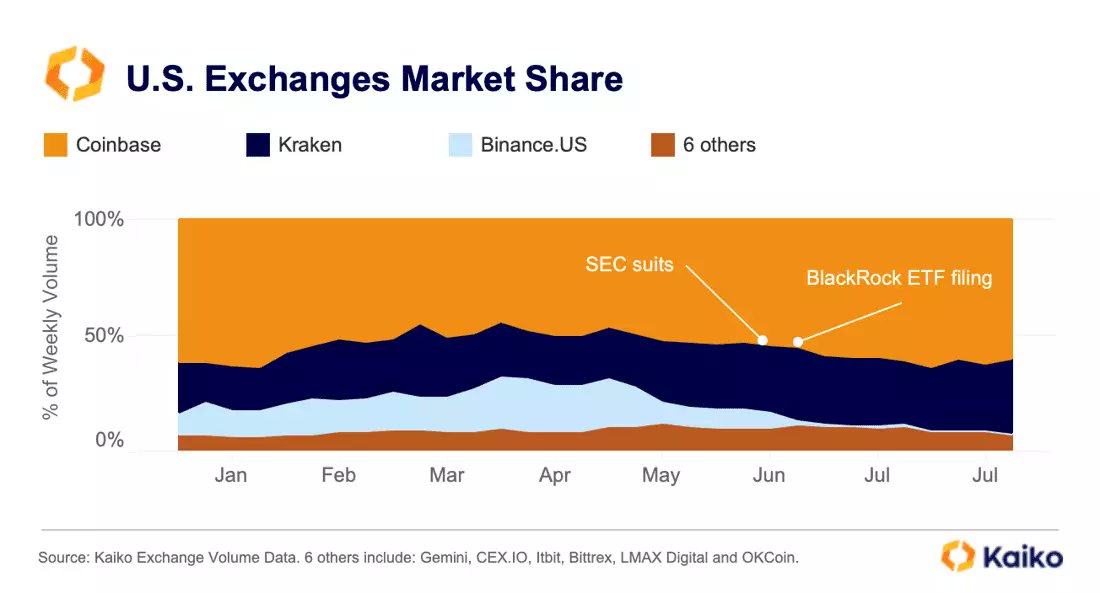

The cryptocurrency exchange in the US has undergone a radical shakeup since the lawsuits filed against some of the biggest names in the industry in early June. The lawsuit filed by the Securities and Exchange Commission (SEC) against Binance has caused turmoil for the exchange’s operations in the country.

Statements from Analytical Company!

According to data provider for digital assets, Kaiko, the two largest trading platforms in the US, Coinbase (COIN) and Kraken, have regained all the market share lost by Binance’s US branch in the past three months. Binance.US has been one of the biggest casualties during this period, with market makers and investors withdrawing liquidity from the trading platform due to tense market conditions.

The market share plummeted from 20% in mid-April to below 1% as of August, severely hampering the growth in the world’s largest financial market. On the other hand, Coinbase, which was also affected by an SEC lawsuit, increased its market dominance to 60%, indicating the need to pay attention to how it expands its footprint in the US market.

Despite facing some setbacks as a result of the lawsuit, the largest US exchange has managed to turn the tide with a major catalyst for growth. Coinbase has been chosen as a surveillance sharing partner by traditional finance (TradFi) giants like Fidelity and many others who have recently applied for spot Bitcoin (BTC) ETFs.

Crypto Developments from the US!

This has resulted in Coinbase becoming the go-to platform for cryptocurrency spot trading in the country. Things could further worsen for the world’s largest exchange in terms of US oversight. The crypto giant’s activities in Russia have caught the attention of the US Department of Justice, and experts believe that a criminal indictment is imminent.

In early May, the US government launched an investigation into Binance over allegations that it allowed Russian users to bypass economic sanctions due to the Kremlin’s military operation in Ukraine. Binance has repeatedly denied the accusations. Despite the FUD, Binance has continued to be the undisputed leader in cryptocurrency trading. According to CoinGecko’s data, the exchange has conducted transactions worth over $6.2 billion in the last 24 hours, nearly six times more than second-place Coinbase.

Türkçe

Türkçe Español

Español