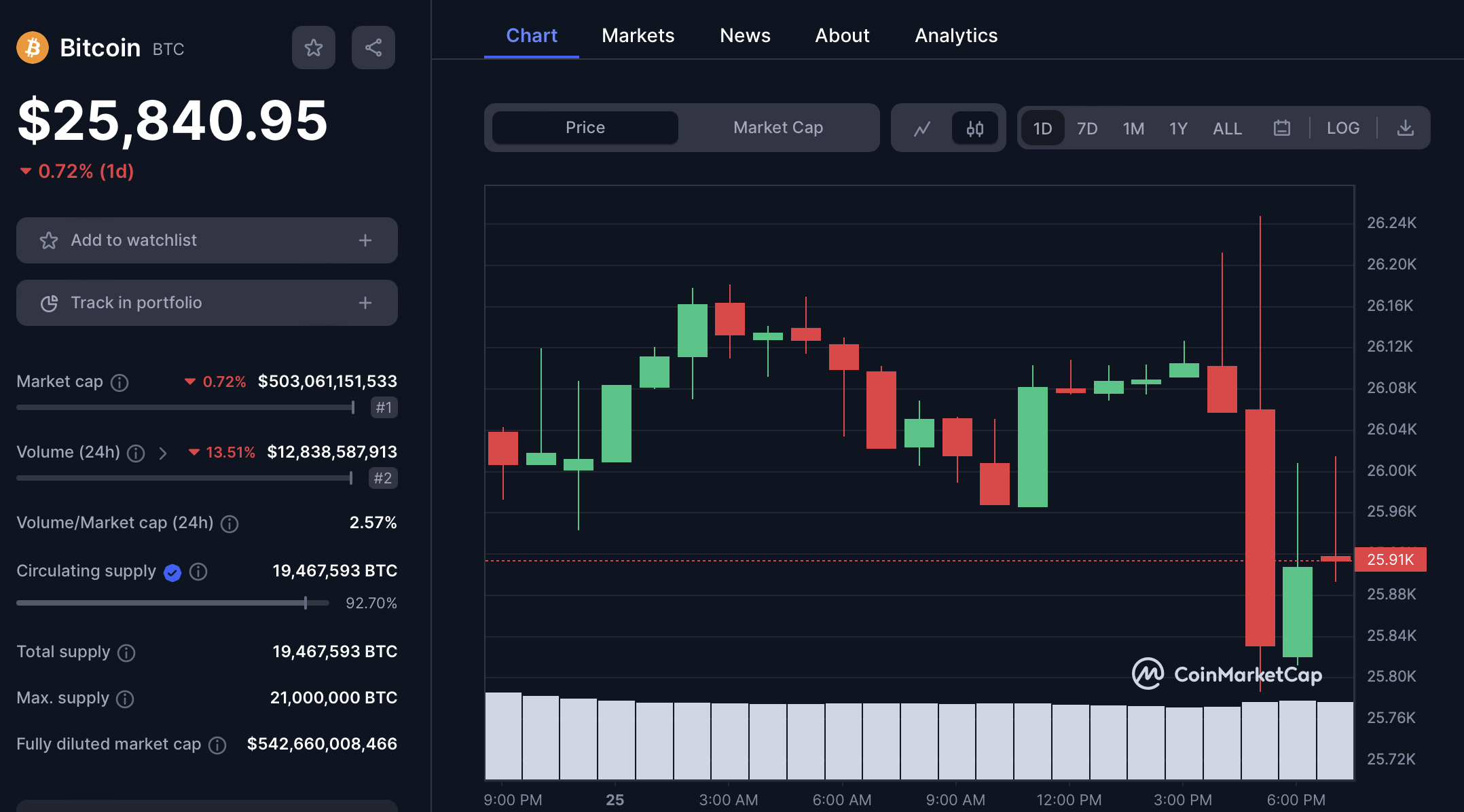

The crypto market has started to decline after Federal Reserve (Fed) Chairman Jerome Powell signaled that interest rate hikes could continue. The leading cryptocurrency Bitcoin (BTC) fell below the $26,000 level again and started trading at around $25,800. According to CoinMarketCap (CMC) data, the total market value of the crypto ecosystem has also dropped to $1.04 trillion.

Market Falls After Fed Chairman’s Comments

Fed Chairman Jerome Powell made statements signaling that interest rate hikes could continue. Powell emphasized that inflation is still at very high levels, stating that their inflation target is 2% and this target will not change. Powell highlighted that further interest rate hikes could be realized in order to bring inflation down to the 2% target.

The leading cryptocurrency Bitcoin (BTC) rapidly declined after Fed Chairman Jerome Powell’s statements and dropped to around $25,800 with its recent losses. Most altcoins in the crypto market also experienced further value losses due to the decline in BTC. Ethereum (ETH) fell below the $1650 level, and the total market value of the crypto industry, according to CoinMarketCap (CMC) data, has dropped to $1.04 trillion.

Will the Decline in Bitcoin Continue?

While the volatile price movements in the crypto market in recent weeks and the current direction uncertainty continue, many crypto analysts evaluated the current situation in the crypto market and the current technical outlook for BTC. Crypto analyst Michael Van de Poppe, who suggested that the expectation of a rise continues and that BTC returning to the $30,000 level is a matter of time, stated via his Twitter account that he believes that the leading cryptocurrency can offer a new opportunity if it falls to the price levels of $24,000 to $25,000 in the short term.

On the other hand, crypto analysis platform Santiment drew attention to the declining BTC supply on exchanges. Santiment stated that the BTC supply on crypto exchanges has reached the lowest levels seen since December 17, 2017, and shared the current data. According to Santiment’s data, only 5.8% of the circulating BTC supply is on crypto exchanges.

Türkçe

Türkçe Español

Español