The price of Bitcoin is currently trading at $26,033. The price is forming a narrow range of $500 again. Cryptocurrency investors are anxiously waiting for BTC‘s next move. Technical analysis is not providing clear signals, and the number of experts expressing bearish expectations is increasing. So, what does the on-chain data say?

Bitcoin and Cryptocurrency Analysis

Four popular indicators suggest that the current outlook for Bitcoin price could indicate further decline. These indicators are closely followed by on-chain experts, and rallies supported by news flow are needed to break these periods of extreme negativity. The four popular indicators signaling a decline are as follows:

- Net Network Growth: Measures momentum and demand

- In the Money: Looks at demand, cost, and momentum

- Concentration: Indicates whales are avoiding accumulation

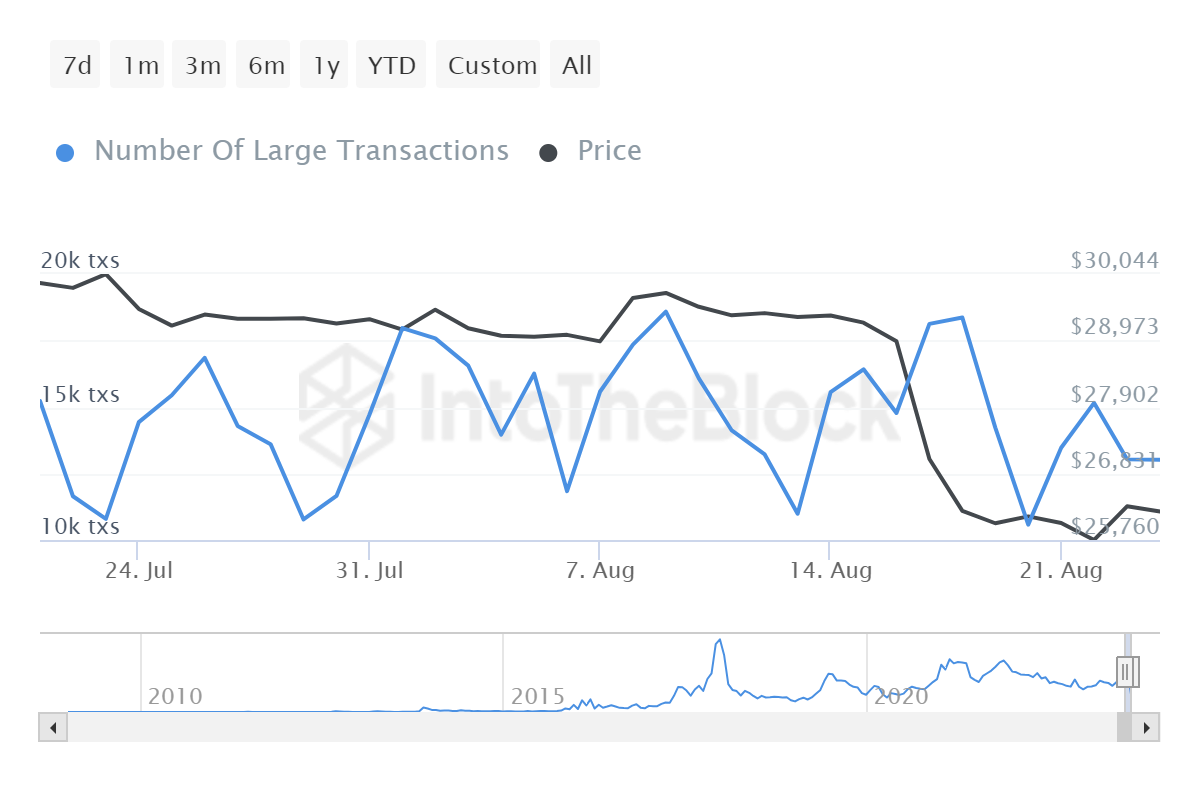

- Large Transactions: Shows weak whale transactions currently

Smart Price is at a neutral level instead of negative. It is a medium price variation where the average of buying and selling prices is weighted according to the volume published in buying and selling. Bid-Ask Volume Imbalance indicates that sellers are dominant.

