One of the most significant cases in the crypto world is the ongoing legal battle of Ripple, which has been dragging on for years. The lawsuit that caused the XRP Coin price to miss out on the 2021 bull season has yet to reach a conclusion, even after all these years. Moreover, there is still a risk of it continuing for another 2 years. So, what did the Expert Attorney say about this case yesterday?

Comment from the Ripple Lawsuit Attorney

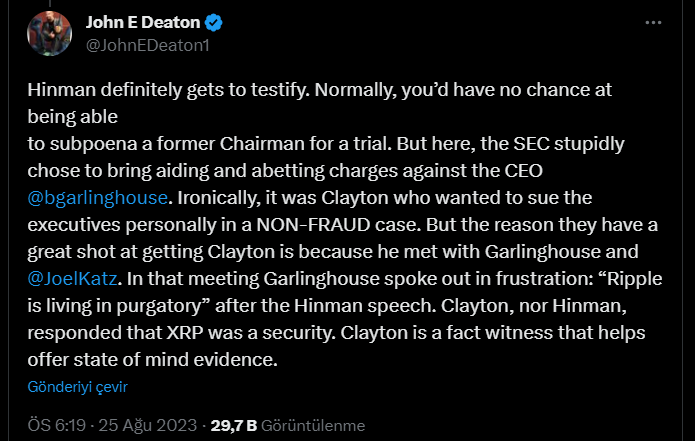

John E. Deaton, a pro-XRP Attorney, claimed that the Securities and Exchange Commission (SEC) made a mistake by accusing Ripple CEO Brad Garlinghouse of aiding and abetting. The Attorney, closely followed by XRP investors, frequently shares updates on this matter.

Deaton provided his latest assessment of the case on his X account. The Attorney emphasized the importance of the statements made by former SEC officials Bill Hinman and Jay Clayton during the U.S. SEC and Ripple Labs case. If these statements had been confirmed by the SEC earlier, XRP Coin and many other cryptocurrencies could have stayed clear of the “investment contract” label for a long time.

Digital Asset Investor expressed his intention to call a16z attorneys Lowell Ness and Chris Dixon as the first witnesses in the case. In addition to former SEC officials Jay Clayton and Bill Hinman, these individuals would also be summoned to testify. Jay Clayton is associated with the concept of Ethereum‘s Howey Test speech and was tasked with leading efforts contributing to this stance. Deaton agrees that Hinman’s testimony is essential.

However, according to Deaton, the SEC made a mistake in accusing CEO Brad Garlinghouse, especially considering Jay Clayton’s tendency to file complaints against executives in a context unrelated to fraud.

The Ripple Lawsuit

According to the Attorney, Clayton (former SEC chairman) must testify in the case. During his meeting with Ripple’s CEO and CTO, Clayton conveyed that Ripple was in limbo after Hinman’s speech. However, neither Clayton nor Hinman explicitly stated that XRP was categorized as a security.

According to the Attorney, the testimony of these two individuals in court could have prevented the case from dragging on for so long, incurring high costs, and causing uncertainty. However, the current administration is not as flexible as its predecessors and has avoided any steps that could be detrimental. This has led to the prolongation of the case against XRP Coin, which was launched during a period of “legal uncertainty.” In fact, there was no clear negative discrimination against cryptocurrencies in the pre-Gensler era, and those operating in the gray area did not believe they were violating laws. So, can laws be applied retroactively? Certainly not, and Gensler avoids creating new laws for crypto, claiming that the laws enacted in the 1940s are sufficient.

Despite Judge Torres ruling that XRP is not a security, the SEC aims to reverse the situation. However, it is expected that crypto regulations will take shape in the coming years. In particular, the 21st Century Cures Act, if implemented soon, will strengthen the CFTC’s hand and help altcoins largely escape the investment contract/security category.

For now, investors are focused on whether the appeal filed by the SEC in September will be approved by the second circuit.

Türkçe

Türkçe Español

Español

I love this XRP