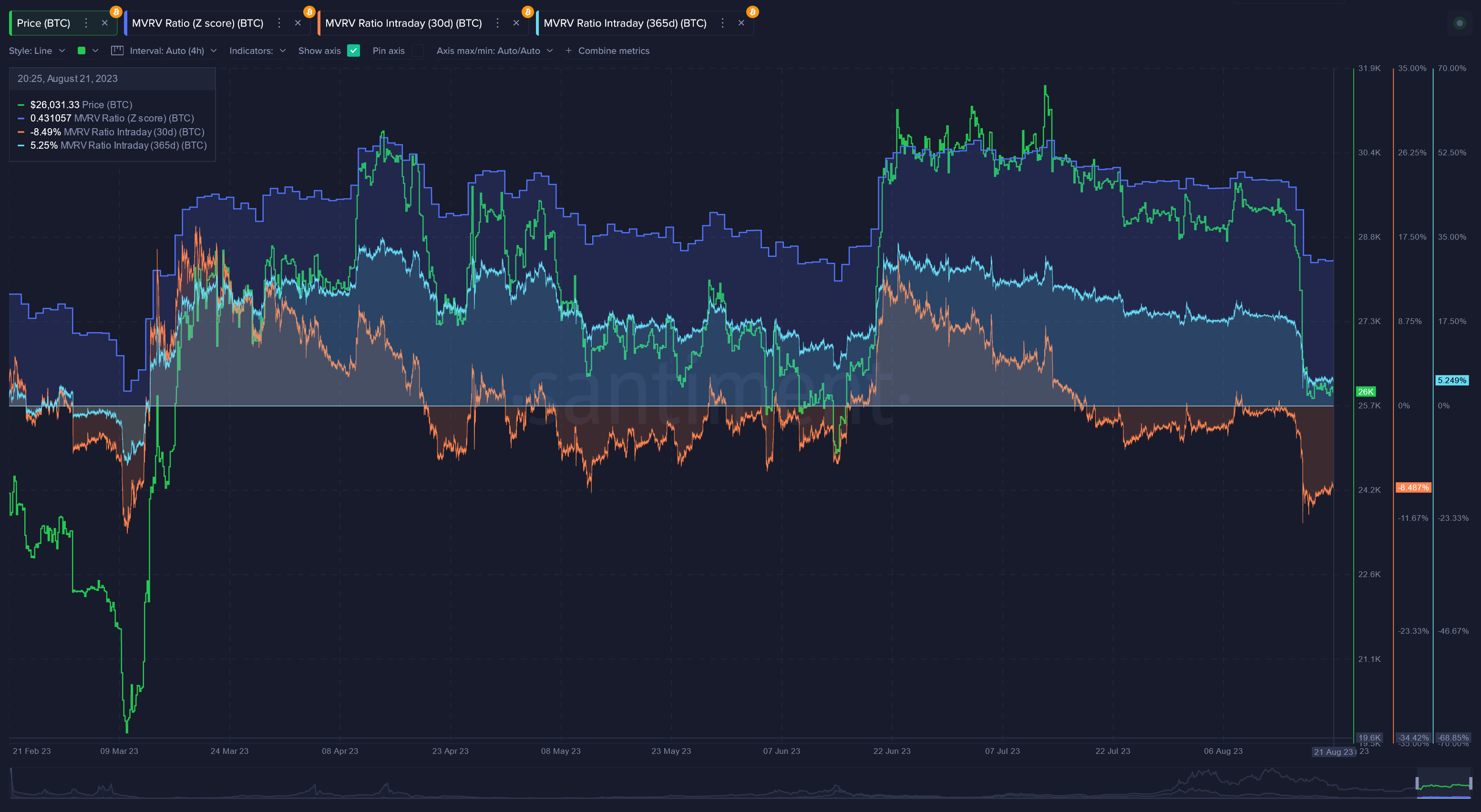

This situation can also be observed when looking at the MVRV indicator and net losses for Bitcoin. Investors are expecting losses like never before since March 2023. As a result, as long as the cumulative value of cryptocurrencies remains above $1 trillion, there could be a strong rally.

Türkçe

Türkçe Español

Español