BTC Correlation with Altcoins

BTC dominates almost all other assets in the crypto market. If the price drops, we also see a decline in altcoins. However, there may be some exceptions. Therefore, it can be useful for investors to monitor the 30 and 60-day BTC-altcoin correlations. The chart below shows this for popular altcoins.

During a downturn, negative and close to negative correlation coefficients are positive for the respective altcoin. The opposite is true when BTC rises.

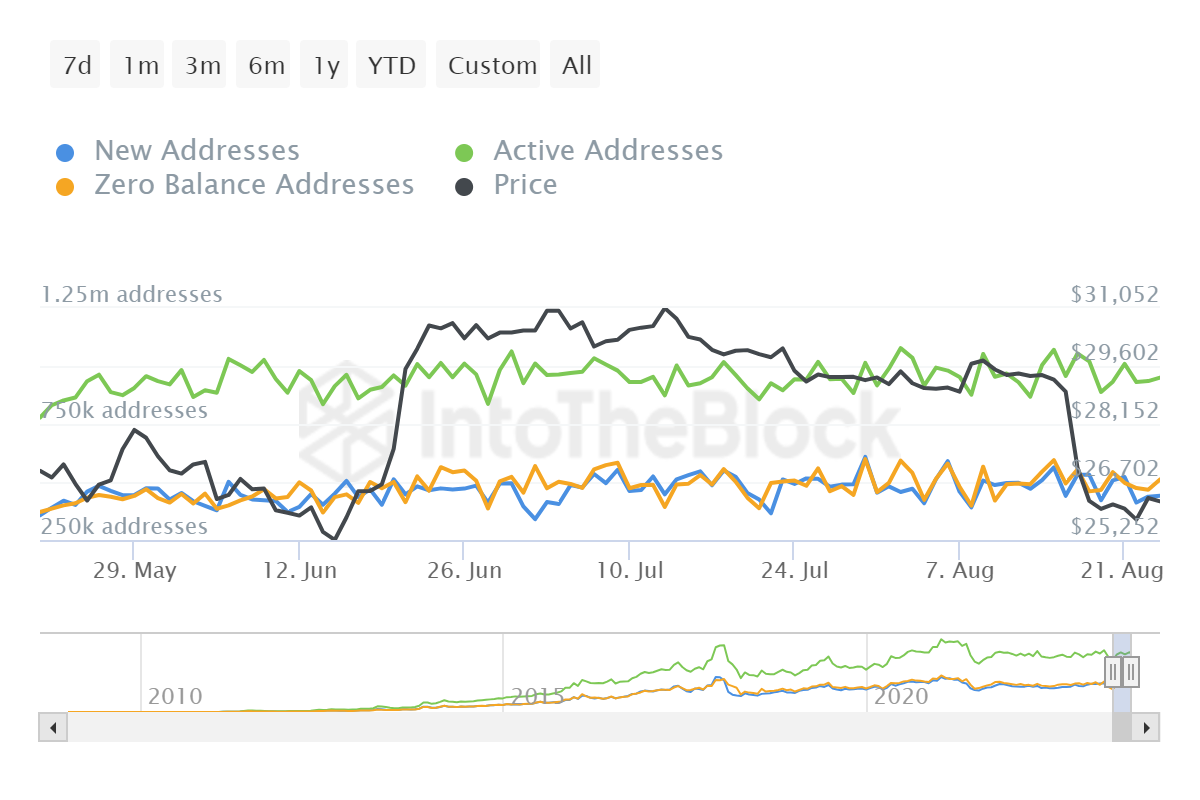

Bitcoin Active Addresses

The weakness in whale interest has not spread to the overall network. The number of active addresses continues to hover around 1 million per day. However, there is a slight decrease on a weekly basis.

