Cryptocurrency asset management company, Hashdex, has entered the race for a spot Bitcoin ETF in the United States. The global leader in cryptocurrency asset management has submitted an application to the U.S. Securities and Exchange Commission (SEC) to include spot Bitcoin in its Bitcoin futures ETF. Unlike other recent Bitcoin ETF applications, Hashdex will not rely on Coinbase custody sharing agreement and instead will hold spot Bitcoin through physical exchanges on the CME market.

Details of Hashdex’s Bitcoin ETF Application

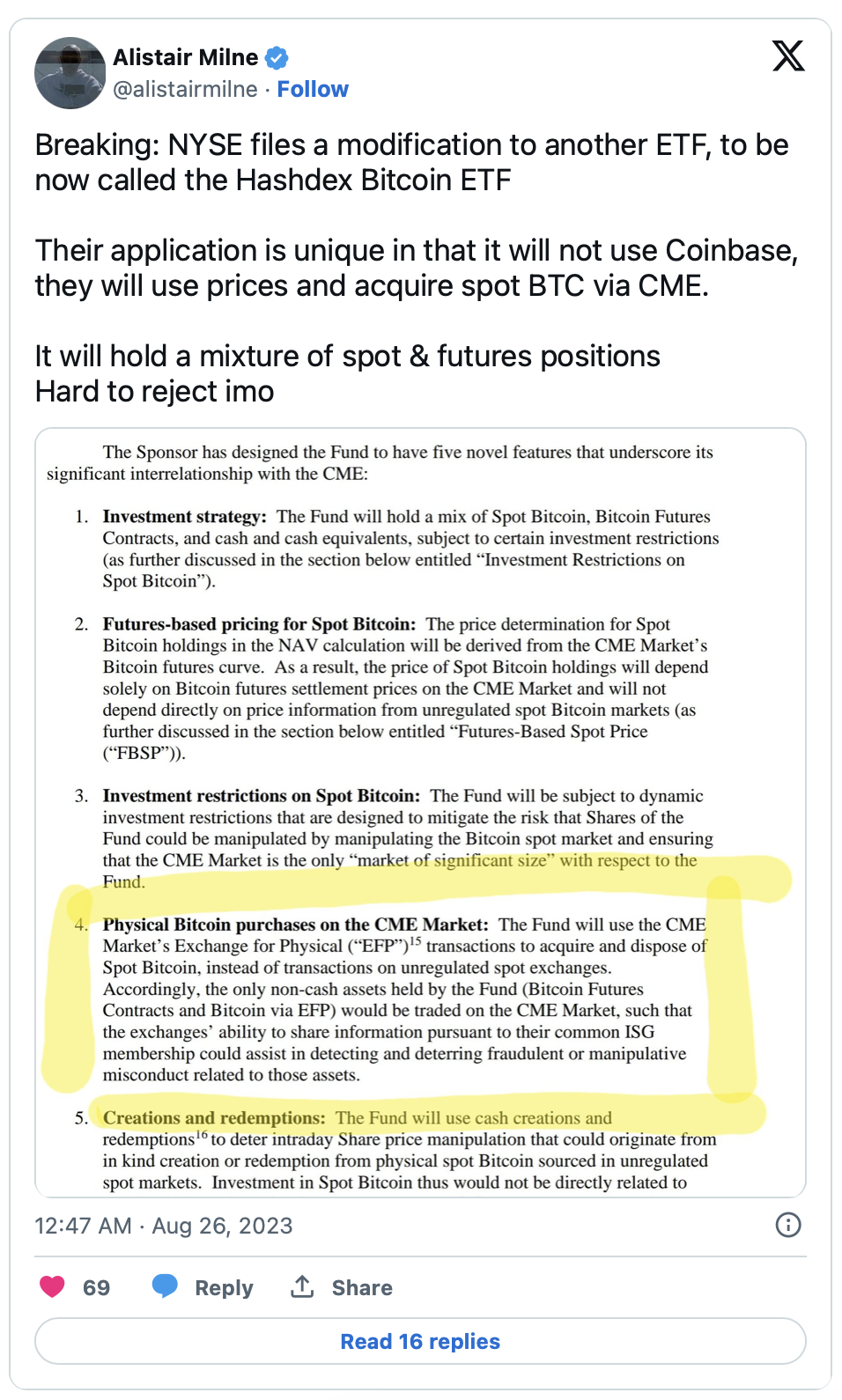

According to the 19b-4 application filed by NYSE Arca to the U.S. federal regulator SEC, Hashdex plans to hold spot Bitcoin in its Bitcoin futures ETF and change the name to Hashdex Bitcoin ETF with DeFi involvement.

Bloomberg analyst James Seyffart noted that Hashdex’s ETF application is unique because it does not rely on Coinbase custody sharing agreement. Hashdex’s Bitcoin ETF will hold spot Bitcoin through physical exchanges on the CME market. Additionally, it plans to conduct Exchange for Related Positions (EFRP) transactions only for relevant positions. This means swapping futures contracts for equivalent spot exposure instead of buying cash directly from exchanges.

James Seyffart believes that due to the pressure on Gary Gensler from the SEC-Grayscale case, Ethereum futures ETF application, and BlackRock’s Coinbase custody sharing agreement, there is a higher chance of approval for Hashdex’s Bitcoin ETF application from the SEC.

Other experts such as Nate Geraci, the president of The ETF Store, investor Alistair Milne, and financial attorney Scott Johnsson, have also responded positively to Hashdex’s unique Bitcoin ETF application, stating that it could address some of the SEC’s concerns regarding manipulation and liquidity in the Bitcoin market.

SEC and Gensler Yet to Comment on ETFs

So far, there have been no comments from the SEC or SEC Chairman Gary Gensler regarding spot Bitcoin ETF applications, Ethereum futures ETFs, and whether the spot Bitcoin ETF will be approved this year. Bloomberg analysts have previously expressed the view that the likelihood of Ethereum futures ETFs being approved this year is higher than that of a spot Bitcoin ETF.

The price of the largest cryptocurrency, Bitcoin, is currently trading at $26,045 and has been moving sideways for about a week amid market uncertainty. Bitcoin’s trading volume has also decreased by 9% in the past 24 hours.