Since the release of Worldcoin’s mainnet a month ago, regulatory concerns have caused the token value to drop by over 50%. According to data from CoinMarketCap, the price per WLD token, which was trading at $2.71 on the day the project was launched, has since dropped by 53% to $1.27 as of writing.

The Future of Worldcoin

Since its launch, Worldcoin, created by Sam Altman, has raised privacy concerns from regulators in various countries around the world. For example, one week after the project went live on the mainnet, the French data protection agency Commission Nationale Informatique & Libertés (CNIL) stated:

“The legality of such collection, including conditions for storing biometric data, appears to be controversial.”

Similarly, a statement released by the UK Information Commissioner’s Office on July 31st highlighted the data privacy concerns that regulators in the region are investigating regarding Worldcoin.

The Kenyan government announced on August 2nd, through a Facebook post, that the operations of Worldcoin would be suspended until a risk assessment is conducted by relevant state institutions.

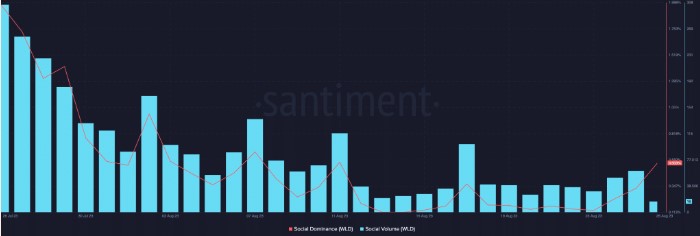

These regulatory reviews have put downward pressure on the value of the WLD token. Social activity around the token decreased last month, indicating a significant decline in interest.

According to on-chain data provider Santiment, the social volume and dominance of WLD have decreased by 95% and 74% respectively in the past 30 days, indicating a significant decline in interest around the project.

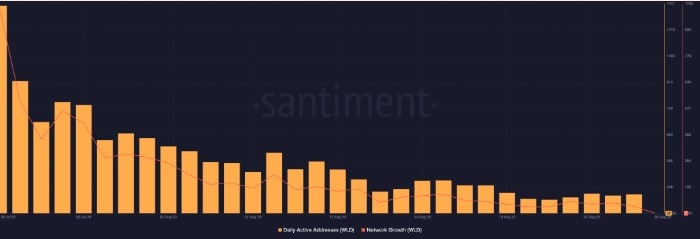

With the increase in regulatory issues, daily demand for WLD has also decreased. Since July 26th, the daily address count created for trading WLD has shown a downward trend, decreasing by 98%.

Additionally, the daily address count involved in WLD transactions has steadily declined since its price decline. For instance, as of July 25th, 1673 addresses completed WLD transactions, but on August 25th, less than 150 addresses conducted altcoin transactions.

Will WLD Rise?

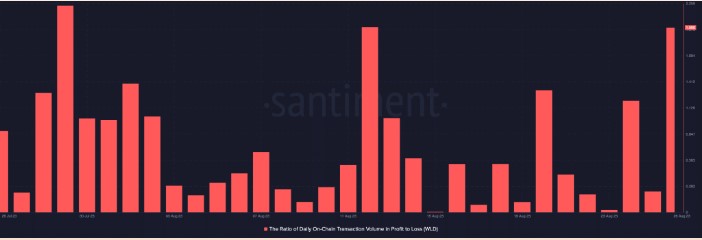

Despite the price drop experienced last month, another assessment on the profitability of WLD revealed that its holders continue to make profits. Data from Santiment at the time of writing showed that the on-chain transaction volume profitability ratio of WLD was 1,998.

A ratio of 1,998 meant that for every $1,998 profit made in WLD transactions, there was $1 loss. This indicated a positive ratio and demonstrated that there was more profit than loss in WLD transactions. In other words, the daily profit from on-chain transactions was nearly twice the realized loss.

However, while day traders found a way to overcome losses in their daily transactions, most WLD holders continued to incur losses. According to IntoTheBlock, 98% of WLD token holders were “in the red” at the time of writing.

Türkçe

Türkçe Español

Español