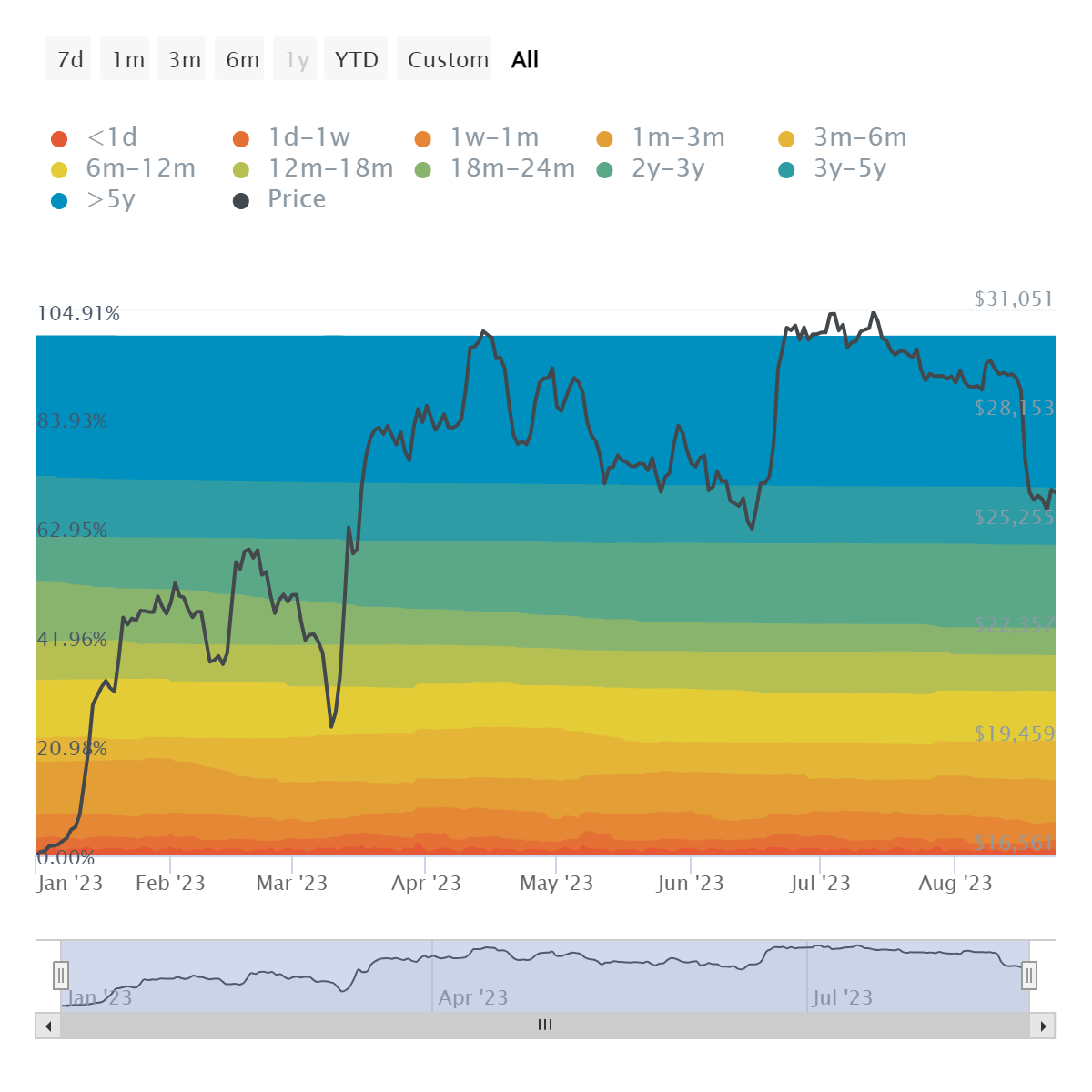

Bitcoin Investor Profile

When looking at the average coin age, 6-12 and 1-3 month investors appear to be the largest group contributing to the recent decline. In contrast, the number of wallets holding BTC for more than 5 years remained relatively stable. Therefore, it can be said that investors who believe in increasing negative sentiment in the short term may have seen the recent downturn as a buying opportunity.

Depending on the news flow, this investor group may quickly enter BTC when the negative sentiment reverses. The fear of missing out on the bottom may be higher among this group of investors. Of course, these are not definitive information but rather predictions based on past trends.

Türkçe

Türkçe Español

Español