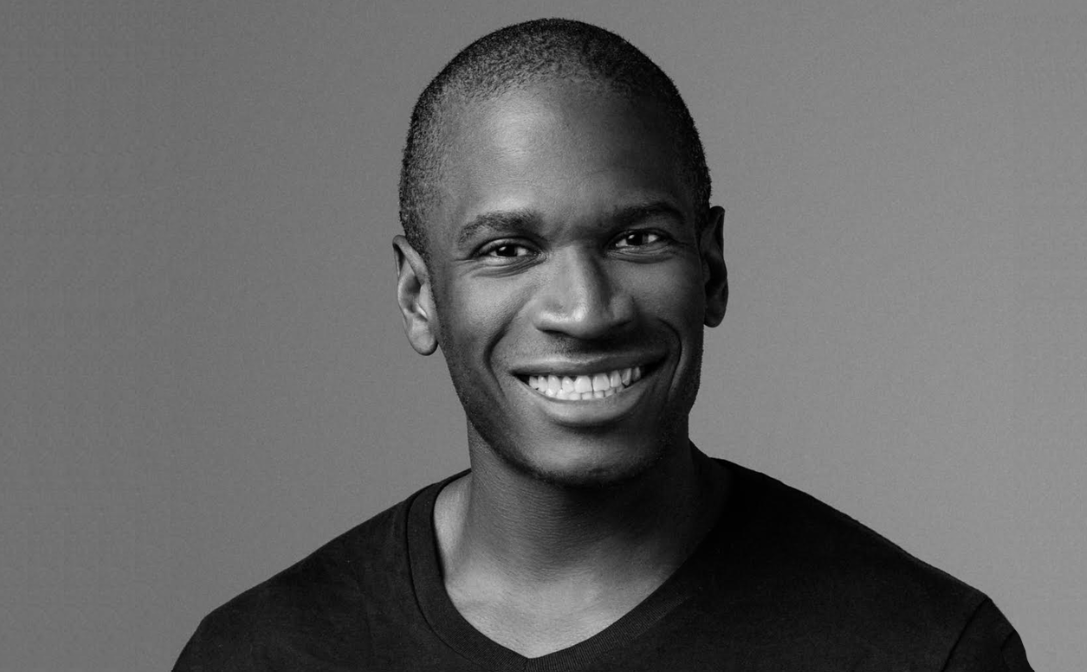

Arthur Hayes, the founder of BitMEX, closely followed by cryptocurrency investors, has shared his latest market analysis. The expert, known for his consistent predictions in the past, foresaw the 2022 crash and shared his expectations for recovery in 2023. So, what does Arthur predict for cryptocurrencies?

Bitcoin Comments from Experts

Arthur Hayes, the founder of BitMEX, predicts that the king of cryptocurrencies will hover around $25,000 in the third quarter instead of dropping below $20,000. He believes that the market fails to grasp how quickly it loses control over the US Treasury market, and thus fails to realize the swift return of interest rate cuts and QE.

He also reiterated his view that Bitcoin will continue its steady rise in the long term. When expressing this view, he stated:

“One of Bitcoin’s value propositions is that it is the antidote to a broken, corrupt, and parasitic fiat banking system. Therefore, as the banking system collapses, Bitcoin’s value proposition strengthens. Additionally, Bitcoin benefits from increasing fiat money liquidity. Rich people don’t need real things; they need financial assets so that they can effortlessly consume to their hearts’ content. Bitcoin has a limited supply, and therefore, as the denominator of fiat money (toilet paper) grows, the value of Bitcoin in fiat currency will also increase. The reason Bitcoin has increased by 18% since March is this.”

What Are Experts Investing In?

In a lengthy article, Hayes focuses on the performance of technology companies, artificial intelligence, and cryptocurrencies. He also provides clear clues on what to invest in under current conditions.

“Dr. Calomiris’ article offered a very strong ‘solution’ to the problems of the Fed and the US Treasury. I would bet heavily on the likely path of finding a fool who will buy long-term US Treasury bonds at favorable returns for the government. Now the real question is how I will position my portfolio and how I will wait for financial dominance to enforce the policy prescriptions outlined by Dr. Calomiris.

Cash is great right now because, overall, it has been outperformed only by big technology and crypto in terms of financial returns. I have to feed myself, and unfortunately, I cannot earn income by holding technology stocks or crypto. Technology stocks do not pay dividends, and there are no risk-free Bitcoin bonds that I can invest in.”

So, what are the predictions for the next move by the Fed?

“I don’t know when the US Treasury market will break and force the Fed to act. Given the policies demanding the Fed to raise interest rates and shrink its balance sheet, it is a good assumption that long-term interest rates will continue to rise. The 10-year UST yield has recently exceeded 4%, reaching record levels. As a result, risky assets like cryptocurrencies are taking a hit. The market believes that higher long-term rates are detrimental to perpetual assets such as stocks and crypto.”

Felix Baba predicted a significant market correction approaching in all assets, including crypto. It seems as valuable as ever. I need to generate income and be able to cover losses in the crypto market. My portfolio is prepared exactly for this purpose.

I believe I made an accurate prediction about the future because the Fed mentioned that bank reserve balances need to increase, and as expected, the banking sector was not happy with this. Rising long-term US Treasury yields are a sign of deep decay in the market structure. China, oil exporters, Japan, the Fed, etc., are no longer buying US Treasury bonds for various reasons. When the usual buyers are on strike, who will step forward to buy trillions of dollars worth of debt that the US Treasury needs to sell in the coming months at low yields? The market is rapidly moving towards the scenario predicted by Dr. Calomiris: a failed auction that forces the Fed and the Treasury to take action.

The market has not yet realized that the faster the Fed loses control over the US Treasury market, the faster interest rate cuts and QE will resume. We have already demonstrated this when the Fed abandoned monetary tightening by expanding its balance sheet by hundreds of billions of dollars in a few trading days to ‘rescue’ the banking system from various regional bank defaults earlier this year. A dysfunctional US Treasury market is beneficial for limited supply risk assets like Bitcoin. However, investors are not traditionally trained to think of the relationship between risk-free returns offered by fiat bonds and fiat-denominated risk assets in this way. We must go down to go up. I will not fight the market; I will just sit still and accept my warnings.”