The dYdX team, which enabled many users to earn thousands of dollars with its airdrop, is now taking another important step. Today, there is a new token unlock, which coincides with the voting. So how will the inflation of the popular altcoin affect its future price? Why was the ongoing voting being conducted?

DYDX Token Unlock

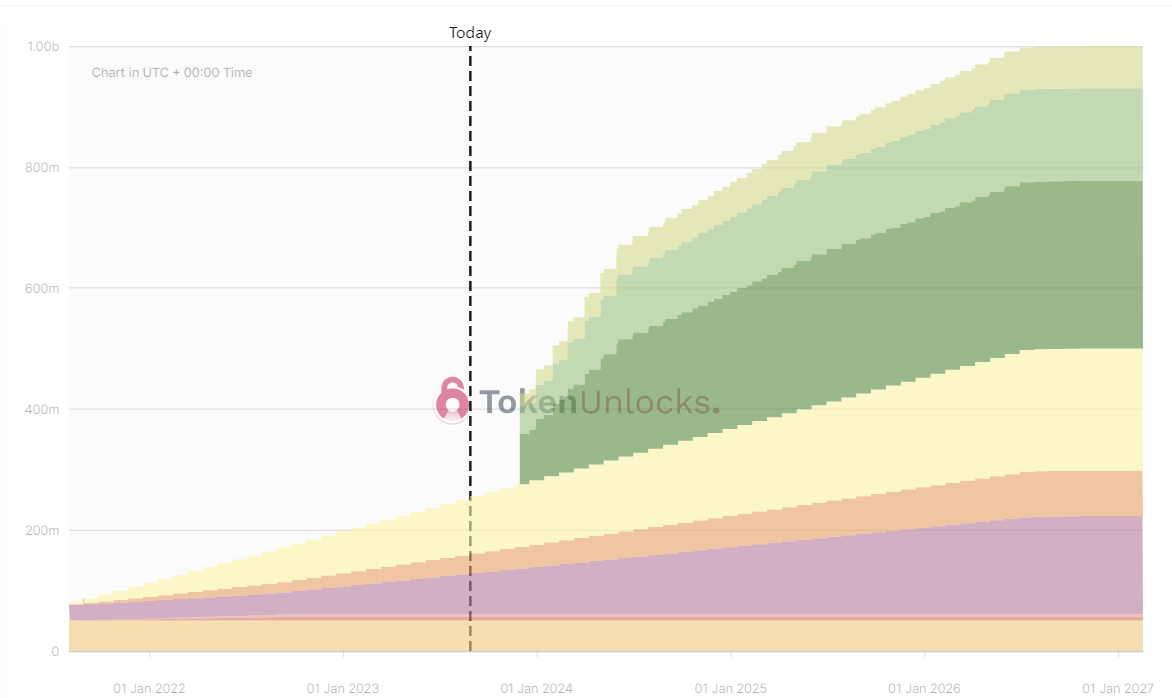

Today, there will be a token unlock worth approximately $13.63 million at 18:00. When it was released, only a small portion of the maximum supply was in circulation, and the price approached the $30 limit. However, as time passed, token unlocks caused the circulating supply to increase. On the other hand, an increase in circulating supply means a decrease in price unless demand increases at the same rate. In this regard, DYDX token holders have not been happy for a while.

Investors who bought at a price just above $20 are now facing a 90% loss. Moreover, since the circulating supply will continue to increase as seen in the graph below, the price decrease can gain momentum. However, if the token utility is enhanced, staking is incentivized, and a new mechanism is announced where the supply is regularly burned, demand can be increased and this vicious cycle can end.

DYDX Voting Begins

The dYdX community is currently voting on Wintermute’s protocol upgrade to version 4. This is a governance vote that also involves introducing DYDX as the layer1 token for the new dYdX Chain. Wintermute’s proposal includes a call for creating an Ethereum smart contract commissioned by the dYdX Foundation. This contract will be designed to allow the one-way, permissionless transfer of DYDX tokens from the existing Ethereum network to the dYdX Chain.

As of now, the voting on the Snapshot platform is supported by a unanimous vote, mainly from Wintermute, with 10 million votes. If the proposal receives 20 million votes, it can proceed to the second phase. The proposal recently published by the dYdX Foundation, suggesting the migration of DYDX tokens from the Ethereum network to the Cosmos network (currently on the testnet) received great interest. When this proposal is implemented, the utility of the token will also be enhanced.

Charles d’Haussy, CEO of the dYdX Foundation, said:

“dYdX Chain will be a proof-of-stake network, and therefore, when deployed on the mainnet, there will be an opportunity to stake to secure the network.”

Türkçe

Türkçe Español

Español