Historical data is widely used by investors to measure the performance of Bitcoin (BTC) and predict its future movements. Some metrics provide accurate results. For example, we saw that after the volatility decreased to its lowest point last month, BTC experienced significant losses. Volatility increased with the selling pressure due to strong resistance levels.

Bitcoin Historical Data and Models

There are numerous historical models followed for BTC. These models, created around significant events like the Halving, allow us to understand where the price stands compared to the past. For example, we can say that BTC is currently lingering in the range before a major rally. Or according to historical models, the price can create a local peak before making a deeper dip. All of these can be expressed as flexible predictions within 3-6 month intervals in the 4-year cycles.

The king cryptocurrency is currently in a strong support zone about six months before the Halving scheduled for the second quarter of 2024. The crypto market ecosystem has witnessed groundbreaking developments such as the Summary Judgement on the XRP case, several Bitcoin ETF applications, and Grayscale’s victory in the case to convert its Bitcoin Trust into a spot ETF product. Therefore, although the BTC price is moving horizontally, recent developments are laying the groundwork for an upward explosion.

Let’s remember the days when Bitcoin reached its all-time high after the PayPal announcement.

Will Bitcoin Reach $40,000?

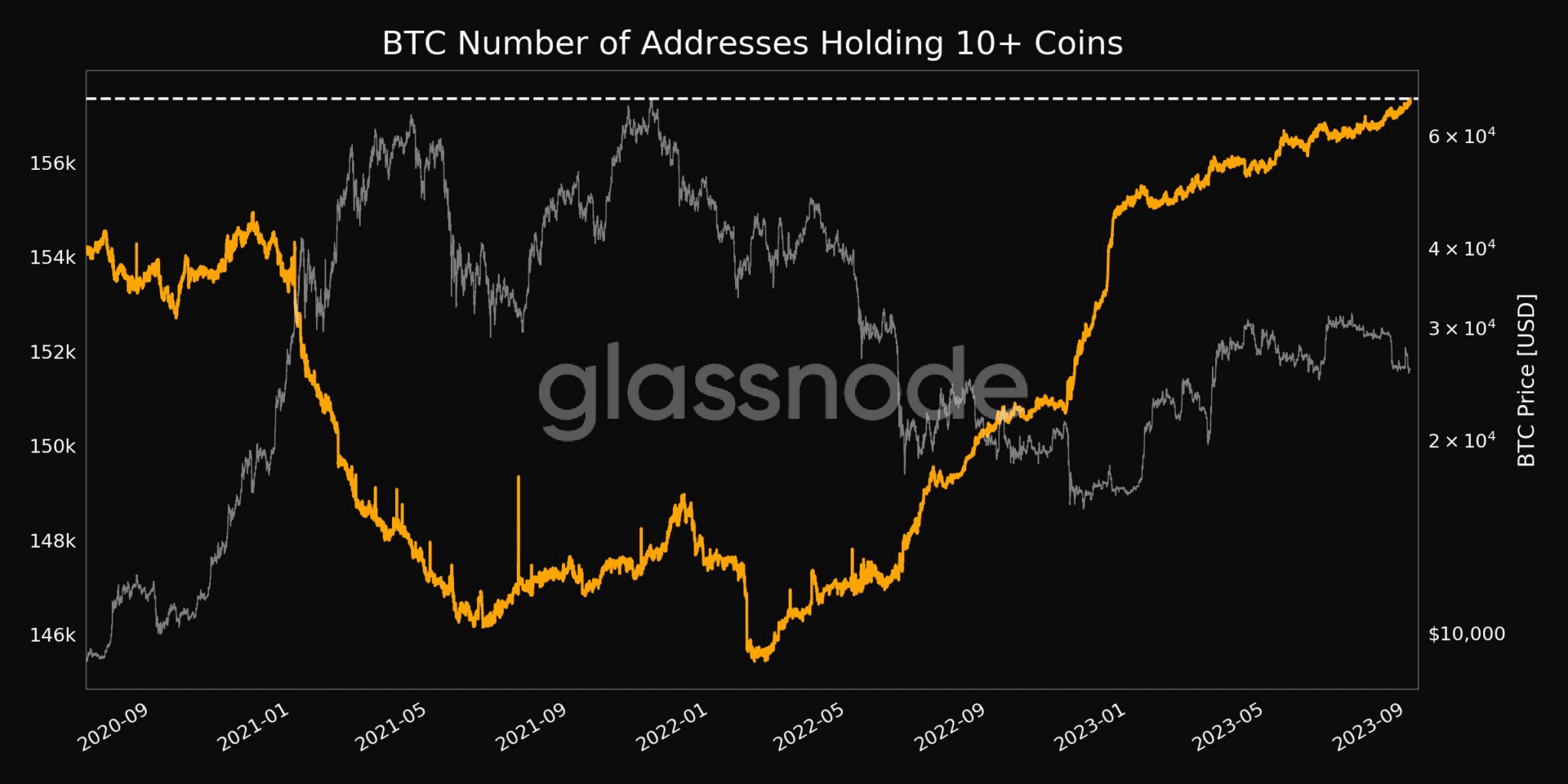

According to Glassnode data, the number of addresses holding more than 10 BTC shows increasing flexibility in growth potential. The data reveals that the number of addresses holding more than 10 Bitcoin is currently at its highest level in three years with 157,352 and has maintained steady growth since January 2023.

Considering BlackRock, Grayscale, other Bitcoin ETFs, EDX Markets, the 21st Century Adaptation Act, and all other positive developments together, the current situation may not be as bad. With the recent delay, the U.S. Securities and Exchange Commission (SEC) has postponed the next decision date for companies such as BlackRock, Invesco, Bitwise, and WisdomTree to mid-October 2023. The final decision dates are in mid-March.

On the other hand, experts predict a significant increase in the price of BTC until the Bitcoin Halving event, scheduled to take place in 840,000 blocks in April or May 2024.

In conclusion, Glassnode data and positive news flow in the crypto space, excluding macro factors, suggest that $40,000 may not be an unlikely possibility in the medium term.

Türkçe

Türkçe Español

Español